Whether or not you are considered an “accredited investor” will, more often than not, decide whether you can invest in a particular privately held (i.e. not publicly traded) company. Qualifying as an accredited investor has become even more important with the enactment of Title II of the J.O.B.S. Act which allows companies to solicit, and sell securities to, accredited investors over the internet and other forms of social media. This article is a primer as to what it means to be an accredited investor and why it matters generally and in the crowdfunding context.

What is an Accredited Investor and Why Does It Matter?

The term “accredited investor” is defined In Section 501 of the Securities Act of 1933 (the “Act”). Under the current test an individual will qualify as an accredited investor if he or she:

earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two (2) years, AND reasonably expects the same for the current year; OR

earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two (2) years, AND reasonably expects the same for the current year; OR- has a net worth over $1 million, either alone or together with a spouse (excluding the value of the person’s primary residence).

It should be noted that, for the income test, the person must satisfy one (or both) of the thresholds for subject period and they cannot mix and mingle the thresholds. Put another way, a person cannot rely on the individual threshold in one year then the joint threshold in the next year (unless that person just got married).

So why does being an accredited investor matter? Under the Act and other applicable federal and state securities laws, a company (an “issuer”) may not offer or sell stock or other equity/debt interests (“securities”) unless either the company has registered the securities with the SEC (and applicable state agencies) OR an exemption from registration is available. For ease of discussion, let’s assume that “registered” securities refer to public securities like those that everyone is familiar with such as shares of Apple, Facebook or Microsoft. Let’s also assume, again for simplicity, that any other offer or sale of securities would require an exemption from registration.

Generally, when companies (particularly start-ups and young companies) go looking for investors, they do not want to have to register their securities due to the substantial personal and financial commitment involved (e.g. professional costs, public disclosure obligations, ongoing compliance obligations, etc.). Fortunately, there are a number of exemptions under the Act which will allow these companies to sell their securities to investors without registration, the most popular of which involve “private placements.”

Private Placements and Regulation D

The most common exemptions relied on to avoid registration under the Act are those commonly referred to as “private placement” exemptions. Section 4(a)(2) of the Act (formerly known as Section 4(2) prior to the enactment of the J.O.B.S. Act) provides an exemption from registration for “transactions by an issuer not involving any public offering.” As a result of the vagueness as to what is, or should be, considered a “public offering,” and the years of litigation over this issue, the SEC ultimately adopted “Regulation D” to provide certain specific types of “safe harbor” transactions which would be considered “private placements” and thus be exempt from registration. These safe harbor transactions are commonly referred to as Rule 504, Rule 505 and Rule 506 offerings (Rule 506 offerings split into 506(b) offerings and 506(c) offerings with the enactment of the J.O.B.S. Act).

exemption from registration for “transactions by an issuer not involving any public offering.” As a result of the vagueness as to what is, or should be, considered a “public offering,” and the years of litigation over this issue, the SEC ultimately adopted “Regulation D” to provide certain specific types of “safe harbor” transactions which would be considered “private placements” and thus be exempt from registration. These safe harbor transactions are commonly referred to as Rule 504, Rule 505 and Rule 506 offerings (Rule 506 offerings split into 506(b) offerings and 506(c) offerings with the enactment of the J.O.B.S. Act).

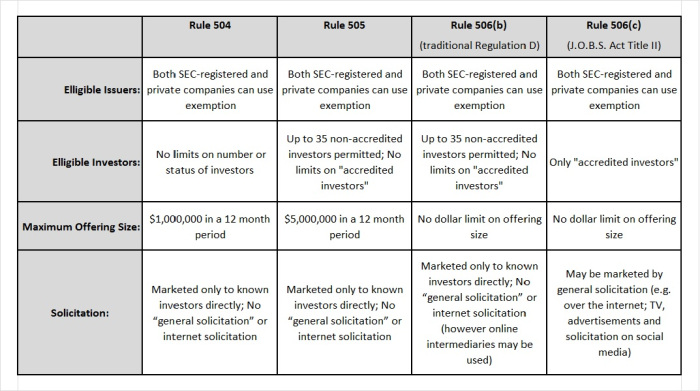

While a detailed description of these safe harbor rules is beyond the scope of this article, here is a brief comparison of the differences between Rule 504, Rule 505 and Rule 506 offerings:

Take Aways

By far, the most widely used of the above exemptions today are 506 offerings as Rule 506 allows companies to raise an unlimited amount while at the same time being the most flexible in terms of solicitation of investors. These offerings, however, rely on the majority (if not all) of the investors being accredited investors. Put another way, many companies looking for investors today are relying in Rule 506 and, if you wanted to invest in such a company, in most cases you would have to qualify as an accredited investor. Hence, the importance of who can qualify as an accredited investor.

With the enactment of Title II of the J.O.B.S. Act, the popularity of Rule 506 offerings (i.e. Rule 506(c) offerings) have only increased because now companies may use the internet and social media to solicit investments through crowdfunding. With such general solicitation comes a greater pool of potential investors but this only means that determining who qualifies as an accredited investor and who doesn’t is even more important. Especially because the SEC is keeping a close eye on how, and to who, offerings through the internet/social media are being made.

With the enactment of Title II of the J.O.B.S. Act, the popularity of Rule 506 offerings (i.e. Rule 506(c) offerings) have only increased because now companies may use the internet and social media to solicit investments through crowdfunding. With such general solicitation comes a greater pool of potential investors but this only means that determining who qualifies as an accredited investor and who doesn’t is even more important. Especially because the SEC is keeping a close eye on how, and to who, offerings through the internet/social media are being made.

If you are considering investing in a private offering and would like to know if you qualify as an accredited investor, the SEC has prepared an Investor Bulletin which may be helpful. Either way, you should consult your accountant, attorney and financial advisor before investing in ANY private offering.

Pingback: CHANGES TO “ACCREDITED INVESTOR” DEFINITION MAY CLIP THE WINGS OF MANY ANGEL INVESTORS | CROWDFUNDINGLEGALHUB.com

Pingback: New Markets | Times Realty News

Pingback: “ACCREDITED INVESTOR,” WHAT IT MEAN...

Pingback: RECFUNDS VS TRADITIONAL REAL ESTATE INVESTMENT, AN OVERVIEW (Part 2) | CROWDFUNDINGLEGALHUB.com

Pingback: New Markets | Times Realty News

Pingback: Real Estate Crowdfunding VS Traditional Real Estate Investment, An Overview (Part 2) | Times Realty News

Pingback: CHANGES TO “ACCREDITED INVESTOR” DEFINITION MAY CLIP THE WINGS OF MANY ANGEL INVESTORS | Times Realty News

Pingback: Changes To “Accredited Investor” Definition Recommended By SEC Staff; The Good, The Bad And The Ugly | CROWDFUNDINGLEGALHUB.com