W hat started as an action against a single company in late June has evolved into a probe of an entire industry. As reported by the Wall Street Journal late last week, the Securities and Exchange Commission (SEC) has launched a new probe spurred by the recent meteoric uptick in the number and amount of sales of pre-IPO tech-startup shares and related derivative instruments. The SEC is particularly concerned with the fact that many of these transactions are currently being conducted through “private” transactions in violation of applicable securities laws.

hat started as an action against a single company in late June has evolved into a probe of an entire industry. As reported by the Wall Street Journal late last week, the Securities and Exchange Commission (SEC) has launched a new probe spurred by the recent meteoric uptick in the number and amount of sales of pre-IPO tech-startup shares and related derivative instruments. The SEC is particularly concerned with the fact that many of these transactions are currently being conducted through “private” transactions in violation of applicable securities laws.

Background.

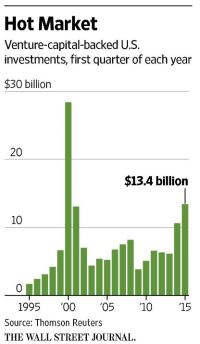

The desirability of pre-IPO shares of tech start-up companies, particularly “unicorn” companies (i.e. tech start-ups worth $1 Billion or more), should come as no surprise. Tech companies, like many start-ups, issue shares (or options to acquire shares) to founders, initial employees and early investors as incentives. The hope of course is that the company will be extremely successfully and, eventually, engage in an initial public offering (IPO) resulting in a dramatic appreciation of the issued private shares (or options). Given the potentially huge appreciation in value once an IPO occurs, private shares of established tech companies (or derivative instruments based on such shares) are extremely desirable to high net worth and institutional investors. Couple this with the fact that there is a growing desire among companies and employees to monetize the value of their pre-IPO shares and it is no wonder why this market has exploded in recent years. In fact, according to Dow Jones VentureSource, “unicorn” startups have raised about $15.5 billion in additional funds from venture capital backed investments made through the first half of 2015 alone.

will be extremely successfully and, eventually, engage in an initial public offering (IPO) resulting in a dramatic appreciation of the issued private shares (or options). Given the potentially huge appreciation in value once an IPO occurs, private shares of established tech companies (or derivative instruments based on such shares) are extremely desirable to high net worth and institutional investors. Couple this with the fact that there is a growing desire among companies and employees to monetize the value of their pre-IPO shares and it is no wonder why this market has exploded in recent years. In fact, according to Dow Jones VentureSource, “unicorn” startups have raised about $15.5 billion in additional funds from venture capital backed investments made through the first half of 2015 alone.

The Probe.

The SEC’s probe of this market comes on the heels of a recent settlement with Silicon Valley based Sand Hill Exchange, a firm that was allegedly selling “security-based swaps” (as defined in 15 U.S.C. § 78c(a)(68)) to retail investors in violation of applicable securities laws. Although Sand Hill settled without admitting or denying the findings, they agreed to cease and desist from their current operations. The fact that the SEC took action against Sand Hill at all is frankly more important than the actual result. It is being seen as a signal that the agency is ready and willing to exercise its statutory authority under the Dodd Frank act of 2010 over security-based swap transactions. As stated by Reid A. Muoio, deputy chief of the SEC enforcement division’s complex financial instruments unit, in a statement concerning the Sand Hill action: “[the SEC] will continue to scrutinize this space for companies circumventing the law to offer security-based swaps without the safeguards provided to retail investors.”

In the last year or so, several companies (such as EquityZen and Equidate) have emerged which advertise themselves as a way for employees to monetize their shares and for investors to access pre-IPO opportunities. In connection with the current probe the SEC is rumored to have issued informational subpoenas to many of these companies (including EquityZen and Equidate). So what exactly is the SEC looking for with this probe? They are primarily concerned with identifying companies that have been offering derivative instruments in exchange for pre-IPO shares (or options to acquire shares) owned by present or former employees of highly valued private tech companies (e.g. Snapchat, Uber, Airbnb, etc.) through private transactions. It’s easy to see why the SEC might be looking at Equidate when its FAQ clearly states that: “The contracts Equidate has designed have aspects similar to both a derivative contract and a asset-backed loan.”

The problem here is the lack of required transparency in the transactions. Title VII of the Dodd Frank act of 2010 grants the SEC regulatory authority over all security-based swap transactions. Section 5(e) of the Securities Act of 1933 and Section 6(l) of the Securities Exchange Act of 1934 govern the sale of security-based swaps. Taken together, these provisions prohibit any person from conducting a security-based swap transaction with or for a person who is not an “eligible contract participant” (see 7 U.S.C. § 1a(18))), unless an effective registration statement has been filed AND the transaction is effected on and through a national securities exchange. These rules are intended to make financial information about the swap transactions transparent to retail investors and to limit arbitrary and biased valuations. In a recent Bloomberg interview, Former SEC Chairman Arthur Levitt commented on the probe saying “what I think [the SEC] is looking at is to see to it that any derivatives transactions are done on an exchange and not over the counter as before Dodd Frank.” Levitt went on to add, “I don’t think it generally is a healthy thing to be selling unlisted securities privately [over the counter] … as a general notion I would like to see the money going to the company rather than to see valuations that are imprecise, at best, for employees to sell their stock on the second market.”

Going Forward.

We are still in the preliminary stages of the SEC’s ongoing probe into this industry and it will probably be some time before we see additional actions taken against other companies. That being said, it is clear that the main issue of concern is the lack of transparency in the “private” offering of the derivative instruments. Lack of transparency “private” securities transaction is certainly not limited to this industry and is an ongoing and growing concern of the SEC, particularly as the need and demand for secondary “private” securities markets continues to increase.

“private” securities transaction is certainly not limited to this industry and is an ongoing and growing concern of the SEC, particularly as the need and demand for secondary “private” securities markets continues to increase.

What effects this probe will ultimately have on the pre-IPO tech stock industry as a whole, or even if the current “private” market model will be able to survive without significant modification, is anyone’s guess. Either way, I believe that this is a very important topic to stay on top of because the ultimate findings and actions of the SEC in this probe have the potential to reach well beyond this particular industry. For example, whatever arguments are made for increased transparency in this industry are certain to be echoed in subsequent SEC discussions concerning venture exchanges and other secondary markets of “private” securities (e.g. crowdfunded equity). Moreover, if the SEC allows the current “private” market model to continue, how long do you think it will be before we see firms offering a similar model for pre-Reg A+ IPO securities? I can already see the wheels in motion…