Photo by David McBee on Pexels.com

Through a triad of recent releases/interviews, the SEC has further clarified how it views the offering and sale of crypto assets. These guidance materials provide some really good insight on the SEC’s thinking with respect to its treatment of crypto assets; including some bright line interpretations with respect to both Bitcoin and Ethereum. However, certain of the SEC’s recent statements may give industry participants a false sense of hope and there are still may questions left unanswered.

Background:

Last July the SEC issued its investigative report on DAO Tokens and concluded both that subject tokens were “securities” and that the offering of the tokens was an unlawful securities offering. Since then the SEC has made it abundantly clear that they generally view the offering and sale of crypto assets (particularly Initial Coin Offerings (ICOs)) as security offerings which must adhere to applicable U.S Securities Laws. That being said, the crypto asset market is on a bit of a high of late (albeit misplaced as I will discuss later) due to a series of recent releases/interviews from SEC representatives.

It all began earlier this month when Jay Clayton gave an interview to Bob Pisani of CNBC discussing several matters currently before the SEC; most notably the SEC’s treatment of crypto assets. During the interview (a full transcript of which is available here) Mr. Clayton made several definitive statements regarding the SEC’s treatment of crypto assets including:

PISANI: So you’re saying the classic definition of security, you invest in a common enterprise with an expectation of profit. You’re saying the way you look at most ICOs, they are securities?

PISANI: So you’re saying the classic definition of security, you invest in a common enterprise with an expectation of profit. You’re saying the way you look at most ICOs, they are securities?

CLAYTON: Correct.

PISANI: Are you planning now to make a clear statement on that? — Because there seems to be a lot of confusion about whether anybody is going to get approved or not.

CLAYTON: Bob, I hope I just did. If it’s a security, we’re regulating it.

As well as the following:

PISANI: You seem to be saying the SEC is not going to be changing the definition of a security just to suit the ICO community. Is that right?

CLAYTON: I’m certainly not going to support that … We are not going to do any violence to the traditional definition of a security, which has worked well for a long time, and I believe will continue to work well.

However, the sound bite that got ALL of the attention from crypto advocates was the following statement from Mr. Clayton (emphasis added): “Replace the Dollar, the Yen, the Euro with Bitcoin, that type of currency is NOT a security.” That is all anyone seemed to take away from the entire interview. It’s even reflected in the official CNBC title to the interview, “SEC chairman: Cryptocurrencies like Bitcoin are not securities.” As you can imagine, sound bites like that get pro crypto/anti-SEC advocates all giddy.

That excitement was further compounded as a result of a recent speech given by SEC Director of Corporate Finance, William Hinman, at the Yahoo Finance conference in San Francisco. Similar to the Clayton interview, Mr. Hinman’s speech contained several definitive statements, including:

That excitement was further compounded as a result of a recent speech given by SEC Director of Corporate Finance, William Hinman, at the Yahoo Finance conference in San Francisco. Similar to the Clayton interview, Mr. Hinman’s speech contained several definitive statements, including:

“[W]hether a transaction in a coin or token on the secondary market amounts to an offer or sale of a security requires a careful and fact-sensitive legal analysis.”

As well as:

“[S]imply labeling a digital asset a “utility token” does not turn the asset into something that is not a security. I recognize that the Supreme Court has acknowledged that if someone is purchasing an asset for consumption only, it is likely not a security. But, the economic substance of the transaction always determines the legal analysis, not the labels.”

However, just as with the Clayton interview, the industry chose to focus almost entirely on the following isolated sound bites rather than the entirety of Mr. Hinman’s remarks:

“[B]ased on my understanding of the present state of Ether, the Ethereum network and its decentralized structure, current offers and sales of Ether are not securities transactions. And, as with Bitcoin, applying the disclosure regime of the federal securities laws to current transactions in Ether would seem to add little value.”

Photo by Pixabay on Pexels.com

While the remarks given by Mr. Hinman were delivered with the typical disclaimers (i.e. based on his opinion, not reflective of definitive SEC policy, etc.) pro-crypto/anti-SEC advocates chalked this up as a big win; as evidenced by the marked price increases in both Bitcoin and Ether following the comments.

This winning high was only exacerbated by last week’s release of Jay Clayton’s testimony before the U.S. House of Representatives, Committee on Financial Services. Only a portion of Mr. Clayton’s testimony even related to crypto assets and ICOs. However, Mr. Clayton seemed to specifically reinforce the comments made by Mr. Hinman by stating: “[o]ur Corporation Finance Division Director recently further outlined the approach staff takes to evaluate whether a digital asset is a security,” and specifically referencing by footnote the speech given by Mr. Hinman. This was viewed by industry participants as evidence that the SEC is formally agreeing with Mr. Hinman’s statement that “offers and sales of Ether are not securities transactions.”

If you read only the headlines and/or heard only the above sound bites you might take this as a significant backtracking of the SEC’s treatment on crypto assets. In particular, you might read the above to signal that any crypto asset which is intended to be in form and function similar to Bitcoin or Ether will not be treated as a security by the SEC. That would be the absolute WRONG take away from these recent releases. As I will discuss below, the real take away from these releases is, and should be, that “what” is being sold is not nearly as important as “how” it is sold when determining whether a particular asset will be viewed as a security by the SEC.

the real take away from these releases is, and should be, that “what” is being sold is not nearly as important as “how” it is sold when determining whether a particular asset will be viewed as a security by the SEC.

New Guidance:

The above releases, particularly those from Mr. Hinman, actually provide some very clear insight as to how the SEC evaluates whether the offering/sale of a particular crypto asset will be treated as a security. The applicable guidance can be truly summed up by the following two quotes from Mr. Hinman’s speech:

“[W]e should frame the question differently and focus not on the digital asset itself, but on the circumstances surrounding the digital asset and the manner in which it is sold.”

“Central to determining whether a security is being sold is how it is being sold and the reasonable expectations of purchasers. When someone buys a housing unit to live in, it is probably not a security. But under certain circumstances, the same asset can be offered and sold in a way that causes investors to have a reasonable expectation of profits based on the efforts of others.”

The majority of pro-crypto/anti-SEC advocates like John McAfee often focus too much attention on arguing whether a particular type of asset (i.e. “utility” coins/tokens) should be treated as a security rather than taking the time to truly understand what it is the SEC is concerned with. As Mr. Hinman outlines in his comments, the circumstances surrounding how a particular asset is sold to investors, and the expectations of investors at the point of sale, matter more than the actual type of asset being sold. In fact, if these advocates truly understood comments like those of Mr. Hinman they would see that once a crypto asset becomes truly decentralized (as they are advocating for) it most likely will not be deemed by the SEC to be a security. Perhaps a more absurd example will help to illustrate the point better.

Photo from Money Inc.

If you are a child of the 90’s you are certain to know what Beanie Babies are. These plush toys were sold (and are still being sold I believe) by Chicago-based toy company Ty Inc. Certain of the toys quickly sky-rocketed in value as collector’s items (some as much as 8,000%) and were flying off the shelves. In fact many collectors dumped, and continue to dump, substantial amounts of money into these fluffy toys, treating them as investment vehicles rather than stuffed animals. Now Ty sold each of the toys for a set market price and did not directly benefit from the subsequent increase in value of any particular model etc. so any security analysis given the actual fact pattern would be pointless. However, let’s change up the fact pattern just a bit.

Let’s instead assume that Ty Inc. was just starting out and decided to sell SAFBs (Simple Agreements for Future Beanies) to investors. Let’s also assume that Ty Inc. promised (or otherwise implied to) investors that: (a) Ty would use their investment dollars to form a company that would produce cute, fuzzy, stuffed animals (i.e. beanie babies); (b) once the company’s operations were up and running inventors would receive X number of stuffed animals in consideration for their investment; and (c) the stuffed animals would significantly increase in value as collector’s items. Now no one would readily think of a Beanie Baby as a security. However, if you plug the foregoing assumed fact pattern into the Howey test (and into some of the factors outlined by Hinman) it is more than likely that the SEC will view the “SAFBs,” and the resulting Beanie Babies to be received by investors, as securities. Just view this fact pattern in light of the following statement from Mr. Hinman:

“[I]n many cases, the economic substance is the same as a conventional securities offering. Funds are raised with the expectation that the promoters will build their system and investors can earn a return on the instrument – usually by selling their [instrument] in the secondary market once the promoters create something of value with the proceeds and the value of the … enterprise increases.”

Photo from Medium

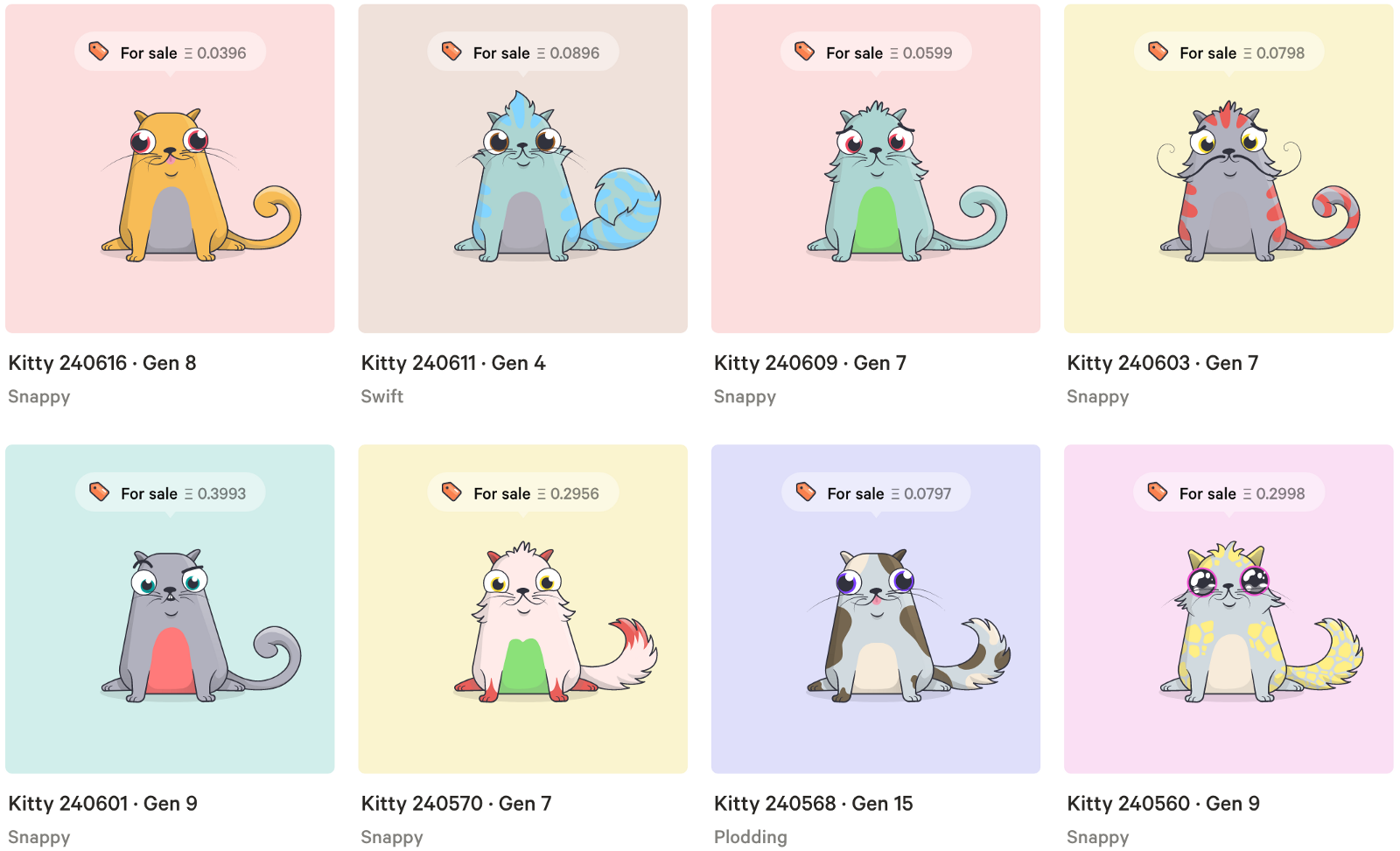

Obviously this is intended to be an exaggerated example meant to prove a point. That being said, it’s not as far fetched as you might think. Take a look at CryptoKitties, a company that markets “collectible,” “one-of-a kind,” blockchain based digital cats and even provides a marketplace for the trading and sale of these cats for actual money. It even specifically tries to liken itself to Bitcoin and Ethereum by saying:

“CryptoKitties is one of the world’s first games to be built on blockchain technology—the same breakthrough that makes things like Bitcoin and Ethereum possible. Bitcoin and ether are cryptocurrencies but CryptoKitties are cryptocollectibles. You can buy, sell, or trade your CryptoKitty like it was a traditional collectible, secure in the knowledge that blockchain will track ownership securely.”

This is just one example of literally thousands of currently available crypto assets; many of which are pure fraud. There is a real need for investor protection in this area, regardless of what many crypto advocates like John McAfee might say, and this type of investor protection is exactly what the SEC is about. As Mr. Hinman notes in his speech, the impetus behind the Securities Act and the SEC’s treatment of certain ICO/crypto asset sales as securities is to help ensure transparency in the transaction and remove the information asymmetry between issuers/promoters and investors. Put another way, it is intended to help make sure that investors have access to enough information to make an informed decision about whether to invest in a particular assets.

Now Mr. Hinman’s speech focuses primarily on the question of whether the sale of a particular asset may be deemed a security at one point and later transition to an asset/sale that would not be deemed a security. Based on his remarks, the answer is clearly yes, but it must be looked at in context with all of the applicable guidance provided in his speech; in particular why this is the case. The primary reason again goes back to the fact that how an asset is sold matters more than what the asset is. If the circumstances surrounding how a particular asset is sold no longer raise securities concerns then of course the offer/sale of the underlying asset may later not be viewed as the sale of a security. Put another way, the offer/sale of a particular asset may be treated as a security in one context and not as a security in another based on the circumstances surrounding the actual sale. This makes complete sense if you remember to focus on how the particular asset is sold/marketed.

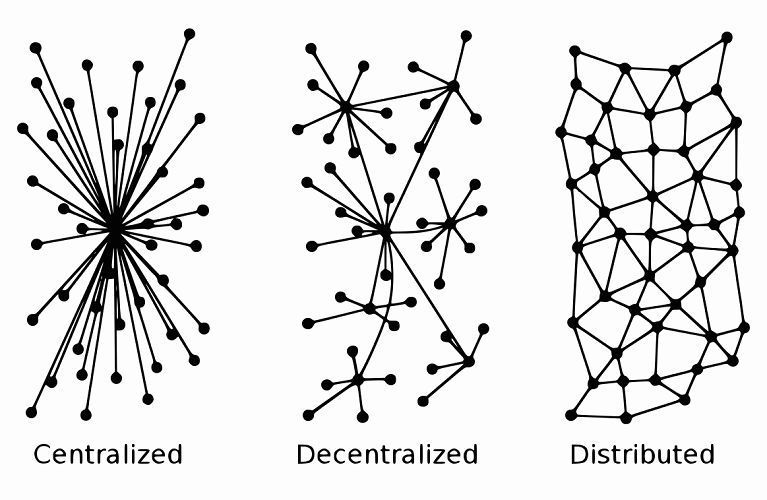

From Mr. Hinman’s comments, one of the key factors in determining whether a particular crypto asset (particularly a “utility” token/coin) should be treated as a security is whether there exists a “central third party whose efforts are a key determining factor in the enterprise.” Put another way, if/when there is no longer a particular issuer/entity who is independently/primarily responsible for determining (or otherwise influencing) the value of a particular crypto asset, and the asset becomes truly decentralized, that asset will most likely not be viewed by the SEC as a security.

Photo from Ethfinex

However it should be noted that with respect to any crypto asset true decentralization is extremely rare and should not be counted on; particularly in connection with any proposed ICO/SAFT transaction where such an argument would not even be applicable. For true decentralization to occur with respect to a particular crytpo asset: (a) the underlying blockchain framework needs to be fully functional (i.e. not a birth stage company); (b) the subject asset has to be a true utility asset (i.e. function solely as a means of exchange with no express/implied promise that the asset will increase in value); and (c) the subject asset needs to be truly embraced by one or more industries as a means of facilitating value exchange, resulting in the price of the particular asset being determined by natural supply/demand pressures and not the direct or indirect efforts of a particular issuer or group of holders. This is no small task and if true decentralization/utility with respect to a particular crypto asset is the goal, as Mr Hinman notes it may be easiest to:

“[C]onduct the initial funding through a registered or exempt equity or debt offering and, once the network is up and running, distribute or offer blockchain-based tokens or coins to participants who need the functionality the network and the digital assets offer. This allows the tokens or coins to be structured and offered in a way where it is evident that purchasers are not making an investment in the development of the enterprise.”

As noted above, many take Mr. Hinman’s statement regarding Etherium not being a security as the most important takeaway from his speech. For my money however, the most important parts of Mr. Hinman’s speech are the following: (a) non-exhaustive, 6-point list, of factors to be considered in determining whether the offer/sale of a particular crypto asset should be looked at as a security; and (b) non-exhaustive, 7-point list, of features to be considered in structuring a particular crypto asset to function more as a pure utility token.

Factors to consider in assessing whether a digital asset is offered as an investment contract and is thus a security

- Is there a person or group that has sponsored or promoted the creation and sale of the digital asset, the efforts of whom play a significant role in the development and maintenance of the asset and its potential increase in value?

- Has this person or group retained a stake or other interest in the digital asset such that it would be motivated to expend efforts to cause an increase in value in the digital asset? Would purchasers reasonably believe such efforts will be undertaken and may result in a return on their investment in the digital asset?

- Has the promoter raised an amount of funds in excess of what may be needed to establish a functional network, and, if so, has it indicated how those funds may be used to support the value of the tokens or to increase the value of the enterprise? Does the promoter continue to expend funds from proceeds or operations to enhance the functionality and/or value of the system within which the tokens operate?

- Are purchasers “investing,” that is seeking a return? In that regard, is the instrument marketed and sold to the general public instead of to potential users of the network for a price that reasonably correlates with the market value of the good or service in the network?

- Does application of the Securities Act protections make sense? Is there a person or entity others are relying on that plays a key role in the profit-making of the enterprise such that disclosure of their activities and plans would be important to investors? Do informational asymmetries exist between the promoters and potential purchasers/investors in the digital asset?

- Do persons or entities other than the promoter exercise governance rights or meaningful influence?

Features to be considered in structuring a particular crypto asset to function as a pure utility token:

- Is token creation commensurate with meeting the needs of users or, rather, with feeding speculation?

- Are independent actors setting the price or is the promoter supporting the secondary market for the asset or otherwise influencing trading?

- Is it clear that the primary motivation for purchasing the digital asset is for personal use or consumption, as compared to investment? Have purchasers made representations as to their consumptive, as opposed to their investment, intent? Are the tokens available in increments that correlate with a consumptive versus investment intent?

- Are the tokens distributed in ways to meet users’ needs? For example, can the tokens be held or transferred only in amounts that correspond to a purchaser’s expected use? Are there built-in incentives that compel using the tokens promptly on the network, such as having the tokens degrade in value over time, or can the tokens be held for extended periods for investment?

- Is the asset marketed and distributed to potential users or the general public?

- Are the assets dispersed across a diverse user base or concentrated in the hands of a few that can exert influence over the application?

- Is the application fully functioning or in early stages of development?

These lists, while inherently open ended and non-exhaustive, are the first real beacons of guidance from the SEC in structuring, and evaluating, crypto asset transaction.

Conclusion

The main points the SEC is making in these recent releases are actually quite clear if you are willing to see it. First, it doesn’t really matter what exactly you are selling; if you are marketing the asset for sale as (or otherwise implying that it can be an) investment vehicle that will generate a return to investors, and/or the value of what investors are buying are materially dependent on your efforts (including getting the company up and running), you ARE selling a security in the eyes of the SEC. Second, the substance of a transaction will always trump the form of the transaction (e.g. what the asset is titled as, etc.). These are not new concepts by any means but they tend to get clouded over by crypto advocates who focus more on isolated sound bites then on the actual entirety of the guidance.

Photo by Pixabay on Pexels.com

It should also be noted that while these new releases do offer some significantly greater insight as to what the SEC considers in determining whether a crypto asset will be treated as a security, in particular the factor lists noted above, there are still multiple questions that remain unanswered such as:

- If any of the thousands of currently available crypto assets being traded on exchanges are deemed to be a security, how is the SEC going to handle it? Will they shut them down all together or create some sort of grandfathering safe harbor opportunity?

- What will happen to current crypto exchanges, particularly if they choose to trade only in “utility” based assets like Bitcoin and Etherium? Will they need to be registered with the SEC as an exchange or ATS? If not, where is the defining line?

- What is the plan for actually enforcing these rules against current and new violators? Will they get a slap on the wrist or be made an example of? We have seen some subpoenas/information requests issued to date but when will actual enforcement actions be taken by the SEC?

These are just a few of the open questions still plaguing the industry. We are still very much in the nascent of this industry and only time will tell how the above issues get resolved. That being said, it is good to finally have some substantive insight from the SEC in this area. Further, if there is one take away from this article it’s this… do NOT invest in CryptoKitties!