While I have kept both my statutory summary pages and comparative summaries relatively up to date, it has been quite a while since I have done an editorial update on Intrastate Crowdfunding. With the increased number of active Intrastate regulations, as well as the growing popularity of the new Title III regulations, I though it was time to take another lay of the land.

The Big Picture:

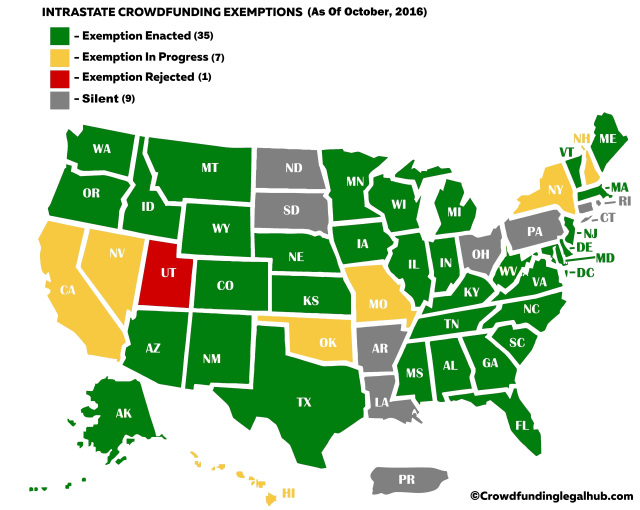

In just over two years we have gone from only a handful of states having Intrastate regulations to the overwhelming majority having some form of active regulations. As of today (to the best of my knowledge) the count stands at thirty-five (35) states who have enacted and effective Intrastate crowdfunding regulations, seven (7) states who have filed proposed Intrastate crowdfunding regulations, and only nine (9) states/territories (including Puerto Rico) who have yet to address the issue. They break down as follows:

To put this in perspective, the number of proposed bills about a year ago was somewhere around twenty-one (21) and the number of then states with enacted/effective intrastate crowdfunding regulations was somewhere around nineteen (19).

For a full list of (and links to) each of the currently enacted/proposed rules, see my recently updated post “STATE OF THE STATES – List of Current Active And Proposed Intrastate Crowdfunding Exemptions (Updated).”

The Key Differences:

Just because the majority of states now have Intrastate crowdfunding regulations, does not mean they are in any way similar to each other. In fact, they actually differ significantly from state to state. Here are a few of the key differences that issuers should be aware of:

- Offering Caps: The maximum amount an issuer can raise in any given 12 month

period varies significantly depending on the state they are in. Some states have very small offering caps in place (e.g. $100,000 in Maryland) while others provide for significantly higher amounts (e.g. $4 Million in Illinois). There are even a couple states whose regulations do not currently specify a cap at all (i.e. New Mexico and South Carolina). That being said, in most states the maximum amount that an issuer can raise in any given 12 month period is between $1-$2 Million.

period varies significantly depending on the state they are in. Some states have very small offering caps in place (e.g. $100,000 in Maryland) while others provide for significantly higher amounts (e.g. $4 Million in Illinois). There are even a couple states whose regulations do not currently specify a cap at all (i.e. New Mexico and South Carolina). That being said, in most states the maximum amount that an issuer can raise in any given 12 month period is between $1-$2 Million.

- Non-Accredited Investor Caps. Under all of the current Intrastate regulations, accredited investors are permitted to invest as much and as often as they would like. On the other hand, for non-accredited investors there are typically caps as to how much they can invest in a given year. Moreover, like offering caps, the rules vary significantly from state to state. Currently the investment caps for non-accredited

investors range from a low of $100 (i.e. Maryland) all the way up to $10,000. On average, the stated investment cap for a non-accredited investor tends to be about $5,000. That being said, the states also vary as to whether the caps are calculated on a “per year” or “per offering” basis. Put another way, even when two separate states provide for a $5,000 investment cap for non-accredited investors, one might prohibit such investors from investing more than $5,000 total in any given year (regardless of how many investment they make) while the other state may prohibit such investors from investing more than $5,000 per company, per year (hence allowing them the ability to invest, in theory, an unlimited amount as long as its spread out). In most states, the caps are calculated on a “per year” basis though, as you might imagine, trying to keep track of such amounts can create an administrative hassle for issuers.

investors range from a low of $100 (i.e. Maryland) all the way up to $10,000. On average, the stated investment cap for a non-accredited investor tends to be about $5,000. That being said, the states also vary as to whether the caps are calculated on a “per year” or “per offering” basis. Put another way, even when two separate states provide for a $5,000 investment cap for non-accredited investors, one might prohibit such investors from investing more than $5,000 total in any given year (regardless of how many investment they make) while the other state may prohibit such investors from investing more than $5,000 per company, per year (hence allowing them the ability to invest, in theory, an unlimited amount as long as its spread out). In most states, the caps are calculated on a “per year” basis though, as you might imagine, trying to keep track of such amounts can create an administrative hassle for issuers.

- Use of Crowdfunding Portals. You might think that there would be some unity on this point but there really isn’t. About half of the states permit (or are silent as to) the use of Crowdfunding Portals to conduct an Intrastate offering but do not require it. Hence, in these states an issuer could technically conduct an Intrastate offering

through its own websites etc. The other half of states specifically require that Intrastate offerings be made only through registered/qualified Crowdfunding Portals. For various reasons that I won’t get into, the lack of a requirement to use centralized Crowdfunding Portal tends to get my attorney side all riled up. This is why I drafted Illinois’ regulations to conform to the latter and specifically requiring the use of a registered/qualified Crowdfunding Portal.

through its own websites etc. The other half of states specifically require that Intrastate offerings be made only through registered/qualified Crowdfunding Portals. For various reasons that I won’t get into, the lack of a requirement to use centralized Crowdfunding Portal tends to get my attorney side all riled up. This is why I drafted Illinois’ regulations to conform to the latter and specifically requiring the use of a registered/qualified Crowdfunding Portal.

- Use of Escrowee. Most of the states specifically require the use of a 3rd party escrowee to hold investors funds until the offering closes. However, one of the issues that continues to plague earlier legislation is the requirement that the

escrow agent be chartered/formed within the respective state. Administratively, this turned out to be much easier said than done. Many of the currently proposed bills attempted to alleviate this roadblock by providing that such entities only need to be “authorized to transact business” within the state. Even with this change however, finding a workable escrow agent in each state is no easy feat.

escrow agent be chartered/formed within the respective state. Administratively, this turned out to be much easier said than done. Many of the currently proposed bills attempted to alleviate this roadblock by providing that such entities only need to be “authorized to transact business” within the state. Even with this change however, finding a workable escrow agent in each state is no easy feat.

- State Filings. While the majority of the states have enacted Intrastate crowdfunding regulations, not all of them currently have all of the related administrative filing and

other processes in-place. As a result, many states are still silent as to what filings and/or fees, if any, need to go to the state in connection with conducting an Intrastate offering. Generally speaking, most states require the delivery of a notice filing to the state, copies of all offering and advertising materials to be used in the offering, and a nominal fee. Also, where the use of a 3rd party escrowee is required, the state will typically want to see a copy of the respective escrow agreement.

other processes in-place. As a result, many states are still silent as to what filings and/or fees, if any, need to go to the state in connection with conducting an Intrastate offering. Generally speaking, most states require the delivery of a notice filing to the state, copies of all offering and advertising materials to be used in the offering, and a nominal fee. Also, where the use of a 3rd party escrowee is required, the state will typically want to see a copy of the respective escrow agreement.

- Ongoing Reporting. Most states are silent as to the ongoing reporting requirements

of issuers. Certain states however, specifically require issuers to deliver quarterly, semi-annual and/or annual financial statements (internally prepared/audited). In my opinion, as a matter of practice issuers should expect to deliver such reports regardless of whether or not they are statutorily required.

of issuers. Certain states however, specifically require issuers to deliver quarterly, semi-annual and/or annual financial statements (internally prepared/audited). In my opinion, as a matter of practice issuers should expect to deliver such reports regardless of whether or not they are statutorily required.

For a full side-by-side comparative summary of each of the currently enacted/proposed rules, see my other recently updated post “STATE OF THE STATES – Comparative Summaries of Current Active And Proposed Intrastate Crowdfunding Exemptions (Updated).”

Current Use of Intrastate Exemptions:

As noted above, the filing requirements vary significantly from state to state. As such, we (and by we, I mean the North American Securities Administrators Association (NASAA)) currently have minimal information as to the actual number of Intrastate offerings conducted to date. From the limited information that has been obtained, it is estimated that over 170 Intrastate offerings have been conducted over the last 3 years, nationwide, with the average offering size being between $250k and $500k. Even at the lower offering size, this represents approximately $42.5 Million in investments. Not an earth shattering amount by any means but impressive nonetheless given the fact that these regulations were virtually unknown to most investors and issuers a year or so ago.

In terms of the types of companies using the Intrastate regulations to raise capital, it runs the gambit from idea stage/start-up companies to existing revenue-producing companies. That being said, companies who are revenue producing and/or whose business involves one or more of the following, have tended to have more success in soliciting investors:

- Consumer goods

- Mobile tech products

- Real estate projects

- Restaurants and Breweries

It should be noted that the above numbers, even by NASAA’s count, are extremely conservative and are based only on information from those limited states that require notice filings and who have elected to reported such numbers to NASAA. Another important point to take note of is the fact that the majority of successful (at least those made known to NASAA) have come only from a handful of states (e.g. Georgia, Texas, Oregon, Michigan, Indiana, etc.) where the Intrastate regulations have gained much more publicity and traction among issuers and investors.

Intrastate vs Title III:

With the rising popularity of the newly released Title III (Regulation CF) rules, one of the questions I get asked all the time is “why do we still need Intrastate rules?” My response is always the same; there are pros and cons to both offering types which need to be evaluated subjectively to determine which approach is best for the issuer/project being funded. In many instances the Intrastate rules may be preferable to the Title III rules (e.g. where the issuer is looking to raise more than the $1 Million permitted under the Title III rules). Some of the pros and cons of the two offering types are as follows:

An in-depth discussion as to when the Intrastate option might be preferable is beyond the scope of this post, but if you would like more color on this point you can see another post of mine “Intrastate Crowdfunding: The Often Overlooked Option.” Either way, the takeaway here is that the Intrastate rules of many states can be a workable, and in many instances a preferable, option for a lot of companies looking to raise capital and, in my opinion, will continue to remain powerful capital raising alternatives.

Conclusion:

Albeit slowly, the popularity and recognition of Intrastate crowdfunding exemptions continues to grow as does the use of such exemptions. The slowness of adoption of Intrastate exemptions is, and always has been, the result of a general lack of public knowledge as to what these exemptions do and how to use them rather than the effectiveness of such exemptions. As noted above, certain states such as Oregon, Texas, Georgia, Michigan and Indiana have had more success than others in raising public awareness of Intrastate exemptions. Luckily investment based crowdfunding stories  continue to push their way into mainstream media which, ultimately, will raise public awareness of many of the viable Intrastate exemptions. As public awareness continues to grow, and as larger states like Illinois start significantly adopting these rules (which should be in the next couple weeks), I predict that we will see the use of Intrastate exemptions (in certain states) rise significantly over the next 1-3 years.

continue to push their way into mainstream media which, ultimately, will raise public awareness of many of the viable Intrastate exemptions. As public awareness continues to grow, and as larger states like Illinois start significantly adopting these rules (which should be in the next couple weeks), I predict that we will see the use of Intrastate exemptions (in certain states) rise significantly over the next 1-3 years.