Do you remember that scene from the movie Tommy Boy where the store manager rants about the importance of having a guarantee on the product box “calling out, I’ll never let you down, but if I do I’m gonna make things ALL better.” I can’t help but be reminded of that scene whenever I see real estate crowdfunding portals using words like “asset-backed” and/or “guaranteed” to describe their lending investment opportunities. But how secure are these investments really???

Do you remember that scene from the movie Tommy Boy where the store manager rants about the importance of having a guarantee on the product box “calling out, I’ll never let you down, but if I do I’m gonna make things ALL better.” I can’t help but be reminded of that scene whenever I see real estate crowdfunding portals using words like “asset-backed” and/or “guaranteed” to describe their lending investment opportunities. But how secure are these investments really???

I’d like to preface this article by saying that I truly think that crowdfunding represents the future of real estate investment and I would like nothing more than to help further the crowdfunding industry. That being said, I believe that the real estate crowdfunding (i.e. “RECfunding”) loan industry may be moving a bit too fast for its own good and overlooking some key investor protection elements.

Ignoring the “crowdfunding” aspect, these are commercial loan transactions which carry the same risks and concerns as any commercial loan. I have reviewed several offering documents and, speaking as an attorney who documents asset and real estate backed loans on a daily basis, I have noticed several issues that give me cause for concern. First, what investors may believe to be secured investments are, in many cases, completely unsecured from a legal standpoint. Second, if the proper security documents are not being used, and/or are not drafted properly, any “collateral” offered in connection with the deal may be illusory. Third, unless adequate project control and oversight measures are being included in the underlying loan documents, signs of a project failure may go unnoticed until it is too late. Finally, the interests of the investors and the other parties are not truly aligned.

estate backed loans on a daily basis, I have noticed several issues that give me cause for concern. First, what investors may believe to be secured investments are, in many cases, completely unsecured from a legal standpoint. Second, if the proper security documents are not being used, and/or are not drafted properly, any “collateral” offered in connection with the deal may be illusory. Third, unless adequate project control and oversight measures are being included in the underlying loan documents, signs of a project failure may go unnoticed until it is too late. Finally, the interests of the investors and the other parties are not truly aligned.

ISSUE #1 – Investors Are Often NOT Secured

As illustrated in my other article (“Real Estate Crowdfunding Vs Traditional Real Estate Investment, An Overview“), in many RECfunding campaigns the investor is actually making a loan to the crowdfunding portal who in turn makes a loan to the real estate developer. In return for their investment an investor will receive what is referred to as a “payment dependent” (or “borrower dependent”) promissory note from the crowdfunding portal. A payment dependent note simply means that if the portal doesn’t get paid from the developer, the investor won’t get paid from the portal. Simple enough for an investor to understand. Where it gets tricky is determining what, if anything, is securing these payment dependent notes.

You may have gotten emails (or seen other promotional materials) from some of these RECfunding portals advertising “asset-backed” and/or “guaranteed” investment opportunities. Hearing words like these may make you feel more secure about investing. Or as Chris Farley puts it, “Guy puts a fancy guarantee on a box ’cause he wants you to feel all warm and toasty inside.” The problem is, more often than not, it is only the crowdfunding portal that is secured and NOT the investor.

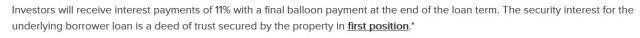

Take for example this excerpt taken directly from the description of the collateral associated with a RECfunding campaign which recently ran on one of the industry leading platforms:

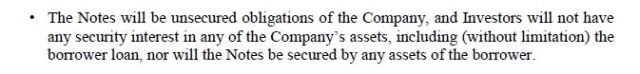

As an investor you might read this description and think, “Great! So my loan is secured by a first position lien on the subject property.” You would, however, be wrong. The term “underlying borrower loan” means the loan from the portal to the developer, NOT the loan from the investor to the portal. In fact, if you reviewed the investor document package associated with this loan (as you should always do) you would have read the following (among other similar provisions):

So what’s the problem? The problem is managing investor expectations. Some of us more experienced investors may understand the difference between the loan we are making to the RECfunding portal and the “underlying borrower loan.” Given my conversations with many educated investors however, I would venture to say that many investors are looking at these loans as being secured when they are not. Not convinced that people can be confused? Maybe this example will change your mind.

I recently got an email from a different major RECfunding portal advertising an opportunity that was being personally guaranteed by the president of the real estate developer company. I was interested so I clicked through and one of the first things I see in the description is this (redacted in part): Experienced investor or not, almost anyone reading this would think “My loan is guaranteed.” Wrong again! As with the above example, the investor document package associated with this loan contained the following language (redacted in part), in multiple places, making it clear that my loan would not be guaranteed:

Experienced investor or not, almost anyone reading this would think “My loan is guaranteed.” Wrong again! As with the above example, the investor document package associated with this loan contained the following language (redacted in part), in multiple places, making it clear that my loan would not be guaranteed:![]() There is no real reason that these notes need to be unsecured in the first place. There are legal structures that can be easily created to allow for the same transactions (including taking advantage of any interest arbitrage between the parties) while still adequately passing the collateral interest from the developer, through the portal, and to the investor. In fact, some of these same portals are offering “fund” type investments where the collateral IS actually passed through. Putting that aside, if investors want to make an unsecured investment, I say more power to them. However, I believe that the way these RECfunding investments are being advertised is misleading to investors.

There is no real reason that these notes need to be unsecured in the first place. There are legal structures that can be easily created to allow for the same transactions (including taking advantage of any interest arbitrage between the parties) while still adequately passing the collateral interest from the developer, through the portal, and to the investor. In fact, some of these same portals are offering “fund” type investments where the collateral IS actually passed through. Putting that aside, if investors want to make an unsecured investment, I say more power to them. However, I believe that the way these RECfunding investments are being advertised is misleading to investors.

As further evidence of the type of miscommunication I am referring to, here is an excerpt taken directly from the terms of service of one of the larger RECfunding platforms (redacted in part):This specifically says that investors (as a group) are buying a specific loan or pool of loans but in the two RECfunding campaigns discussed above (one of which was off this site), that is not what is happening at all. In the above campaigns investors are making unsecured loans to the RECfunding portals, plain and simple. There is an absolute difference between making an unsecured loan to a lending intermediary (i.e. the portal) and buying a loan or pool of loans. The latter implies that any security with respect to the purchased loan will be transferred to the investors which is NOT what is occurring.

Don’t get me wrong, I absolutely think that investors need to read all of the documentation associated with these investments but I do not think that the first time they should hear that a loan is unsecured is halfway through the document package. As an industry standard, if an investment is unsecured I believe it should be clearly marked as unsecured in the advertising materials in order to properly manage investor expectations.

that a loan is unsecured is halfway through the document package. As an industry standard, if an investment is unsecured I believe it should be clearly marked as unsecured in the advertising materials in order to properly manage investor expectations.

I asked a colleague of mine, Samuel S. Guzik, to give me his comments on this situation and here is what he had to say:

“The versatility of the Internet as a means of communicating information to investors, coupled with the JOBS Act provision allowing general solicitation of accredited investors, has spawned the recent growth of real estate crowdfunding platforms. With the click of a mouse an investor is able to both conduct substantial due diligence on the investment, and participate in real estate investments with a modest amount of capital. The ease of investing and obtaining detailed information does not, however, diminish the importance to an investor of conduct its own due diligence. And regardless of the extent of due diligence undertaken, smaller investors must invariably rely on the expertise of the real estate crowdfunding platform itself.”

ISSUE #2 – The Collateral For The Loan May Not Be As Good As It Looks

Ignoring issue 1, let’s assume now that an investor understands that their loan is unsecured but invests in a campaign based on the strength of the collateral offered from the developer to the RECfunding portal (e.g. a security interest in the underlying property, the incoming lease revenues, etc.). Now what if the security documents evidencing that RECfunding portal’s interest in that collateral were not drafted properly and the portal ultimately could not collect on that collateral? If said project were to go under this would be catastrophic, not just for the investors but for the industry as a whole.

Unlike equity-based crowdfunding which lends itself more to a cookie-cutter type of approach to documentation, there are an endless number of variations when it comes to adequately documenting a collateral interest in real property and/or other assets. The same goes for making sure that loan guaranties offered by developers and other parties are properly drafted in order to be effective. So you may be wondering “are current RECfunding offerings being adequately documented?” I cannot say definitively as the underlying loan documents are not made available, but personally knowing the complexities involved in documenting these transactions I am willing to bet that material oversights are being made which put the value and/or accessibility of the underlying collateral security at risk.

Unlike equity-based crowdfunding which lends itself more to a cookie-cutter type of approach to documentation, there are an endless number of variations when it comes to adequately documenting a collateral interest in real property and/or other assets. The same goes for making sure that loan guaranties offered by developers and other parties are properly drafted in order to be effective. So you may be wondering “are current RECfunding offerings being adequately documented?” I cannot say definitively as the underlying loan documents are not made available, but personally knowing the complexities involved in documenting these transactions I am willing to bet that material oversights are being made which put the value and/or accessibility of the underlying collateral security at risk.

Proper collateral documentation requires deal, and most often state, specific provisions. Here are just a few examples:

![]() Taking an interest in real property in Illinois requires the property owner to sign a “Mortgage” in favor of the lender. However, if you are in California, the proper document is NOT a Mortgage, it is a “Deed of Trust” which involves the use of a Trustee. If you were to try and secure an interest in a California property via a Mortgage that document would not be effective and the lender would not have a proper collateral interest in the property.

Taking an interest in real property in Illinois requires the property owner to sign a “Mortgage” in favor of the lender. However, if you are in California, the proper document is NOT a Mortgage, it is a “Deed of Trust” which involves the use of a Trustee. If you were to try and secure an interest in a California property via a Mortgage that document would not be effective and the lender would not have a proper collateral interest in the property.

![]() For each interest in real property, the lender should receive a “loan” title insurance policy in the full amount of the loan and evidencing that the lender’s collateral interest will be “first priority” (i.e. before any other party). Further, the loan policy should have the proper endorsements (e.g. extended coverage endorsements, zoning endorsements, etc.).

For each interest in real property, the lender should receive a “loan” title insurance policy in the full amount of the loan and evidencing that the lender’s collateral interest will be “first priority” (i.e. before any other party). Further, the loan policy should have the proper endorsements (e.g. extended coverage endorsements, zoning endorsements, etc.).

![]() The loan documents should require the developer to hold certain minimum types/amounts of insurance with respect to the property. The lender should also receive evidence that such insurance is in place and that the lender is named as “additional insured” and “loss payee” (and that the policy cannot be canceled without notice to lender).

The loan documents should require the developer to hold certain minimum types/amounts of insurance with respect to the property. The lender should also receive evidence that such insurance is in place and that the lender is named as “additional insured” and “loss payee” (and that the policy cannot be canceled without notice to lender).

![]() If the collateral property is residential, the collateral document often needs to provide a specific waiver of what are referred to as “homestead rights” (which are an encumbrance on the property’s title and can present a threat to the marketability of residential property). Moreover, if the owner of the property is married, in many states both spouses need to sign this waiver in order to make it effective.

If the collateral property is residential, the collateral document often needs to provide a specific waiver of what are referred to as “homestead rights” (which are an encumbrance on the property’s title and can present a threat to the marketability of residential property). Moreover, if the owner of the property is married, in many states both spouses need to sign this waiver in order to make it effective.

![]() In order to properly perfect a security interest in any “fixtures” (i.e. any physical property that is permanently attached (fixed) to real property) the lender needs to file a UCC fixture filing with the county in which the property is located.

In order to properly perfect a security interest in any “fixtures” (i.e. any physical property that is permanently attached (fixed) to real property) the lender needs to file a UCC fixture filing with the county in which the property is located.

![]() If a guarantee is signed by a married individual in a “community property” state, the guarantee most often needs to be signed by the spouse as well or the lender cannot collect against the “marital assets” (which could be all of the assets) of the guarantor.

If a guarantee is signed by a married individual in a “community property” state, the guarantee most often needs to be signed by the spouse as well or the lender cannot collect against the “marital assets” (which could be all of the assets) of the guarantor.

To make matters worse, the transactions become significantly more complex when you are dealing with newly constructed property and/or leased property. For one, in a construction project the lender needs to make sure that, in addition to an interest in the property, they are getting a collateral assignment of the construction agreements (e.g. general contractor, engineer, architect, etc.), plans and specifications, management agreements etc. If not, the lender might get back a piece of property that is half finished and without the construction agreements it might cost them more to complete the project than it might be worth. Also, the funds should be placed in a construction escrow account (held for the benefit of the lender) and should be paid out to the developer over time in accordance with the project budget rather than all at once.

agreements etc. If not, the lender might get back a piece of property that is half finished and without the construction agreements it might cost them more to complete the project than it might be worth. Also, the funds should be placed in a construction escrow account (held for the benefit of the lender) and should be paid out to the developer over time in accordance with the project budget rather than all at once.

These are just a sampling of the complexities involved with properly documenting a collateral interest in connection with a loan. My point here is not to discuss what exactly should be considered. It is, instead, to point out that there is a distinct possibility that many of these intricacies may be being overlooked in an effort to create a cookie-cutter set of RECfunding loan documents. Whether or not the underlying loan is properly secured is a material piece of information that an investor needs to know in order make their investment decision. Without providing copies of the underlying loan documents the investor is left relying on the portal’s word that the underlying loan is in fact secured.

On an industry level, unless a portal is willing to make the loan documents available to the investor I believe that the portal should NOT be allowed to make reference to any “security” interest granted by the developer. To allow such a reference is essentially tantamount to saying “trust us, the loan is secured!” Moreover, once one of these projects goes wrong if it turns out the collateral was not properly perfected, it’s almost inevitable that the portal will be held to have misled investors by claiming it was.

On an industry level, unless a portal is willing to make the loan documents available to the investor I believe that the portal should NOT be allowed to make reference to any “security” interest granted by the developer. To allow such a reference is essentially tantamount to saying “trust us, the loan is secured!” Moreover, once one of these projects goes wrong if it turns out the collateral was not properly perfected, it’s almost inevitable that the portal will be held to have misled investors by claiming it was.

ISSUE #3 – Who Is Watching Over The Developer?

In documenting real estate backed loans on behalf of banks for many years, I have noticed a recurring pattern. Regardless of the deal, banks almost always build in certain project control and oversight measures into the loan documentation. These include, among other things, ongoing financial reporting covenants (quarterly, annually, etc.), loan-to-value covenants, debt-service-ratio covenants, project completion benchmarks/deadlines, etc. The intent of these provisions are to alert the lender that a deal is potentially going south sooner rather than later. Sure missing a payment is a good sign that a deal is going bad, but often the problems start WAY before that occurs. Borrowers can typically use other funds to continue to make loan payments even when the project is failing (think Ponzi scheme) so lender’s do not rely on that alone. Instead requiring these ongoing covenants allows a lender to keep an eye on the status of a project and mitigate their damages by stepping in at the first sign the project might fail.

covenants allows a lender to keep an eye on the status of a project and mitigate their damages by stepping in at the first sign the project might fail.

Who knows what, if any, proactive project management covenants are currently being included in RECfunding loan documents. Moreover, even if such covenants are included, the question remains as to whether they being adequately monitored by the RECfunding portals in order to mitigate damages. From an industry standard perspective, I believe that: 1) RECfunding loan documents NEED to include at least some proactive project management covenants; 2) compliance with these covenants needs to be monitored by the portal (or some third-party on behalf of the portal); and 3) the developer’s ongoing compliance with such covenants NEEDS to be relayed to the investors. This is essential both to mitigating the damage caused by failed projects as well as maintaining the transparency which is at the heart of crowdfunding.

ISSUE #4 – The Interests Of The Parties Are Not Truly Aligned

As an investor you might think that that you can rely on the portal to enforce the underlying developer loan documents and capitalize on any collateral offered by the developer. While this can, and most often will, be the case that fact remains that the investor’s interest and the portal’s interest are NOT exactly aligned. The investor wants to get paid back (plus interest) and wants to be able to foreclose (or have the portal foreclose) on any collateral in the event that the developer defaults. The portal wants the same things but other concerns might get in the way. For example, the portal may choose to forgive certain technical defaults by the developer and/or renegotiate terms with the developer (while still making payments to the investors) rather than foreclosing on the collateral and having a failed project affect its reputation. These types of decisions, however, can significantly adversely affect the risk of the investor’s loan.

The above concerns are no different than those of bank lenders in what are referred to in the lending industry as “participation loans” (or “club loans”). Without going into detail, these types of loans involve one or more banks loaning funds to a particular borrower with a lead bank acting as “agent” (or “administrative agent”) to interact directly with the borrower. As you might notice, the structure of these types of loans is somewhat similar to what is occurring in many RECfunding loans (e.g. the portal is acting as agent), with one important difference. In traditional participation loans, the documents provide that the agent cannot make certain decisions without the consent of the other lenders (or, at least, a requisite percentage of them). These decisions can include lending more money, forgiving certain defaults, foreclosing/not-foreclosing on collateral, etc. The reason for  these consent provisions are to ensure that the agent cannot take unilateral actions that may benefit them at the expense of the other lenders.

these consent provisions are to ensure that the agent cannot take unilateral actions that may benefit them at the expense of the other lenders.

As the same concerns exist with RECfunding loans the same provisions should be included in the subject RECfunding documents. Put another way, a RECfunding portal should not be able to make certain material unilateral decisions with respect to the developer loan and/or the underlying collateral without the consent of a requisite number of the investors. This is the only way to make sure that the interest of the lending parties are aligned with respect to the enforcement of the loan documents.

CONCLUSION

I said it before and I will say it again, crowdfunding IS the future of real estate investment and the intent of this article is NOT to point fingers at any particular portal (hence my attempt to redact certain identifying information above). However, even a single project could cause irreparable harm to the industry as a whole and if the above issues are not adequately addressed such a failure is inevitable. Some of you might read the above concerns as being overkill given the size of the deals being made, the current loan-to-value ratios etc. That may be somewhat true but if the goal is for RECfunding to continue to grow these loans will eventually grow in size, the projects will become riskier and the loan-to-value ratios will get higher (FYI, some current projects are already over 75% loan-to-value).

Traditional real estate lending went through a similar life cycle and we saw how that ended up with the last recession. There are some crowdfunding portals and ancillary companies that have identified, and are taking active measures to address, one or more of the concerns above, such as: PatchofLand (a RECfund portal); Loquidity (a RECfund portal); FundHub (a crowdfunding legal documentation provider) and CommunityLeader (a “white label” crowdfunding portal creator).

Joseph Elias of Loquidityemphasized their focus on investment transparency and investor education:

“At Loquidity, we believe that transparency isn’t just about adding legal jargon to investor documents, but rather explaining the investment opportunity to the investor in a manner that is both clear and understandable. By doing so we, as an industry, can help foster more confident, educated and loyal investors.”

the investor in a manner that is both clear and understandable. By doing so we, as an industry, can help foster more confident, educated and loyal investors.”

AdaPia d’Errico of PatchofLand shared a similar focus and noted the need for cooperation between industry leaders and participants for the betterment of the industry:

“It is extremely important that each portal be fully transparent and take the time to educate its investors about its offerings. If investors misunderstand the nature of their investment, this will be problematic for the real estate crowdfunding industry as a whole-not just that particular platform. We here at PatchofLand believe in taking a friendly ally approach-not a competitor approach-when interacting with other platforms because when one platform takes a risk, they take that risk on behalf of the entire real estate crowdfunding industry.”

platforms because when one platform takes a risk, they take that risk on behalf of the entire real estate crowdfunding industry.”

Unfortunately not all RECfunding portals are being as proactive as those noted above and I believe it is time for the industry as a whole to take a step back, review the transactions being conducted and work to create best practices. I also believe that platforms need to work closely with experienced real estate lending attorneys when documenting RECfund loans. Only by doing so can we hope to avoid a recurrence of the last real estate lending crash as the real estate crowdfunding industry continues to grow.

transactions being conducted and work to create best practices. I also believe that platforms need to work closely with experienced real estate lending attorneys when documenting RECfund loans. Only by doing so can we hope to avoid a recurrence of the last real estate lending crash as the real estate crowdfunding industry continues to grow.

Sam Guzik had this to add:

“Not all platforms are created equally, and their level of expertise will vary, particularly those portals which have recently commenced operations and may in the early stages have limited resources or a fragmented organization. These platforms also make investments in a number of different jurisdictions, where laws governing real estate can vary considerably. So there will be a learning curve for these platforms, which I expect will increase the risk to investors somewhat in the early stages of online real estate investing. Though, on balance, I expect that these risks will diminish over time, as real estate platforms get ahead of the learning curve and industry leaders adopting best practices emerge.”

Pingback: INVESTOR PROTECTION ISSUE – PATCH OF LAND ADDRESSES GROWING INDUSTRY CONCERNS | CROWDFUNDINGLEGALHUB.com

Pingback: New Markets | Times Realty News

Pingback: Patch Of Land Raises The Bar By Releasing New Truly “Secured” Investment Structure | CROWDFUNDINGLEGALHUB.com

Pingback: Patch Of Land: New Truly “Secured” Investment Structure | Times Realty News