As you are probably aware, the SEC is currently considering sweeping changes to some of the most long-standing rules and regulations governing private transactions. These changes include fundamental revisions of both Rule 501, the definition of “accredited investor” and arguably the most important term in all of private securities regulations, and Rule 147, the backbone of intrastate securities transactions. Given the substantial and far-reaching effects the SEC’s proposed changes to such rules and regulations may have, it’s no surprise to see the Crowdfund Intermediary Regulatory Advocates (CFIRA) weighing in with their comments.

As you are probably aware, the SEC is currently considering sweeping changes to some of the most long-standing rules and regulations governing private transactions. These changes include fundamental revisions of both Rule 501, the definition of “accredited investor” and arguably the most important term in all of private securities regulations, and Rule 147, the backbone of intrastate securities transactions. Given the substantial and far-reaching effects the SEC’s proposed changes to such rules and regulations may have, it’s no surprise to see the Crowdfund Intermediary Regulatory Advocates (CFIRA) weighing in with their comments.

“IF I SAID IT BEFORE …” - CFIRA’s Comments To SEC’s Proposed “Accredited Investor” Changes

Whether an individual is permitted to invest in most (let’s face it almost any) private placement will depend on whether they are deemed an “accredited investor.” Under the current, purely monetary, standard provided in Rule 501 an individual will, generally speaking, qualify if they earned income of $200,000 (or $300,000 together with a spouse) or more in each of the prior two (2) years (AND they reasonably expect the same for the current year) OR they have a net worth of over $1 million excluding the value of their primary residence. This definition, which has remained virtually unchanged for over three decades, was created as a means of identifying individual investors who are independently capable of assessing and weathering the risks of investing in private companies. The major problem is that, in making such an identification, the current definition relies solely on the level of the individual’s wealth and does not take into account their respective education or sophistication. Put another way, the current definition effectively limits private investment only those who are wealthy enough to meet the lofty monetary standard.

definition relies solely on the level of the individual’s wealth and does not take into account their respective education or sophistication. Put another way, the current definition effectively limits private investment only those who are wealthy enough to meet the lofty monetary standard.

While objective and relatively easy to measure, a monetary standard cannot, and should not, be the ONLY standard for qualifying an individual as an accredited investor. There are obviously individuals who, by virtue of their education, profession or past investment experience, have the necessary financial acumen to determine whether or not to invest in private companies. This is true regardless of their current level of wealth so a monetary standard alone is clearly insufficient. Thankfully the days of a purely monetary standard seem to be numbered.

As part of its duty under the Dodd Frank Act, for the last year or so the SEC has been reviewing the current definition to determine what changes, if any, should be made. In connection with this review the SEC’s Staff recently released a report with its recommended changes. While, in my opinion, not all of the proposed changes would be favorable, the Staff does recommend the inclusion of certain non-monetary qualifying standards such as the holding of certain professional credentials and/or having experience in investing in similar investments (for my full breakdown on the proposed changes see “Changes To “Accredited Investor” Definition Recommended By SEC Staff; The Good, The Bad And The Ugly”).

CFIRA has long been an advocate of expanding the current definition to broaden the pool of accredited investors. Back in August of 2014, CFIRA originally sent a very concise and thorough letter to Elizabeth Murphy of the SEC outlining their recommendations and comments concerning changes to the accredited investor definition. It seems would seem that not much has changed in their view since that original letter as CFIRA has elected to re-submit it, verbatim, to SEC Commissioner Mary Jo White in response to the SEC’s request for comments to the Staff’s recent recommendations.

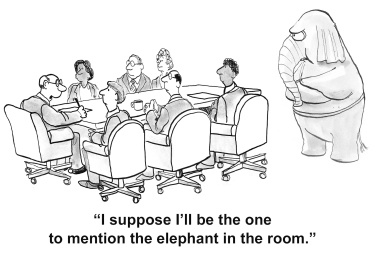

As outlined by Kim Wales, CEO and founder of Wales Capital and executive board member of CFIRA, in the adjoining cover letter “[m]any of CFIRA’s proposed recommendations from the original letter have been considered in the [Staff’s] report.” These include those Staff recommendations noted in the second set of bullet points in Kim’s cover letter (i.e. those related to including non-monetary standards and other  changes). That being said, the cover letter fails to specifically address the elephant in the room; the Staff’s failure to accept CFIRA’s original recommendation to leave the current financial thresholds unchanged.

changes). That being said, the cover letter fails to specifically address the elephant in the room; the Staff’s failure to accept CFIRA’s original recommendation to leave the current financial thresholds unchanged.

In its original letter CFIRA recommend emphatically that “the SEC take no action with regard to increasing the financial limits of the current Accredited Investor Standard for Regulation D offerings until more data is available as to the accurate demographics of the current active accredited investor base.” They went on to add that any such changes “could have grave and deleterious consequences to capital formation and the economy at large.” It’s clear the Staff chose to ignore CFIRA’s recommendation on this point in proposing, among other things, that the current standards be indexed for inflation; both now and going forward. Moreover, while the Staff’s report provided certain tenuous census and other data regarding current accredited investor demographics, I do not believe the data provided is anywhere near accurate or compete enough to satisfy CFIRA’s original comment above or to warrant increasing the current standards.

I think it is extremely important that CFIRA continue to advocate for the positions identified in its original letter and I am glad they re-submitted it as it will again bring their concerns to the forefront. While the Staff’s recommendations do incorporate some of CFIRA’s original recommendations they do not go far enough. Plain and simple, the SEC needs to leave the current monetary standards as-is until the potential consequences of any adjustment can be better assessed. If not, the potentially substantive and far-reaching negative effects of any such changes in the monetary standards could, and most likely will, wipe out any positive gains made by expanding the definition to include other non-monetary standards.

“FULL STEAM AHEAD! …” - CFIRA’s Comments To SEC’s Proposed Changes To Rule 147 and Rule 504

While notably to less acclaim, at the same time the final Title III rules were released in early November last year the SEC released its proposed amendments to the current Rule 147 and Rule 504 to help foster intrastate crowdfunding. On the whole, I believe that the  SEC made some very solid proposals to help modernize the outdated rules (with one major exception). Given their recent comment letter to SEC Assistant Secretary Brent J. Fields, it appears CFIRA concurs.

SEC made some very solid proposals to help modernize the outdated rules (with one major exception). Given their recent comment letter to SEC Assistant Secretary Brent J. Fields, it appears CFIRA concurs.

CFIRA was able to slide a comment letter in just before the January 11th deadline. More a letter of support than a true comment letter, Kim Wales begins by commending the SEC “for responding to changes in state regulation and capital formation practices in a pro-active and forward thinking manner.” Kim goes on to state that, generally speaking, CFIRA believes “the proposals, if adopted, will broaden the capital-raising options of early-stage and small companies with no loss of investor protection.” In the remainder of the letter Kim outlines CFIRA’s support of multiple specific proposed changes to Rule 147 and Rule 504 including, among others:

For Rule 147:

- Eliminating the current restriction on offers being made only to state residents while continuing to require that sales be made only to state residents;

- Eliminating the current requirement that the issuer be organized in the state where sales occurs (noting the existence of valid business reasons for incorporating or organizing in other states such as Delaware) and adopting the proposed alternative “doing business” definitions (e. the new 80/80/80 test);

- Requiring a “reasonable belief” as to an investor’s state of residency; and

- Measuring the coming to rest period from the time at which the securities are acquired by a specific investor (rather than the current starting point, the date the offering is completed).

For Rule 504:

- Increasing the maximum offering size of Rule 504 offerings (although recommending it be increased to $10 million instead of the proposed $5 million); and

- Imposing “Bad Actor” disqualifications on Rule 504 offerings.

While overwhelmingly in support of a majority of the SEC’s proposed changes, the letter did make note of certain additional/alternative recommendations. These included:

- Creating a new, separate, Rule 147A (as proposed) to incorporate all of the proposed amendment while simultaneously amending the existing Rule 147, in its current form as a “safe harbor,” to include as many as the proposed revisions as possible (NOTE: this is in intended to alleviate the “major exception” noted above);

- Not imposing ANY offering size or investment size limitations for Rule 147 offerings (letting them instead be governed by the respective state laws);

- Explicitly defining a non-exclusive “safe harbor” method for setting out the means by which the proposed “reasonable belief” as to an investor’s state of residency may be established; and

- Adding a conditional exemption from Section 12(g) for Rule 147 and 504 offerings (g. subject to state reporting and other requirements).

In my opinion the proposed changes to Rule 147 and Rule 504 are going to be a game changer for entrepreneurs and small business looking for capital. They take a lot of the complexity out of, and add significant clarity to, the existing rules making them a much more viable and useful option for capital raisers. As Kim Wales recently stated “CFIRA believes that the capital raising options of early-stage, small and medium size companies, can and will be significantly broadened, with no loss of investor protection, if the proposed revisions [incorporating CFIRA’s comments of course] are adopted.” I could not agree more….

more viable and useful option for capital raisers. As Kim Wales recently stated “CFIRA believes that the capital raising options of early-stage, small and medium size companies, can and will be significantly broadened, with no loss of investor protection, if the proposed revisions [incorporating CFIRA’s comments of course] are adopted.” I could not agree more….