As noted in my prior post, “OFFICIAL DRAFT – Illinois Proposed Intrastate Crowdfunding Exemption,” an official draft of my proposed Illinois Intrastate Crowdfunding Exemption was recently finished. To my surprise, people actually read it and I have been getting a lot of questions as to why I choose to make my bill so different than those of other states. I figured the easiest way to answer that question was to outline some of what I was thinking in drafting the proposed bill.

As noted in my prior post, “OFFICIAL DRAFT – Illinois Proposed Intrastate Crowdfunding Exemption,” an official draft of my proposed Illinois Intrastate Crowdfunding Exemption was recently finished. To my surprise, people actually read it and I have been getting a lot of questions as to why I choose to make my bill so different than those of other states. I figured the easiest way to answer that question was to outline some of what I was thinking in drafting the proposed bill.

In drafting the proposed exemption I have spent (and still spend) a substantial amount of time researching each of the 27 currently enacted/proposed intrastate exemptions in detail, as well as how these exemptions have been working in the real world. As a result, the proposed bill was specifically drafted to include, what I believe to be, stronger anti-fraud protections and remedies to certain practical application issues which have stalled the use of the exemption in other states. As a means of comparison I am going to review some of the provisions of my proposed bill against the bill enacted in Indiana (which is very similar to the enacted/proposed exemptions in many of the other states).

Before I get into specifics, I would like to clarify that I am not here to tout that my proposed bill is fundamentally superior to any other bill, that I am somehow smarter than any of the people who drafted the other bills, etc. Fortunately for me, I have the benefit of being able to analyze the enacted/proposed exemptions that came before mine and to build off of the work of the individuals who helped put each of those bills together (as will those who draft bills after mine). Accordingly, I simply drafted my proposed bill with an eye toward specifically addressing each of the holes and concerns which currently affect the exemptions of the other states. With that said, I would like to address the reasoning behind the two biggest changes I made (the offering “cap” amount and the new “experienced investor” definition) and to point out some of the specific additional/improved anti-fraud provisions I included in the bill.

I. The Offering Cap Amount.

Under Indiana’s exemption, an Issuer is limited to an offering of $1,000,000, unless they are willing to provide audited financial statements, in which case the maximum offering would be $2,000,000. This is similar to the cap structure currently offered in the majority of the other states. These cap amounts however, are completely arbitrary and there are  multiple reasons why, in practical application, these low cap amounts are not working (and I felt would especially not work in Illinois). Under my proposed bill an Issuer would be limited to an offering of $20,000,000, unless they have been in business for more than 1 year and are willing to provide audited financial statements, in which case there would be no limit on the offering amount.

multiple reasons why, in practical application, these low cap amounts are not working (and I felt would especially not work in Illinois). Under my proposed bill an Issuer would be limited to an offering of $20,000,000, unless they have been in business for more than 1 year and are willing to provide audited financial statements, in which case there would be no limit on the offering amount.

Why stray so far from the norm you may ask. There are any of a number of business reasons for the proposed higher limits which are beyond the scope of this post. That being said, the viability of the crowdfunding industry itself needs to be kept in mind when reviewing any proposed exemption. The crowdfunding industry (particularly at the intrastate level) is dependent on there being enough interest and regular offerings to allow the facilitating “intranet portals” to survive. Given the low $1-$2 Million cap levels, Indiana and the other states are finding this to be more of a problem than anticipated. For those that don’t know, the two types of crowdfunding projects that currently lead the national and global industries are real estate crowdfunding projects and general start-up crowdfunding projects. Each of these types of projects however, generally requires significantly more than $1-$2 Million (particularly when taking into account the additional expenses of audited financials (if required), related accounting and legal professionals, etc.). As a result, what you are seeing in Indiana and many of the other currently enacted states, is that Issuers looking to finance larger projects (such as commercial real estate projects) are forced to seek other sources of capital and the intrastate exemption is being used by only by smaller businesses (if at all). While this may not appear to be a problem, it absolutely is in terms of the intrastate crowdfunding industry as a whole.

There is just not enough money to be made in facilitating these types of one off, smaller sized, offerings to make it viable for crowdfunding portals to survive and without the portals the whole crowdfunding concept falls apart. This is illustrated by the fact that most (if not all) of the major “national” crowdfunding portals are currently not even considering getting involved in intrastate offerings as they do not see a profit. Put another way, if the cap is set too low to make it a viable option for larger projects, the market cannot sustain itself. This problem would only be further exacerbated in a major metropolitan state like Illinois where projects might cost significantly more than in states such as Indiana. For example, a typical investment grade commercial, or even multi-unit, real estate project in Illinois can easily require over $2 Million. The difference in the costs of living alone is reason enough to support the fact that the proposed cap should be well above what is offered by Indiana and the other states surrounding Illinois.

Putting aside the above practical concerns, keeping the cap amount low would actually increase the overall potential for fraud in Illinois private placements. Sounds counterintuitive right? Stay with me for a second. If you don’t already know, under Rule 506, an Issuer is capable of raising an unlimited amount (from accredited and up to 35 non-accredited investors) simply by filing a Form D with the Securities and Exchange Commission (SEC) and, typically, a simple notice filing with the state securities agency. As a result, Rule 506 offerings are extremely attractive to Issuers and are the most common manner of conducting a private placement offering. This is currently the case even when both the Issuer and the investors are all within the state (i.e. an intrastate offering). Rule 506 private placements are traditionally done on an individual basis between the Issuer and the respective investor and there are currently very limited (and vague) guidelines as to what information is required to be given to investors before or after the offering. Moreover, there is typically no communication  between the investors so there can be no assurance that the same information is being given to everyone. I am sure you would agree that the simplicity of the notice requirements for a Rule 506 offering, and the lack of specific guidelines, can easily lend itself to investor fraud (as we see with a lot of Ponzi schemes).

between the investors so there can be no assurance that the same information is being given to everyone. I am sure you would agree that the simplicity of the notice requirements for a Rule 506 offering, and the lack of specific guidelines, can easily lend itself to investor fraud (as we see with a lot of Ponzi schemes).

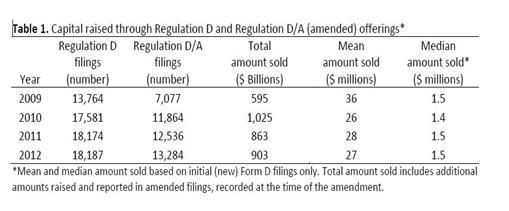

My proposed exemption bill on the other hand, provides for multiple specific anti-fraud provisions (as discussed below). Now what if a majority of would be Rule 506 Issuers could be convinced to voluntarily subject themselves to the increased anti-fraud provisions of the proposed act? I am sure you would again agree that, in this situation, an offering subject to the anti-fraud provisions of the proposed act would be significantly more transparent, and protective of investors, than a similar offer conducted under the vague rules of Rule 506. The problem is, the average Rule 506 offering is approximately $27 Million (as shown in the table below[1]) which is WELL above the $1-$2 Million offering cap in Indiana and the majority of the other states:

[1] Taken from “Capital Raising in the U.S.: An Analysis of Unregistered Offerings Using the Regulation D Exemption, 2009‐2012,” Division of Economic and Risk Analysis (DERA), U.S. Securities and Exchange Commission, (July 2013), available at: http://www.sec.gov/divisions/riskfin/whitepapers/dera-unregistered-offerings-reg-d.pdf

Allowing for a high offering cap, together with the ability to generally solicit investors over the internet, will actually entice Issuers (who would otherwise have used Rule 506) to conduct their intrastate offerings under the new proposed exemption. As a result, more of these private offerings would be subject to the anti-fraud provisions included in the bill which require significantly more transparency and information sharing than under a Rule 506 offering. Put more simply, I believe that the higher cap will actually decrease the overall likelihood of private placement fraud in Illinois by making MORE Illinois Issuers subject to the stronger anti-fraud provisions of the proposed bill.

II. New “Experienced Investor” Definition.

Before getting into the reasoning behind this provision, I would like to point out that the distinction as to whether a person is an “experienced investor” or not is relevant under the proposed bill in only determining whether that individual should be allowed to invest as much as they want in a particular company or if they should be limited to the stated maximum individual amount ($10,000 or 10% of the individual’s income, whichever is greater).

This new definition may appear unique, but there are again several industry specific reasons for electing to include this provision. First, from a common sense standpoint, if an individual can walk into an Illinois casino today and bet their entire savings on a hand of blackjack without anyone batting an eye, there really is no reason to try to limit the amount a person can invest in a company. I mean there is actually a phone app now that lets people play the Illinois lottery by credit card whenever, and however often, they want. That being said, I agree with the theory that there should be certain “per investor” limits established in order to protect less sophisticated individuals. Those limits however, should not apply to individuals who are substantially educated and/or financially experienced, as these  individuals do not need to be protected by the government. This view is not mine alone and represents what is currently the prevailing opinion in the private placement industry.

individuals do not need to be protected by the government. This view is not mine alone and represents what is currently the prevailing opinion in the private placement industry.

The current industry view is that the pool of qualified investors needs to be expanded beyond the current federal “accredited investor” net worth/income test (as relied on in Indiana). In fact the federal net worth/income test is increasingly being viewed, even by members of the SEC, as an ineffective measure of determining an investor’s financial sophistication. The Investor Advisory Committee (IAC) of the SEC recently released its recommendations to the SEC regarding substantial revisions to the current accredited investor definition. In one its recommendations the IAC stated that “[t]he Commission should revise the definition to enable individuals to qualify as accredited investors based on their financial sophistication” without regard to their income or net worth. As part of this recommendation the IAC suggested, among other things, that the definition be expanded to include individuals:

- with series 7 securities license and/or the Chartered Financial Analyst designation;

- regardless of their respective credentials, whose professional experience qualifies them as financial experts (noting, as a reference point, the U.K. test for financial sophistication, including individuals who are working, or have in the last 2 years worked, in a professional capacity in the private equity sector, or in the provision of finance for small and medium enterprises);

- based on investment experience (and an “investment owned” test); and/or

- who pass a qualification test (developed by the SEC in conjunction with FINRA, state regulators etc.)

As I am sure you can see, the provisions included in my proposed new “experienced investor” definition were an attempt to codify the recommendations of the IAC above (other than categories (a) and (b) which were drafted based on Wisconsin’s “certified investor” (Wis. Stat. § 551.102(4m)) exemption from its enacted crowdfunding exemption). Whether or not the SEC enacts all of these recommendations, it is clear that the prevailing industry view is that these individuals are sophisticated enough to fend for themselves. Accordingly, they should be allowed to invest as much as they want in whatever company they want which was the purpose of including this provision.

III. Anti-Fraud Provisions.

My proposed bill includes multiple provisions which are specifically intended to prevent fraud, many of which are either not addressed, or not addressed in sufficient detail, in the other current enacted and proposed intrastate exemptions (including Indiana). The anti-fraud provisions in the proposed bill include the following:

-

Specific Escrowee & Escrow Provisions (new 815 ILCS 5/2.35 & new 815 ILCS 5/4(T)(4) and (9)).

The majority of the state acts require that investor funds be held in escrow until a minimum established offering amount is met. However, these states are either silent as to the qualifications of the escrow agent, or simply require them to be a bank or other financial institution. Indiana’s exemption actually goes so far as to allow any “savings bank” which, as has been proven in practice, includes any number of fly-by-night internet savings banks (including the once preferred “Bancbox,” a new crowdfunding ancillary banking service that is now rumored to be having financial/regulatory compliance issues).

The majority of the state acts require that investor funds be held in escrow until a minimum established offering amount is met. However, these states are either silent as to the qualifications of the escrow agent, or simply require them to be a bank or other financial institution. Indiana’s exemption actually goes so far as to allow any “savings bank” which, as has been proven in practice, includes any number of fly-by-night internet savings banks (including the once preferred “Bancbox,” a new crowdfunding ancillary banking service that is now rumored to be having financial/regulatory compliance issues).

Banks are not in a position to handle these types of escrow transactions and have been almost universally reluctant, in practice, to do so for these transactions (and those that do agree to handle these transactions charge cost prohibitive fees for such services). The proposed Illinois exemption takes a different approach by providing that registered Title Companies (and other entities that meet the requisite insurance and registration requirements) will act as escrowees. Title Companies have a long history of handling cash escrow transactions and the required insurance and registration requirements make them a much safer choice for investors when compared to other alternatives such as internet based financial institutions like Bancbox which are being used in other states.

-

Specific Issuer Minimum Secretary of State (SOS) Disclosure Requirements; Duty to Update (new 815 ILCS 5/4(T)(5), (7), (8) and (10)).

The Indiana act provides for the disclosure of specific information to the SOS and to prospective investors. The proposed Illinois bill provides for the same disclosures as well as numerous specific additional disclosures to be made both to the SOS and the Investor including: copies of the Issuer’s most recent financial statements, delivery of a copy of the fully executed applicable escrow agreement, and identification of all internet portals being used in the offering.

The Indiana act provides for the disclosure of specific information to the SOS and to prospective investors. The proposed Illinois bill provides for the same disclosures as well as numerous specific additional disclosures to be made both to the SOS and the Investor including: copies of the Issuer’s most recent financial statements, delivery of a copy of the fully executed applicable escrow agreement, and identification of all internet portals being used in the offering.

More importantly, under this proposed bill unlike ANY other current act, for so long as the offering remains open, the Issuer has an affirmative duty to update both the SOS and the investors if any material information previously disclosed has changed. This is essential to preventing fraud.

-

Required Quarterly Financial Reports (new 815 ILCS 5/4(T)(5) and (15)).

Like the Indiana act, the proposed Illinois bill requires an Issuer to provide copies of its financial reports quarterly to the investors. Many of the other states however are silent on this requirement. Requiring issuers to provide ongoing financial reports to investors (especially certified reports as discussed below) is essential to the early detection of fraud.

-

Certified Financial Statements/Reports (new 815 ILCS 5/4(T)(5) and (15)).

The proposed Illinois bill provides for another anti-fraud provision that NO other current act provides for - the requirement that all disclosed financial statements and other financial reports of an Issuer be personally certified by “a senior officer of the Issuer as fairly, completely and accurately presenting the financial condition of the Issuer, in all material respects.” This represents a marked improvement over the requirements of other states (including Indiana) for several reasons.

The proposed Illinois bill provides for another anti-fraud provision that NO other current act provides for - the requirement that all disclosed financial statements and other financial reports of an Issuer be personally certified by “a senior officer of the Issuer as fairly, completely and accurately presenting the financial condition of the Issuer, in all material respects.” This represents a marked improvement over the requirements of other states (including Indiana) for several reasons.

First, other states require the delivery of reviewed/audited financials. Early stage companies (i.e. start-ups) and real estate “single purpose” development entities, who will be the primary users of this exemption, will often have a limited financial history so an audit/review of this information will provide little to no additional information or protection for investors. Moreover, given the generally high cost of having financials audited/reviewed, these Issuers will seek out the lowest cost (and most likely lowest quality) providers, further limiting the usefulness and accuracy of the audited/reviewed financials to investors.

On the other hand, requiring that an Issuer’s financials be personally certified by a senior officer will significantly lessen the likelihood that an Issuer will supply fraudulent information. It may be easy to hide false financials behind a cheap anonymous audit/review, but if a person is required to personally attest as to the fairness of the financials (thus making themselves personally liable under the applicable civil/criminal penalties for fraud) they are going to be significantly less likely to engage in fraudulent activity. This is the reason why, in the commercial lending industry, Banks often require the same personal certification of financial statements in connection with commercial loans.

-

Specific Portal Minimum SOS Disclosures Requirements; Duty to Update (new 815 ILCS 5/8d(e)(4) and (f)).

Like the Indiana act, the proposed Illinois bill provides for the disclosure of specific information related to an Internet funding portal to the SOS. However, again my proposed bill goes further by providing: (a) that the registration of each internet portal will need to be periodically renewed (thus requiring a resubmittal of key information); and (b) that the Internet funding portal has an affirmative duty to update the SOS (via a registration amendment) if any information previously disclosed in its registration statement has changed.

Like the Indiana act, the proposed Illinois bill provides for the disclosure of specific information related to an Internet funding portal to the SOS. However, again my proposed bill goes further by providing: (a) that the registration of each internet portal will need to be periodically renewed (thus requiring a resubmittal of key information); and (b) that the Internet funding portal has an affirmative duty to update the SOS (via a registration amendment) if any information previously disclosed in its registration statement has changed.

-

Specific Permitted Portal Vetting Activities (new 815 ILCS 5/8d(g)(6)).

The majority of the state acts (including Indiana’s) are silent as to what actions an internet portal may take in terms of vetting offerings without running afoul of the rules regarding the giving of “investment advice.” Put another way, many internet portals are currently unsure as to what measures (if any) they can take in terms of being selective as to the offerings they allow on their site or even whether they are even permitted to take down suspected fraudulent offerings (as this action has been looked at as “giving investment advice”).

The majority of the state acts (including Indiana’s) are silent as to what actions an internet portal may take in terms of vetting offerings without running afoul of the rules regarding the giving of “investment advice.” Put another way, many internet portals are currently unsure as to what measures (if any) they can take in terms of being selective as to the offerings they allow on their site or even whether they are even permitted to take down suspected fraudulent offerings (as this action has been looked at as “giving investment advice”).

Clearly it can be seen how the inability to effectively vet projects can increase the likelihood of investor fraud. The proposed Illinois act on the other hand, specifically allows internet portals to take certain vetting actions (without being deemed to be giving “investment advice”) including: establishing reasonable Issuer selection criteria for participating in use of the portal and terminating an Issuer transaction at any time before sale if the Internet portal determines that it is appropriate.

-

Required Single Method of Issuer and Investor Communication (new 815 ILCS 5/8d(c) and (d)).

Another anti-fraud provision unique to the proposed Illinois bill is the requirement that an internet portal establishes, and maintains, both: (a) a single point of communication between investors and the Issuer; and (b) a way for investors of a particular offering to communicate with each other. The reasoning for this requirement is simple. First, it ensures that each investor is receiving the same information from the Issuer. Second, it allows investors to benefit from the information provided to, and build off of the questions asked by, other members of the crowd. Such a system has been integral in the detection of fraudulent campaigns in reward based platforms such as Kickstarter.

Another anti-fraud provision unique to the proposed Illinois bill is the requirement that an internet portal establishes, and maintains, both: (a) a single point of communication between investors and the Issuer; and (b) a way for investors of a particular offering to communicate with each other. The reasoning for this requirement is simple. First, it ensures that each investor is receiving the same information from the Issuer. Second, it allows investors to benefit from the information provided to, and build off of the questions asked by, other members of the crowd. Such a system has been integral in the detection of fraudulent campaigns in reward based platforms such as Kickstarter.

-

Specific Procedures For Determining Residency/limiting information (new 815 ILCS 5/4(T)(12) and (13) and new 815 ILCS 5/8d(b)).

In terms of establishing an investor’s residency, Indiana requires that an Issuer obtain “evidence” that an investor is a resident of the state. However, Indiana (like the other states) is completely silent as to what is acceptable in terms of evidence. Similarly, Indiana also requires that internet portals limit access to offering information solely to resident but provides no guidance as to how to do so. While not exhaustive, my proposed bill provides for specific acceptable forms for both evidencing residency (including the ability to rely on a person’s valid driver’s license) and for the limiting of access to residents of the state (including the ability to rely on a person’s (IP) address pursuant to the SEC’s recently released C&DI 141.05).

In terms of establishing an investor’s residency, Indiana requires that an Issuer obtain “evidence” that an investor is a resident of the state. However, Indiana (like the other states) is completely silent as to what is acceptable in terms of evidence. Similarly, Indiana also requires that internet portals limit access to offering information solely to resident but provides no guidance as to how to do so. While not exhaustive, my proposed bill provides for specific acceptable forms for both evidencing residency (including the ability to rely on a person’s valid driver’s license) and for the limiting of access to residents of the state (including the ability to rely on a person’s (IP) address pursuant to the SEC’s recently released C&DI 141.05).

Conclusion.

The efforts of the other states to enact workable intrastate exemptions are truly inspiring and I, better than most, know that it is not an easy task. Innovation rarely is. Like the other bills, I know that my proposed bill is not perfect. There will never be a perfect intrastate exemption no matter how carefully I, or anyone else, attempts to craft one. That’s because best practices are not, and cannot be, written. Rather they evolve from use, trial, error and the glory of hindsight. So the best I can hope for is to put forth a bill that I believe truly balances the current needs of entrepreneurs and investors and, at the same time, attempts to improve on the work of my predecessors. In my humble opinion, my proposed bill does exactly that but I would love to hear what you think so please reach out to me with your comments…

Superb article. If you are successful in getting a bill passed in Illinois as the one you envision and have proposed in your article, I will retain your services and relocate immediately to Illinois. Presently, I am frustrated at the Indiana crowdfunding rules making it all but impossible to have a successful offering. The individual limits at 5K are to low and the cap at 2M with audited financials is economically unrealistic and unfeasible.

Your foresight in understanding business is refreshing and the long hours you are investing without any meaningful monetary compensation is a sacrifice few professionals like yourself are willing to make. If I can do anything as a small Indiana businessman that would further the crowdfunding community in Illinois, please do not hesitate to call or email me. Kindly, R D Fontana. 310-819-0978