Now I know that this is clearly a far shift from the types of blog articles I typically do. However, given the current financial and other issues facing Illinois and its taxpayers, and the fact that things only seem to be getting worse, I felt compelled to offer my own thoughts on some real ways to help bring this state back from the broke, I mean brink.

As a preface to this article let me be clear that I am a corporate attorney with no political power to facilitate any changes within the state; including pushing through any of the ideas set forth below. However, the problems facing this state are going to require unique solutions and this is something I like to pride myself on. As such, my greatest hope with this article is that it falls into the hands of people who can influence policy and sparks the discussions necessary to get us moving in the right direction. Now, with that said, here is my 3-point plan to help put this state back on track.

Point 1. Property Tax Reform – We Need To Fix The Broken and Corrupt Property Reassessment System

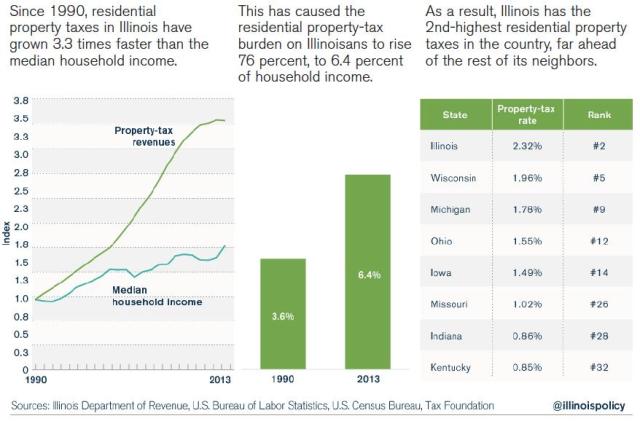

Due to years and years of irresponsible tax and spend politics, Illinois now has the second highest real estate property tax in the county; and we are poised to soon become number 1. Looking at residential property taxes alone, since 1990 property taxes in Illinois have grown 3.3 times faster than median household incomes and now average 2.32% of property value. Furthermore, over the same period the residential property-tax burden, as a percentage of median household income, has risen 76 percent!

Now there are many components which go into making our taxes as high as they are including funding government pension obligations (which I’ll discuss more below), school/educational expenses, infrastructure repairs and other governmental expenses. Dealing with how to reform any of these components individually could be a whole article on its own and is beyond the scope of this post. So for our purposes we are going to assume there is nothing we can do about the general 2.32% rate.

So how can we stop Illinois residents from being taxed into oblivion? A major effort to stop Illinois’ 2.32% property tax rate from creeping even higher has already been started with House Bill 4224. This legislation is part of Gov. Bruce Rauner’s Turnaround Agenda and, if approved, would freeze property taxes at current levels unless local voters approve a future property-tax increase. This is all well and good but I honestly think it’s a prop bill with little chance of passing. Frankly speaking, we will never get Illinois politicians to agree to give up their blank check ability to add % increases to property taxes in order to cover budget gaps; it’s what they know how to do best. Moreover, it doesn’t get to the heart of the problem. It is not the 2.32% rate that is killing Illinois residents; it’s the ridiculously corrupt property reassessment system!

Generally speaking, the amount of a property tax bill is determined by two things: the amount of money local governments charge (i.e. the 2.32%) and the assessed value of the subject property. In Illinois each property’s value is reassessed once every three years (once every 4 years in counties outside of Cook). Now let’s be clear, paying taxes based on some fictional, arbitrary, fair market value is an outright sham on its face. Even if the subject property is actually worth what the assessor says it is the owner doesn’t have more money in his pocket; its phantom gain at best and its not taxable on any other investment. If I own a share of Microsoft and it goes up in value, I am not taxed on that gain unless/until I sell the stock. Why? Because I haven’t actually received any money from it of course! Logic aside, the reassessment of properties will undoubtedly continue so we need to work within those confines. To that end, we need to institute a cap on the amount the property value of a given property can increase.

Generally speaking, the amount of a property tax bill is determined by two things: the amount of money local governments charge (i.e. the 2.32%) and the assessed value of the subject property. In Illinois each property’s value is reassessed once every three years (once every 4 years in counties outside of Cook). Now let’s be clear, paying taxes based on some fictional, arbitrary, fair market value is an outright sham on its face. Even if the subject property is actually worth what the assessor says it is the owner doesn’t have more money in his pocket; its phantom gain at best and its not taxable on any other investment. If I own a share of Microsoft and it goes up in value, I am not taxed on that gain unless/until I sell the stock. Why? Because I haven’t actually received any money from it of course! Logic aside, the reassessment of properties will undoubtedly continue so we need to work within those confines. To that end, we need to institute a cap on the amount the property value of a given property can increase.

The sticker shock Illinois residents get when opening property tax bills doesn’t come from an additional % to the overall tax rate, it comes from the ridiculously arbitrary, and often monumental, property value increases upon reassessment. As a result of the 2018 reassessment alone, many people saw property tax increases of anywhere from 10% to upwards of 70% which is absolutely insane. These increases were the result of nothing more than Illinois arbitrarily assigning some inflated value to the subject properties. There are only 2 parties who win as a result of arbitrarily inflated property values; the state and the “property tax appeal” firms. Think about it, the state assigns your property some ridiculously high value, you basically have 2 choices. Pay it (if you can even afford it which I will discuss later) in which case the city wins or hire one of these firms to contest it and pay them 40% of any amounts you save. Putting aside for a minute the known corruption inherent in the property tax appeal system, the Illinois taxpayers get the short end of the stick no matter which option they chose.

On a highly related note, the “gentrification” issue (i.e. the taxing of people out of their neighborhoods) that many politicians are currently fighting against is caused entirely by this reassessment issue. Development in a neighborhood drives up property values in that neighborhood and existing houses are then assessed at an arbitrarily high property value even though the house hasn’t changed and the people in it are no richer. Eventually those values get so inflated that the once residents of the neighborhood can no longer afford to pay the taxes to live there and are forced out. Moreover, many residents are often not affluent enough to hire one of the above-mentioned tax reassessment firms and are thus left bearing the full weight of these inflated taxes which are crippling at best. To combat this “gentrification” issue many politicians are trying to institute laws/regulations to limit development. This is absolutely the WRONG approach. Development within a neighborhood does eventually put money in the pockets of the residents (i.e. if/when they sell). Accordingly, stopping/limiting development takes future revenues from these people. How is that a good idea? Alternatively, putting a cap on the amount the value of their homes can increase until they are eventually sold would allow these people to be able to better afford to stay in their home (i.e. curing the gentrification issue) while still allowing them to benefit from future revenues if/when they sell.

On a highly related note, the “gentrification” issue (i.e. the taxing of people out of their neighborhoods) that many politicians are currently fighting against is caused entirely by this reassessment issue. Development in a neighborhood drives up property values in that neighborhood and existing houses are then assessed at an arbitrarily high property value even though the house hasn’t changed and the people in it are no richer. Eventually those values get so inflated that the once residents of the neighborhood can no longer afford to pay the taxes to live there and are forced out. Moreover, many residents are often not affluent enough to hire one of the above-mentioned tax reassessment firms and are thus left bearing the full weight of these inflated taxes which are crippling at best. To combat this “gentrification” issue many politicians are trying to institute laws/regulations to limit development. This is absolutely the WRONG approach. Development within a neighborhood does eventually put money in the pockets of the residents (i.e. if/when they sell). Accordingly, stopping/limiting development takes future revenues from these people. How is that a good idea? Alternatively, putting a cap on the amount the value of their homes can increase until they are eventually sold would allow these people to be able to better afford to stay in their home (i.e. curing the gentrification issue) while still allowing them to benefit from future revenues if/when they sell.

To clarify, I am not proposing an outright cap on property increases. It has been tried in the past and, just like the freeze discussed above, I don’t think it would ever pass. As also noted above, politicians like to have property tax rate increases in their pocket as a bargaining chip and that just isn’t going away. What I am proposing is putting a cap on the total amount a particular property can increase upon reassessment unless/until it is sold. This is not an entirely new proposal. In 1994, Michigan adopted Proposal A, a constitutional tax amendment which provides that the annual increase in the taxable value of a particular property is limited (i.e. capped) at the lesser of 5% or the rate of inflation while the real estate is owned by the same person. This is the type of legislation we need here. Illinois could, and should, institute a similar 5% (or even 10%) cap. Illinois could even go so far as adding additional value increasing triggers if they chose, such as automatically increasing the value of a property upon a renovation or cash-out refinance where such an increase in value might actually make sense. The point is the reassessment system is broken and a cap would limit the amount Illinois residents would be harmed by the system across the board.

More specifically, the proposed cap would have several beneficial results:

- First, no more sticker shock! Illinois residents could better expect property tax increases and thus better prepare/budget for the increases.

- Second, the proposed cap would all but eliminate the gentrification issue above. Even in high development areas, if property value increases are capped those residents would be better able to afford to stay in their houses. By way of example, let’s say the cap is set at 5% as noted above (i.e. 15% on a 3-year reassessment). For those residents who were getting hit with 40%-60% increases in the last round of reassessments that would have been capped at 15%. 15% is arguably a budgetable amount; not for everyone I recognize but 15% pales in comparison to the skyrocketing increases we have now no matter who you are.

- Third, given the overall cap, Illinois could save on having to hire costly, individualized, property assessment reports. They could instead rely on more generalized reports showing general increases in market/property value reports (e.g. reports showing median values/increases in median values across each neighborhood). Such reports are readily available from several respected providers and the results could be applied unilaterally across properties. A copy of the report could even be included with the bills to make the adjustments clearer to taxpayers and provide additional transparency. I mean let’s face it how often do our property values go down for tax purposes? I personally have never seen it. So does it really matter to taxpayers whether Illinois conducted a costly report to back their inevitable increase in value? It certainly wouldn’t if there was a cap.

- Finally, and this is my favorite, the proposed cap would basically make the corrupt “property tax appeal” industry in Illinois moot. Most would understand the tax increases and take them in stride without attempting to appeal the underlying valuation; thus negating the need for “property tax appeal” firms. This would have the added benefit of both: (1) saving the Illinois government the money spent in processing/dealing with the numerous property tax appeals that come in every time properties are reassessed, and (2) saving taxpayers the fees that would have otherwise been paid to these appeal firms. That’s a Win/Win if I have ever heard one. Now I’m not saying we eliminate the appeal process altogether; it would still be there. I just think it would be rarely used if there was the proposed cap.

One point to note before I end this section. While the above discussion focused on residential taxes, the same arguments for a cap apply almost equally to commercial properties. Commercial properties have also seen monumental property valuation increases in recent years and a valuation cap on those properties needs to be instituted to incentive people to actually own/improve commercial property here and to keep Illinois business growing. Not to mention to protect Illinois small/local businesses from getting squeezed out of growing neighborhoods. Mind you the cap might not be as low as 10% (perhaps 20%) and/or may have additional value increasing triggers but a cap is just as important in the commercial context as it is in the residential one.

Point 2. Pension Reform – We Need To Stop the Bleeding

I know, “pension reform” is a sound bite that every politician here in Illinois likes to throw out but the type of reform I am talking about is something a bit different. There are really 2 sides to the current pension problem here in Illinois. The first side is what almost everyone focuses on, the fact that we have an enormous existing pension obligation that we cannot even come close to being able to fund. The second side, which no one seems to ever address, it that we continue to allow for pensions to be paid as if they are an immutable right. This makes absolutely no sense whatsoever. WE NEED TO STOP OFFERING PENSIONS, PERIOD! To try to focus on “reforming” our pension obligations while continuing to offering pensions makes about as much sense as trying to mop up a flooding basement without stopping the cause of the flood.

Now let me clarify what I am suggesting. I am NOT suggesting that we simply stop paying, or somehow try to renegotiate/refinance, our existing pension obligations. Our existing pension obligations represent promises made to employees that we need to figure out a way to make good on. That is a different problem that we obviously need to solve but first things first; we need to stop the bleeding. What I am proposing is that we put our foot down and eliminate pensions for all NEW employees; including POLITICIANS. Put another way, anyone who takes one of these jobs going forward does so knowing that they will not be entitled to a pension.

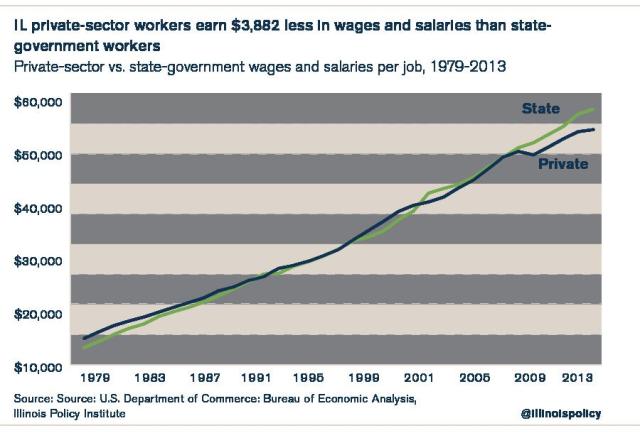

Critics will say that we need to keep paying pensions to incentive those who take these jobs. That is a ridiculous and entirely outdated argument at best. Without getting into a lengthy discussion as to the intended purposes of pensions, they were originally used as an incentive to encourage people to take public sector jobs as opposed to jobs in the private sector by offsetting the lower salaries traditionally paid to public sector employees. The pay discrepancy between the public and private sectors is immaterial if not nonexistent at this point. In fact, on average in Illinois, public sector wages now exceed private sector wages as illustrated by the following:

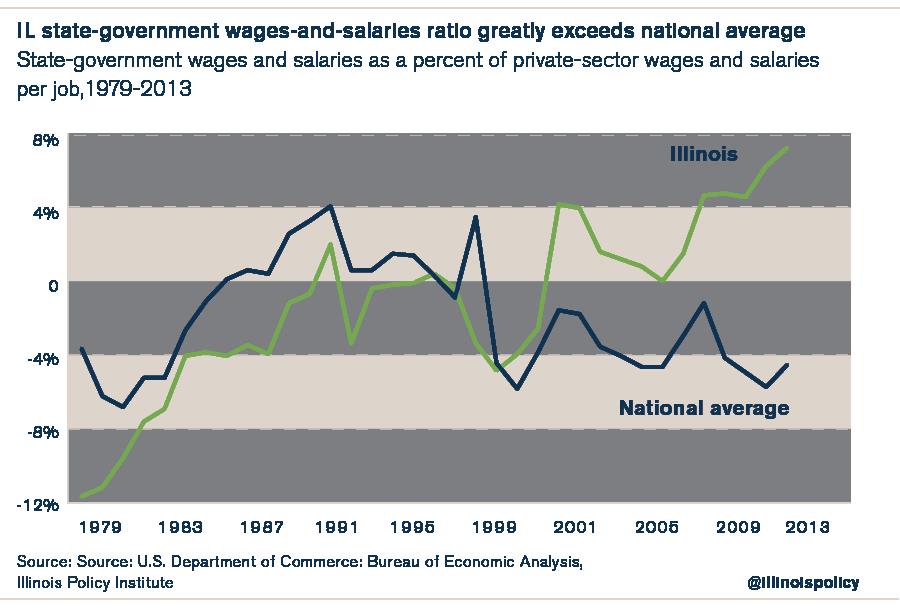

Not to mention that public sector salaries here in Illinois FAR exceed the national average:

And both of the charts above were as of 2013, and Illinois public sector salaries have only gone up since then. So there is absolutely NO REASON that pensions need to continue to be offered to incentive people to take public sector jobs.

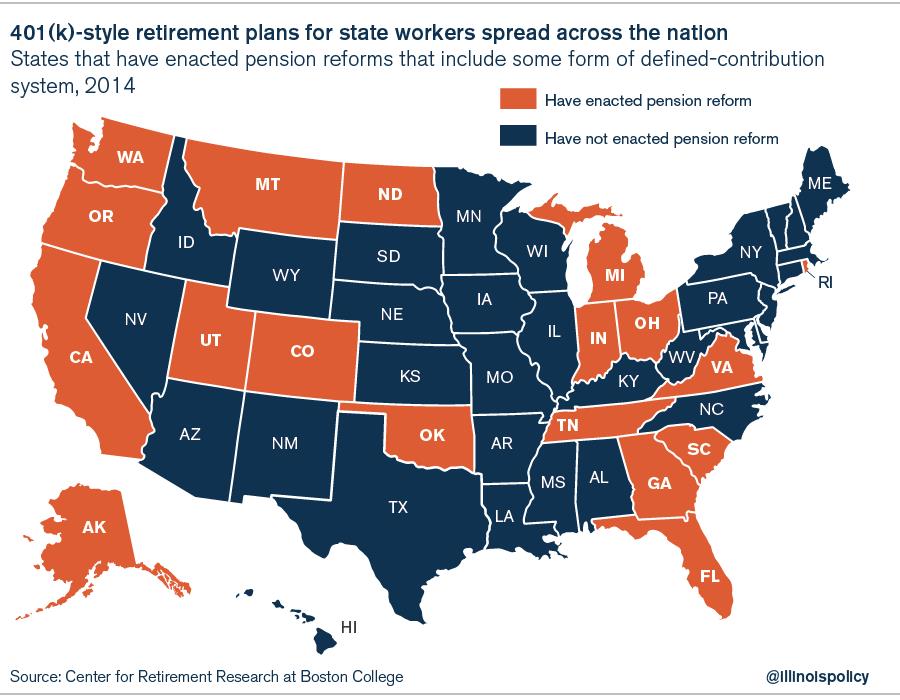

For arguments sake, let’s say that you do still need to provide some incentive to potential public sector employees; whether to incentive them to take the job or as additional compensation for working along side existing pensioned employees. You could do so by offering a higher base salary and/or matching 401(k) plans. These would easily incentive anyone on the fence about these positions and the additional expense created by them would pale in comparison to the costs of continuing to offer pensions. Moreover, you could even offer the increased salary/matching 401(k) plans as an incentive to existing pensioned employees to switch over and forgo their existing pensions (or at least further contributions). This is where the rest of the country is headed and we are well behind the curve.

So what’s stopping us from doing this? Nothing, absolutely nothing! Well nothing other than the fact that we don’t have a leader willing to put their foot down to make it happen that is. Unlike “reforming” our existing pension obligations which would require an amendment to the Illinois constitution to accomplish, payment of pensions to NEW employs is entirely a matter of contract to be bargained between the parties. As such, this should flat out be the starting point to every single union contract negotiation the mayor/governor has from here forward. Frankly, if they are not coming to the table and saying “pensions for new employees are off the table and anything short of that is a non-starter” then they are not living up to the fiscal responsibility of their position, period. Cuts need to be made and lines need to be drawn and we need people willing to take the hard positions necessary to enact real change.

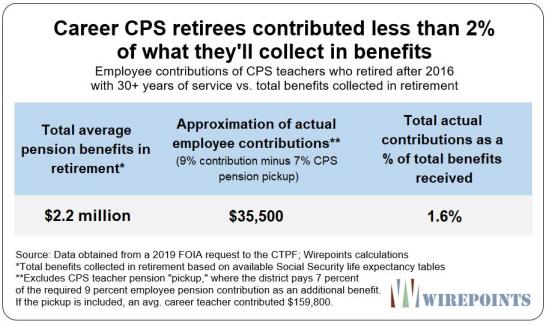

This is not what we are seeing however. Take the recent negotiations with the Chicago Teacher’s Union (the “CTU”). Without getting into my thoughts on the merits of the arguments on either side, in all the back and forth about raises, expenses, etc. there was not a single mention about stopping pensions for new employees. That is insane! The average CPS teacher will collect $2.2 Million in pension benefits while contributing less than 2% of that amount.

That means for every NEW teacher hired without a pension, the city would potentially save $2.2 Million in further pension bleeding. Remember also, this is just the CTU, there are multiple other pensioned public positions that can be eliminated.

Now I am aware the above change is not an easy one to make and will require monumental effort, but it absolutely needs to happen. We are beyond the point of being able to ignore the issue and thinking it can be fixed by taxing “rich people” and the other residents of Illinois. Let’s just take this recently approved CTU deal for example where, among other things, they approved a 16% raise over five years. For those that can’t readily see the connection pensions are based on a % of the individual’s annual salary when they retire so this 16% salary bump is going to further increase our pension bleeding by a ridiculous amount estimated in the hundreds of millions. This bleeding simply cannot continue.

We need to take a stand and change the way business is done, period. Sure, the first union negotiation will be long and hard but after the first one the rest will fall like dominoes. Our mayor/governor needs to stand strong and take a page out of the CTU handbook and gain the support of the people. Why do you think the CTU had TV ads  ready to start playing the minute negotiations stalled, not to mention picket signs and trucks at the ready? They even had Chance the Rapper appear on Saturday Night Live a couple weeks ago in a CTU t-shirt for crying out loud. What did the mayor have? A press conference, maybe 2… yawn. The mayor/governor should have their own marketing plan, including TV ads, in place prefacing every union negotiation and stressing that this absolutely needs to happen. Have a few TV ads showing Illinois residents opening $50,000 property tax bills or paying a 50% sales tax with a “stop pensions now or this is where we will end up” tag line and see how much support you get.

ready to start playing the minute negotiations stalled, not to mention picket signs and trucks at the ready? They even had Chance the Rapper appear on Saturday Night Live a couple weeks ago in a CTU t-shirt for crying out loud. What did the mayor have? A press conference, maybe 2… yawn. The mayor/governor should have their own marketing plan, including TV ads, in place prefacing every union negotiation and stressing that this absolutely needs to happen. Have a few TV ads showing Illinois residents opening $50,000 property tax bills or paying a 50% sales tax with a “stop pensions now or this is where we will end up” tag line and see how much support you get.

Point 3. Government Contract Reform – We Need To Renegotiate/Elimination Underperforming and Non-Preforming Governmental Contracts

Now any governmental agency is going to have its share of underperforming/non-performing contracts, that’s a given. However after years of shady backroom deals I would bet that Illinois tops most others in this category. With the dire straits this state is in its more than past time to figure out what contracts are working for us and which are not.

A normal person or company facing budget issues would immediately try to renegotiate, or outright eliminate, some of their expenses. C’mon, how many times have you called your cable company trying to get a better deal for the same service? For some reason that mentality isn’t present at the governmental level here in Illinois. They appear to view our existing contract obligations as fixed, and immutable, even when those contracts are underperforming/non-performing. As a contract lawyer I can tell you that this is absolutely the wrong mentality. There are numerous arguments to be made to get out of contractual obligations, particularly where the other party is underperforming/non-performing. The state might even go so far as argue “commercial  impracticability” which is a contract defense whereby (generally speaking) a party may be relieved of their contractual obligations in the event such obligations have been made excessively expensive, harmful, or difficult to perform. Given the budget crisis we have here currently, this isn’t a far stretch. Would it ultimately be successful? I couldn’t say as litigation isn’t my area. However, typically the threat of litigation brings people to the bargaining table which would still be a win.

impracticability” which is a contract defense whereby (generally speaking) a party may be relieved of their contractual obligations in the event such obligations have been made excessively expensive, harmful, or difficult to perform. Given the budget crisis we have here currently, this isn’t a far stretch. Would it ultimately be successful? I couldn’t say as litigation isn’t my area. However, typically the threat of litigation brings people to the bargaining table which would still be a win.

The point is that we shouldn’t be content moving forward with agreements that aren’t working for us. What we should be doing is routinely, and periodically, going through every one of the state’s existing agreements with a fine toothed comb and renegotiating those agreements that are underperforming but still working for us and outright terminating those that are non-performing or otherwise not working for us. Let’s look at a few real examples to illustrate my point.

For those that don’t know, you can actually review the city of Chicago’s existing contracts, and related payments, on the city’s “procurement services” website. Now without trying to call anyone out, from this website I found a construction contract awarded on March 15, 2016 for the completion of a $61.7M storm water project. By its terms this agreement was to be completed within 2 years from the award date which was by March 15, 2018

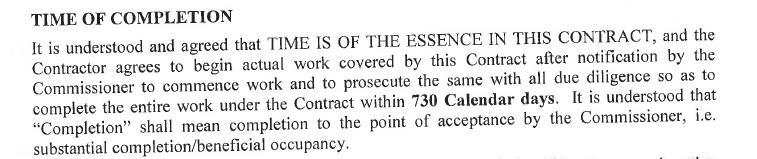

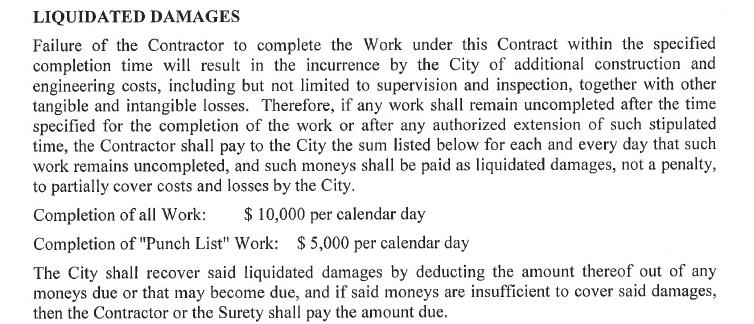

Given that the website shows payments being made on this agreement through February of 2019 it looks like the completion of this project was materially delayed (by almost a year). Now I am sure there were underlying issues and discussions along the way which are not apparent from the black and white on the website so I cannot say for certain whether this delay was justified or unjustified. Assuming for argument’s sake that it was simply an underperforming contract, the state should have been enforcing its rights under the agreement or otherwise leveraging those rights to renegotiate the agreement. For example, this agreement contains the following liquidated damages clause:

There is even a clause that requires round the clock work to be performed (at no additional cost) if the project falls behind schedule IF REQUIRED by the city.

Who knows if these remedies were ever exercised but I don’t see any 24-hour work being done here do you? Again, I don’t claim to know the details of this contract and/or whether the apparent completion delay was an actual one. However clauses like those above are most likely in most similar agreements and they need to be being enforced where the contract is underperforming.

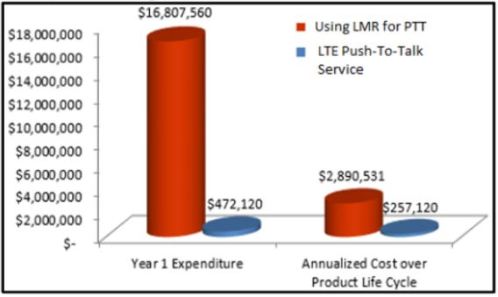

Let’s consider a different type of agreement, one that may (or may not, who knows) be contractually performing but may not continue to make economic sense for us. Again, without trying to call anyone out, on the website you will find several contracts related to the provision/service of the state’s emergency notification infrastructure. Now I don’t claim to have any real knowledge in this area at all. However a simple internet search on the subject will show that our infrastructure is built on an arguably unnecessarily expensive, and rapidly obsolescing, land mobile radio (LMR) push-to-talk system. Such systems are being replaced in other states with new alternatives such as Long-Term Evolution (LTE) technology which are materially less expensive yet arguably just as reliable (if not more reliable). Take a look at this chart that was prepared for Fairfax County, Virginia to assess the cost comparison between continuing with their existing LMR system or moving to a new LTE alternative:

Now the extent of my knowledge on the subject is limited to the above paragraph so I cannot say for certain whether our existing LMR agreements are working for us. What I can say is that, given the potential cost savings illustrated by the above chart, someone at the state level with knowledge on the subject should absolutely be evaluating these agreements and deciding whether they still work for us. Think of it like cancelling a gym membership you never use. Sure, it was a good idea at the time, but you haven’t gone in 2 years; its time to deal with the fact that you’re not going to go, the agreement isn’t working for you and continuing to pay for it makes no sense.

In line with the foregoing, I would propose that first all existing Illinois governmental contracts be audited to identify those that are underperforming/non-performing. This information should be readily available. If it isn’t then we have an inherent contract oversight issue here in Illinois, but I digress. For those contracts identified as non-performing the answer is simple; hire a law firm to terminate the agreement. Alternatively, for those contracts that are identified as underperforming, I would propose using it as an opportunity to renegotiate the terms. For example, the state could first make the other party aware of the known underperformance and offer cost cut in lieu of potential cancellation (e.g 15% cost reduction off the top). Something simple to give the other party the chance to avoid the potential agreement termination. If they rejected that offer the state could hand it over to the aforementioned law firm to find legal measures to compel such renegotiation or otherwise terminate the agreement.

Details aside, the concept is inherently simple. Before we start talking about putting a budget in place the mayor/governor needs to eliminate, or otherwise renegotiate, the  contractual obligations that are no longer working for us. We could potentially save tens, to hundreds, of millions just by doing this. Times change and what might have worked financially before most likely doesn’t today; including the numerous sweetheart contracts that have been doled out over the years. Like any of the suggestions above it won’t be easy and there will be significant expense. However, this should not stop us from taking the measures we need to take and cutting the fat from our contractual obligations. We shouldn’t have to live with underperforming/non-performing agreements simply because it would take effort to get out of them.

contractual obligations that are no longer working for us. We could potentially save tens, to hundreds, of millions just by doing this. Times change and what might have worked financially before most likely doesn’t today; including the numerous sweetheart contracts that have been doled out over the years. Like any of the suggestions above it won’t be easy and there will be significant expense. However, this should not stop us from taking the measures we need to take and cutting the fat from our contractual obligations. We shouldn’t have to live with underperforming/non-performing agreements simply because it would take effort to get out of them.

Conclusion.

Maybe it’s my naiveté but in my opinion our Illinois leaders are too in the weeds with trying to deal with the hot button issue of the day rather than focusing on making real, underlying, changes. Band aid solutions are fine for sound bites and press releases but eventually there are too many cuts to Band-Aid over and that is where we are now. This state is in real trouble and no amount of quick fixes is going to stop the financial hemorrhaging. If we don’t make real, fundamental, changes now, it’s the taxpayers who are going to suffer and they will eventually leave this state in mass exodus.

Please feel free to leave comments on any/all of the above. Again, I am just a corporate attorney with no ability to facilitate any of the above suggestions so I can only hope this sparks some real discussion with the people who actually can help influence such change.