Pursuant to Section 413(b)(2)(A) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the Securities and Exchange Commission (SEC) is required to re-examine the definition of “accredited investor” every four (4) years. The intent of the review is to determine whether the definition should be modified “for the protection of investors, in the public interest and in light of the economy.” In its first formal review since the adoption of the Dodd-Frank Act back in 2010, the SEC’s Staff has recently released a detailed and comprehensive report analyzing the current definition and the resulting investing landscape. The report also contains certain recommendations for the SEC to consider in revising the current accredited investor definition. Several of these recommendations however will, in my opinion, materially contract rather than expand the current accredited investor pool; thus making it harder for everyday people to participate in “private” offerings.

Pursuant to Section 413(b)(2)(A) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), the Securities and Exchange Commission (SEC) is required to re-examine the definition of “accredited investor” every four (4) years. The intent of the review is to determine whether the definition should be modified “for the protection of investors, in the public interest and in light of the economy.” In its first formal review since the adoption of the Dodd-Frank Act back in 2010, the SEC’s Staff has recently released a detailed and comprehensive report analyzing the current definition and the resulting investing landscape. The report also contains certain recommendations for the SEC to consider in revising the current accredited investor definition. Several of these recommendations however will, in my opinion, materially contract rather than expand the current accredited investor pool; thus making it harder for everyday people to participate in “private” offerings.

THE DEBATE:

If you do not already know, the term “accredited investor” is one of the most important definitions in all of securities law as it essentially determines whether a person/entity will be permitted to invest in non-publicly offered investments (i.e. private offerings; For a primer on “accredited investors” and “private placements” See “Accredited Investor,” What It Means And Why It Matters). Over the past couple of years there has been an ongoing debate as to whether the definition of accredited investor should be revised to better reflect the current investment landscape and, if so, how it should be revised (for some background see “Changes To “Accredited Investor” Definition May Clip The Wings Of Many Angel Investors” and “CFIRA Weighs In On The “Accredited Investor” Debate In Letter To The SEC”).

In one camp are those that believe that the current income/net worth requirements (even if imperfect) are the best, and most readily testable, determinants for evaluating the suitability of an individual to invest in a private investment (and to bear the accompanying high risk of loss). Going even further, among these advocates are some who also believe that the current income/net worth requirements have been eroded by inflation overtime and should be updated (i.e. increased). As you can imagine this would significantly decrease the number of persons currently qualified as accredited investors.

In the other camp are those (like myself) who believe that monetary based standards, like the current income/net worth standards, are NOT optimal for determining who should be able to participate in private offerings; at least not as the sole standard. These advocates generally agree that the current income/net worth requirements (again, though imperfect) are working and should be left as-is (or even lowered). More importantly however, these advocates believe that the definition should be expanded to include certain non-monetary based criteria which would  allow individuals, who have enough education and/or experience to understand what they are investing in and the risks involved with such investment, to participate in private offerings regardless of their current income or net worth. Put another way, they believe an individual should not have to be rich in order to qualify as an accredited investor.

allow individuals, who have enough education and/or experience to understand what they are investing in and the risks involved with such investment, to participate in private offerings regardless of their current income or net worth. Put another way, they believe an individual should not have to be rich in order to qualify as an accredited investor.

Back in late 2014, the SEC’s Investor Advisory Committee (IAC) approved an initial set of recommendations for revising the current definition. Most of these recommendations, if accepted, would have made it significantly harder for individuals to qualify as accredited investors. As you might imagine, these recommendations brought about a flurry of opposing comments. In fact, proposed changes to the accredited investor definition was a primary focus at the SEC’s 2014 Government-Business Forum on Small Business Capital Formation. The consensus of the Forum’s group on this subject was to recommend expanding, not contracting, the current investor pool by keeping current income/net worth requirements where they are and providing for certain non-monetary qualifications (see pg. 33 of the Forum’s final report).

While the recently released recommendations appear to have incorporated some of the suggestions made by the Forum participants (and others), many of the potentially detrimental recommendations made by the IAC seem to have been retained.

THE RECENT RECOMMENDATIONS:

The recommendations made by the SEC’s Staff in its report, as well as my analysis and opinion of each, are as follows:

1. “The Commission should revise the financial thresholds requirements for natural persons to qualify as accredited investors and the list-based approach for entities to qualify as accredited investors. The Commission could consider the following approaches to address concerns with how the current definition identifies accredited investor natural persons and entities:”

A. Leave the current income and net worth thresholds in place, subject to investment limitations - In my opinion, this recommendation should NOT be followed.

By “investment limitations” the Staff is referring to capping a particular investor’s total investment amount at a % of such investor’s income or net worth. I am absolutely against this type of approach as administratively it would be a nightmare. There are simply too many variables to make it workable. For example: Are we basing the % on the investor’s current income/net worth or past income? If current, is it the actual income/net worth at the actual point of investment (meaning I could potentially invest more at the end of the year rather than the beginning)? What if an investor’s income/net worth materially goes up or down after they invest? Most importantly, how are you going to prove any of this? … and so on…

Unless this entire requirement can be satisfied by “self-certification” (which clearly would not be the case under A 506(c) offering), no Issuer in their right mind is going to go through the hassle of dealing with these investors. It would just be too much of an administrative burden and would potentially leave the Issuer open to significant liability. This is an unworkable approach. As noted in the Forum’s recommendations, the current income and net worth thresholds should remain in-place WITHOUT qualification.

B. Create new, additional inflation-adjusted income and net worth thresholds that are not subject to investment limitations - In my opinion, this recommendation should NOT be followed.

B. Create new, additional inflation-adjusted income and net worth thresholds that are not subject to investment limitations - In my opinion, this recommendation should NOT be followed.

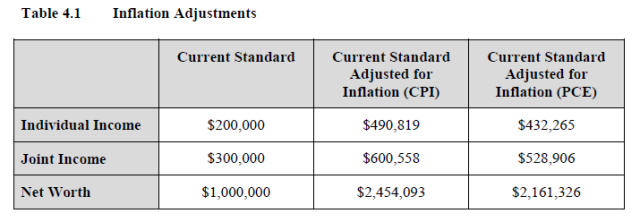

From Table 4.1 of the recent Staff report, the proposed inflation adjustment would more than double the dollar values under the current standard.

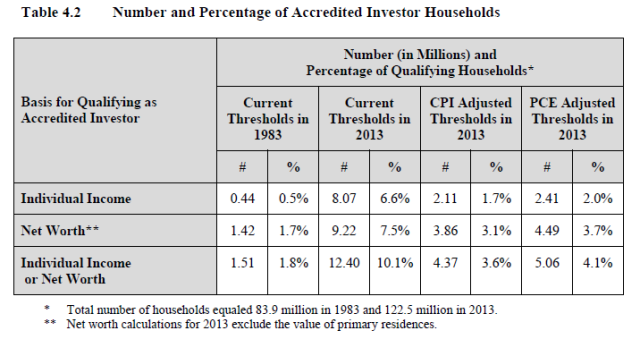

More importantly, as Table 4.2 of the report shows, simply “[a]djusting the income and net worth thresholds for inflation would reduce significantly the number of individuals that qualify as accredited investors.”

As noted by the IAC in its original recommendations, there simply is NOT enough data to determine what effect such a significant reduction in the number of accredited investors might have on the over $1 Trillion dollar private placement market. Moreover, there is NO data, at least that I have seen, showing that the current definition is not working (i.e. those that currently qualify as accredited investor are somehow at more risk or are less sophisticated). Given the potentially disastrous effects that such an adjustment could have on the “private placement” investor pool, and ultimately on small and emerging businesses, making such a move without clear data as to its potential effects is simply reckless. Especially when there is nothing to prove that the current system doesn’t work.

It should be noted that, per the Report, the Staff believes that the combined results of Recommendations 1A, 1B and 2A should actually increase rather than decrease the total pool of investors (See Section X of the Staff’s Report, “Impact of the Potential Approaches on the Pool of Accredited Investors,” Subsection A(1), beginning on pg. 99). However, this appears to be based solely on manipulated “US Census” data which is notoriously unreliable. Moreover, it assumes, I believe incorrectly, that Issuers would be willing to take on the administrative burden of dealing with the investors described in recommendation 1A.

C. Index all financial thresholds for inflation on a going-forward basis - In my opinion, this recommendation SHOULD NOT be followed.

C. Index all financial thresholds for inflation on a going-forward basis - In my opinion, this recommendation SHOULD NOT be followed.

Automatically requiring an indexing of financial thresholds is again an extremely reckless approach for the same reasons as noted with respect to the initial proposed inflation adjustment above. The “private placement” investor pool is the life blood of small and emerging businesses. As such, any adjustment to the definition of accredited investor that could potentially materially affect the size or composition of such pool should be carefully considered; not made subject to automatic actions such as this. Moreover, the duty of the SEC under the Dodd-Frank Act is to regularly evaluate whether the definition should be modified “for the protection of investors, in the public interest and in light of the economy.” Accordingly, the SEC has an affirmative duty to actively and thoroughly review the effect of ANY proposed change in the accredited investor definition and inflationary adjustments simply cannot be left to automation as recommended by the Staff.

D. Permit spousal equivalents to pool their finances for purposes of qualifying as accredited investors - In my opinion, this recommendation SHOULD be followed.

D. Permit spousal equivalents to pool their finances for purposes of qualifying as accredited investors - In my opinion, this recommendation SHOULD be followed.

The term “spousal equivalent,” as defined in the proposed recommendations, includes “a cohabitant occupying a relationship generally equivalent to that of a spouse.” The intent of this recommendation is to clarify the rules to provide consistent regulatory treatment among marriages, civil unions and domestic partnerships. I believe this is a much-needed clarification given the number of states currently recognizing such unions.

E. Revise the definition as it applies to entities by replacing the $5 million assets test with a $5 million investments test and including all entities rather than specifically enumerated types of entities - In my opinion, this recommendation SHOULD be followed.

E. Revise the definition as it applies to entities by replacing the $5 million assets test with a $5 million investments test and including all entities rather than specifically enumerated types of entities - In my opinion, this recommendation SHOULD be followed.

This recommendation is two-fold. The first part of the recommendation replaces the current $5 million ASSET test with a $5 million INVESTMENT (as defined in Rule 2a51-1(b)) test to provide a more bright line qualifier. The biggest part of this recommendation is the fact that it would apply to ALL entities that have over a $5 million in qualifying investments, not certain specific types of entities as has always been the case. Not only does this qualify the treatment of limited liability companies and business trusts (which have always been murky in the past), it would allow certain currently excluded entities to participate in private offerings; including without limitation: Indian tribes, labor unions, social enterprises, sovereign wealth funds, 529 Plans, and governmental/quasi-governmental bodies. This could potentially provide for a HUGE infusion of capital into the private market as these entities, and their deep pockets, have traditionally been excluded from participation.

F. Grandfather Issuers’ existing investors that are accredited investors under the current definition with respect to future offerings of their securities - In my opinion, this recommendation SHOULD NOT be followed.

F. Grandfather Issuers’ existing investors that are accredited investors under the current definition with respect to future offerings of their securities - In my opinion, this recommendation SHOULD NOT be followed.

I understand the idea behind wanting to “grandfather” currently qualifying accredited investors but I do not understand the proviso that it needs to be limited to future offerings of an Issuer’s securities. Honestly there seems to be a lack of logic in this recommendation. Basically speaking, here is how the recommendation works. Let’s take an investor (call him “Investor A”) who, today, qualifies as an accredited investor under the current definition and can thus invest in ANY private offering they want. Assuming the definition is changed, effective tomorrow (the “Effective Date“), and Investor A would no longer qualify as an accredited investor under the new standard. The Staff’s recommendation provides that, after the Effective Date, though Investor A would no longer qualify as an accredited investor, Investor A would still be deemed qualified to continue to invest in whatever companies Investor A was a holder of as of the Effective Date. What??

That’s like saying Investor A went to sleep smart on Monday but somehow woke up dumber on Tuesday. This recommendation makes no logical sense. Either Investor A should be “grandfathered” in as an accredited investor without qualification (even if for a limited time period) or not. It absolutely needs to be all or nothing. That being said, any grandfathering of investors is going to create an administrative nightmare for Issuers unless it can be completely satisfied by self-certification (otherwise how would it be tested??).

2. The Commission should revise the accredited investor definition to allow individuals to qualify as accredited investors based on other measures of sophistication.

The Commission could consider the following approaches to identify individuals who could qualify as accredited investors based on criteria other than income and net worth - In my opinion, each of these recommendations SHOULD be followed:

The Commission could consider the following approaches to identify individuals who could qualify as accredited investors based on criteria other than income and net worth - In my opinion, each of these recommendations SHOULD be followed:

A. Permit individuals with a minimum amount of investments (as defined in Rule 2a51-1(b)) to qualify as accredited investors.

B. Permit individuals with certain professional credentials to qualify as accredited investors (g. CPAs, CFAs, CFPs, and individuals who have passed the Series 7 examination, Series 65 examination or Series 82 examination).

C. Permit individuals with experience investing in exempt offerings to qualify as accredited investors (“experience may include performing due diligence, negotiating investment terms and making valuation determinations”).

D. Permit “knowledgeable employees” (similar to those under Rule 3c-5 of the Investment Company Act) of private funds to qualify as accredited investors for investments in their employer’s funds.

E. Permit individuals who pass an accredited investor examination to qualify as accredited investors (as noted, portions of FINRA’s Series 7 and Series 82 examinations cover these areas and could potentially be used as a model for developing an accredited investor examination).

The above recommendations can be reviewed as a group rather than individually as they are each intended to provide for a non-monetary based standard for qualifying as an accredited investor. Such standards are consistent with the recommendations made by the 2014 SEC Small Business Forum (as well as other commentators such as CFIRA). In my opinion, these recommended changes are essential. Not just in terms of reflecting the realities of the current economy (i.e. that you don’t have to be rich to be sophisticated enough to determine your own investments), but in order to effectuate the democratization of investments in private companies which is at the heart of the JOBS Act.

CONCLUSION:

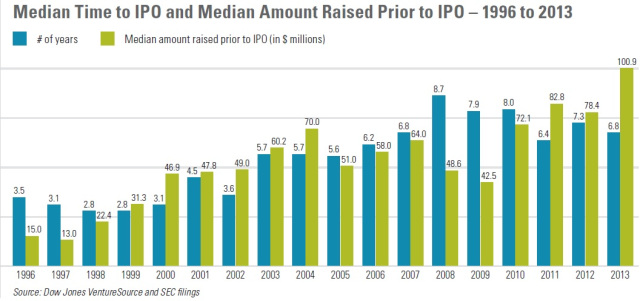

For a multitude of reasons which are beyond the scope of this article (including additional costs of governmental compliance for public companies and Traditional VC’s preferring later stage companies with significance assets), Companies today are staying private significantly longer. This is why the private placement market today is far larger than that for Initial Public Offerings (IPOs), topping out at over $1.3 trillion in 2104.

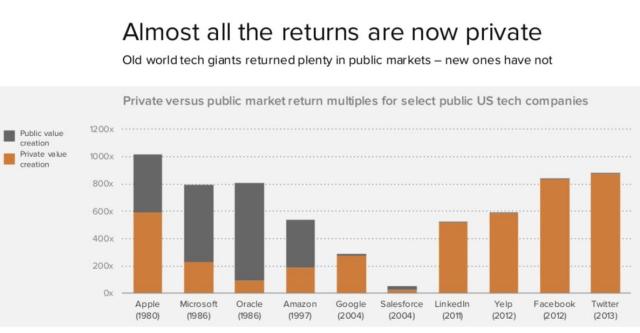

Moreover, as companies are forced to remain private for longer periods of time, the overwhelming majority of equity returns from investment are eaten up in the private markets as illustrated in this recent chart from a recent Andreessen Horowitz presentation:

Under the current definition, only high-net worth individuals can qualify as accredited investors and thus participate in these potentially lucrative “private offerings.” Moreover, if the Staff’s recommendations 1A and 1B are accepted, these monetary qualifiers will only be me made more difficult to satisfy. While the traditional monetary qualifications are easy to manage and measure, having money should not be the sole qualifier as to whether a person can potentially invest in a “private” transaction. There are clearly individuals who are more than capable of protecting their own investment interests and they absolutely should be able to invest should they choose to.

I understand the tight rope that the SEC has to walk between balancing the need for investor protection with the need for fostering a strong private capital market and I do not envy the decisions they need to make. That being said, now is clearly the time for the SEC to make some significant changes to the definition. First, the SEC needs to leave the current income/net-worth standards intact, without qualification. There is no data to support that the current definition is causing any detrimental effects. Further, there is simply not enough data at this time to evaluate the potentially negative effects of adjusting the current monetary thresholds for inflation as recommended by the Staff. Second, the SEC needs to incorporate Staff recommendations 1D, 1E and 2A-E above. Each of these recommendations will significantly broaden the current investor pool. Further, they will allow individuals/entities who are clearly capable of protecting their own investment interests to participate in “private” transactions.

As the private placement industry continues to grow, in particular as a result of the increasing use of the “private offering” provisions of the JOBS Act (e.g. Title II and Title III), the pressure for the SEC to address this definition is quickly reaching a boiling point and they are going to have to make a definitive move soon. In fact, if the bill introduced  this past Spring by Representative David Schweikert (H.R. 2187) entitled the “Fair Investment Opportunities for Professional Experts Act” continues to move forward, the SEC may be forced to revise its accredited investor definition to at least include individuals who pass an accredited investor examination. Until then, I guess all we can do is sit back and wait to see how the SEC reacts to the recent Staff recommendations.

this past Spring by Representative David Schweikert (H.R. 2187) entitled the “Fair Investment Opportunities for Professional Experts Act” continues to move forward, the SEC may be forced to revise its accredited investor definition to at least include individuals who pass an accredited investor examination. Until then, I guess all we can do is sit back and wait to see how the SEC reacts to the recent Staff recommendations.

Good writeup, Anthony. As you aptly reflected, some of these recommended changes are near impossible to verify for Rule 506(c) offerings that require verification of accredited investors. At VerifyInvestor.com, we are on the front lines of such verification, and we see where investors struggle to get verified. While the only goal shouldn’t be to make it easy for everyone to become an accredited investor, it is extremely frustrating and harms the capital markets when someone qualifies as an accredited investor but has a difficult time proving it due to the nature of the accredited investor method (for example, an investor that has the requisite minimum net worth or assets but who holds assets in illiquid investments that are difficult to value easily/inexpensively).

Pingback: All the News | smallchange

Pingback: CFIRA Offers Its Comments To SEC On Proposed Regulatory Changes. | CROWDFUNDINGLEGALHUB.com

Pingback: Working To Change The Definition of Accredited Investor – A Tale of Two Schweikert Bills | CROWDFUNDINGLEGALHUB.com

I know why the investors want equity, but what do you think the incentive is for an inventor or creator to do an equity crowdfunder as opposed to a reward based which doesn’t have all these limits,legal costs, and busy work?

Just a different step in the process Vivian. Reward based might be good for initial idea stage companies but when companies are looking for serious amounts of money to help them grow etc. they are almost always going to have to give more than some “Reward”; i.e. equity or interest (if debt based).

Anthony, I’m considering using crowdfunding through Equity Net for my company. My Company is in Florida and I’m trying to find an overview & source for the specific Florida State forms and other such things that are doable by our company therefore using the least amount of monies for expensive hourly rates from the lawyer I will no doubt need along with any other professional or representative that may be required by the State. Also, I find these two parts of the regulation untenable, especially the second one!

1)”The notice must: Be filed with the office at least 10 days before the issuer commences an offering of securities or the offering is displayed on a website of an intermediary, in reliance upon the exemption provided by this section.”

2) “Execute an escrow agreement with a “bank” for the deposit of investor funds, and ensure that all offering proceeds are provided to the issuer only when the aggregate capital raised from all investors is equal to or greater than the target offering amount.”

Am I to believe that while I’m getting investors that are ready to invest now I must wait to have access to any of the funds that have procured until the full offering amount has been met? As I understand this, it means that my company may go broke waiting for all the target capital ($2MM for us) to be raised before the company has use of the funds!!

I am thinking that Title II or maybe Title III should be my choice. Out of the 5 options I’m a bit lost.

Charles,

The applicable intrastate crowdfunding laws for Florida should be available here: https://crowdfundinglegalhub.com/2015/01/16/state-of-the-states-list-of-current-active-and-proposed-intrastate-exemptions/ As far as what forms etc. you need you will need to check with the state agency/your attorney.

With respect to your question, the answer is yes, you will need to wait until the minimum target amount has been reached. This is an anti-fraud provision that is in most, if not all, intrastate rules as well as the Title III rules. If you are concerned with the length of time before you receive funds you will just need to establish a lower minimum (i.e. not $2MM). As to your comment about which of the various rules might be best for you, I can’t really speak intelligently on that without knowing your particular situation (and without actually being engaged as your attorney). To the extent it is helpful however, I have prepared this summary chart comparing Title II, Reg A+, and Title III (among others) available here: https://crowdfundinglegalhub.com/2016/03/29/how-does-illinois-crowdfunding-law-stack-up-to-the-federal-options-a-comparative-summary/

Good luck.

Pingback: SEC Discussion On ‘Accredited Investor’ Definition Could Have Major Repercussions For Startups, Crowdfunding | Trading Common Sense

Pingback: All the News from 2016 | smallchange