While it passed somewhat under the radar with the holiday season, on December 18, 2019 the Securities and Exchange Commission (“SEC”) released a proposal to significantly amend the existing “accredited investor” definition; which is integral in determining who can participate in private securities transactions. The proposal seeks to add several new categories of both qualifying individual and entity level investors. The proposal is currently in the 60-day comment period, however if enacted in substantively its current form the included amendments will open the floodgates to a ton of new, and in many cases deep-pocketed, potential investors.

While it passed somewhat under the radar with the holiday season, on December 18, 2019 the Securities and Exchange Commission (“SEC”) released a proposal to significantly amend the existing “accredited investor” definition; which is integral in determining who can participate in private securities transactions. The proposal seeks to add several new categories of both qualifying individual and entity level investors. The proposal is currently in the 60-day comment period, however if enacted in substantively its current form the included amendments will open the floodgates to a ton of new, and in many cases deep-pocketed, potential investors.

Background:

If you do not already know, the term “accredited investor” is one of the most important definitions in all of securities law. More particularly, this definition is a central component to use of several exemptions from registration under the the Securities Act of 1933 (the “Act”), most notably Rule 506(b) and Rule 506(c) of Regulation D, and plays an important role in other federal and state securities law contexts. There is value in qualifying as an accredited investor because, under SEC rules, whether a person/entity qualifies as an “accredited investor” will generally determine whether they will be permitted to invest (or in some cases how much they will be permitted to invest) in non-publicly offered investments (i.e. investments in private companies and offerings by certain funds, not generally available to non-accredited investors; For a more detailed discussion on the current “accredited investor” definition and its importance please see “Accredited Investor, What It Means And Why It Matters”).

If you do not already know, the term “accredited investor” is one of the most important definitions in all of securities law. More particularly, this definition is a central component to use of several exemptions from registration under the the Securities Act of 1933 (the “Act”), most notably Rule 506(b) and Rule 506(c) of Regulation D, and plays an important role in other federal and state securities law contexts. There is value in qualifying as an accredited investor because, under SEC rules, whether a person/entity qualifies as an “accredited investor” will generally determine whether they will be permitted to invest (or in some cases how much they will be permitted to invest) in non-publicly offered investments (i.e. investments in private companies and offerings by certain funds, not generally available to non-accredited investors; For a more detailed discussion on the current “accredited investor” definition and its importance please see “Accredited Investor, What It Means And Why It Matters”).

For some time the SEC has been considering ways to expand, and to open new investor classes to, the private investment framework while still maintaining appropriate and necessary investor protections. To that end, in June of 2019 the SEC issued a concept release soliciting comments on possible ways to improve and streamline the current exempt offering framework, including modifications to the current definition of “accredited investor.” This release generated a significant amount of comments/suggestions ranging in focus and position (both for and against). After carefully considering such comments the SEC released its, 153-page, proposal (the “Proposal”) to amend the current “accredited investor” definition late last year.

Proposed Amendments:

Generally speaking, the proposed amendments intend to significantly broaden the current “accredited investor” definition by adding new categories of “qualifying natural persons and entities.” These newer categories represent persons/entities the SEC believes do not need the additional protections afforded by registration under the Act because they have the knowledge and expertise to participate in private capital markets. The proposed amendments would also broaden the list of entities eligible to qualify as institutional buyers, as defined in Rule 144A of the Act. Here is a brief summary of the proposed new categories of natural person/institutional investors:

- Amendments to Categories of Individual Investors:

The Commission premised the proposed amendments on the notion that the traditional wealth based qualifiers present in the current definition should NOT be the only means for establishing financial sophistication to qualify as an “accredited investor.” Put another way, they believe an individual should not have to be rich in order to qualify as an “accredited investor.” As such they have proposed to expand the definition to include certain non-monetary based criteria which would allow individuals, who have enough education and/or experience to understand what they are investing in and the risks involved with such investment, to participate in private offerings regardless of their current income or net worth.

the definition to include certain non-monetary based criteria which would allow individuals, who have enough education and/or experience to understand what they are investing in and the risks involved with such investment, to participate in private offerings regardless of their current income or net worth.

More specifically the amendments propose two additional new, non-monetary, categories:

- individuals holding certain educational or professional certifications the SEC “has designated as qualifying an individual for accredited investor status;” and

- individuals constituting “knowledgeable employees” of a particular a private fund solely with respect to investment in such private fund.

For clarification, under the proposed amendments a person who falls within one of these new categories would qualify as an “accredited investor” without the need to further meet the traditional earned income/net worth requirements.

The first new category above is the most significant as it will allow the SEC flexibility to identify qualifying certifications/designations and related qualifications from time to time (which will most likely initially include Series 7, 65, and 82 licenses as discussed therein). It also opens the possibility of creating some form of general “qualification” test for persons who would otherwise not meet the criteria to qualify. As noted in the proposal, the SEC will be considering the following factors in determining which certifications/designations might qualify:

- whether the subject certification/designation arises out of an examination(s) administered by a self-regulatory organization (or other industry body) or an accredited educational institution;

- whether the examination giving rise to the subject certification/designation is designed to reliably and validly demonstrate an individual’s comprehension and sophistication in the areas of securities and investing;

- whether persons obtaining the subject certification/designation can reasonably be expected to have sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of a prospective investment; and

- whether persons holding the subject certification/designation are publicly identified by the issuing body.

In addition to the above, the amendments propose making certain modifications to the existing wealth standards as well. More particularly, the proposed amendments propose to expand the “accredited investors” definition to include joint income and joint net worth from “spousal equivalents,” and do not require assets to be held jointly in calculating wealth. The term “spousal equivalent,” as defined in the proposed amendments, includes “a cohabitant occupying a relationship generally equivalent to that of a spouse.” The intent of this amendment is to clarify the rules to provide consistent regulatory treatment among traditional marriages, same-sex marriages, civil unions and domestic partnerships.

It should also be noted that the SEC specifically chose NOT to upwardly adjust the current income/net worth benchmarks (i.e. $200,000 income per year ($300,000 jointly)/ $1,000,000 net worth) as many thought might happen. As stated in the proposed amendments, “notwithstanding the significant increase in the number of investors that qualify as accredited investors since 1982, we do not believe it necessary or appropriate to modify the definition’s financial thresholds at this time.” Among the reasoning discussed for this decision in the proposed amendments was the disparate impact an increase in these standards might have to the current “accredited investor” pool and related business in which they currently invest. They did, however, leave the door open to future amendments to these standards; stating that they are still soliciting additional comment/conducting more research in this area.

- Amendments to Categories of Entity/Institutional Investors:

Like the additional categories being proposed for individual natural persons to qualify as “accredited investors,” the SEC is proposing to add the following several new categories of qualifying entities/institutional investors:

- entities certified as Registered Investment Advisers pursuant to state law and/or Section 203 of the Investment Advisers Act;

- entities qualifying as “Rural Business Investment Companies” (as defined in Section 384(A) of the Consolidated Farm and Rural Development Act);

- any limited liability company having total assets exceeding $5 million which not formed for the purpose of acquiring the subject offered securities;

- any entity which is either directly owned by individuals who qualify as “accredited investors,” or indirectly owned by another entity comprised of equity owners that are individuals who qualify as “accredited investors;”

- any entity owning “investments” (as defined in 17 CFR 270.2a51-1(b)) in excess of $5 million which not formed for the purpose of acquiring the subject offered securities; and

- any “family office” or “family client” (each as defined in 17 CFR § 275.202(a)(11)(G)-1) having at least $5 million in assets under management which not formed for the purpose of acquiring the subject offered securities and whose prospective investments are managed by “a person who has such knowledge and experience in financial and business matters that such family office is capable of evaluating the merits and risks of the prospective investment.

What These Changes All Mean:

The proposed amendments materially broaden the existing “accredited investor” definition and, resultantly, significantly increase the potential pool of investors in exempt securities offerings; including Rule 506(b) and Rule 506(c) offerings and (for purposes of determining the total amount a particular investor can invest in a given offering) Reg CF and intrastate crowdfunding offerings.

The proposed amendments materially broaden the existing “accredited investor” definition and, resultantly, significantly increase the potential pool of investors in exempt securities offerings; including Rule 506(b) and Rule 506(c) offerings and (for purposes of determining the total amount a particular investor can invest in a given offering) Reg CF and intrastate crowdfunding offerings.

The modifications to the individual investor categories will be particularly significant to those entities engaging in, and those portals supporting, Reg CF and intrastate crowdfunding offerings as they open the doors to a large pool of new, previously unqualified, investors; such as younger persons who may otherwise be certified/experienced in financial matters but who otherwise would not meet the existing income/net worth standards. Looking only at FINRA certified individuals (as the Series 7, 65, and 82 licenses are expected to be among the initial categories of qualifying certifications/designations) the SEC estimates that there are approximately 691,000 such individuals as of December, 2018. While many of these individuals may already qualify under the existing income/net worth standards, it’s easy to see how just allowing this one subset of FINRA certified individuals to automatically qualify could allow for a significant number of new potential investors, meaning more money available to companies seeking funds. Moreover, FINRA certified individuals are just one set of individuals the SEC could eventually deem as qualified under the proposed new generalized approved certification/designation. In prior comments from the SEC (including in the proposal) there is much discussion about extending similar treatment to CPA, attorneys, and certain financial intermediaries who have enough education and/or experience to understand what they are investing in and the related risks. Not to mention the fact that the proposed amendments leave open the possibility of the SEC (either directly or in conjunction with FINRA or similar organization) from putting forth a general qualification test to allow any individual to seek qualification. All in all, the new proposed approved certification/designation category of individuals, if passed, will certainly and materially increase the pool of potential individual investors. This will no doubtedly give a big boost to the nascent Reg 506(c)/Reg CF/Intrastate offering industry and the related offering portals.

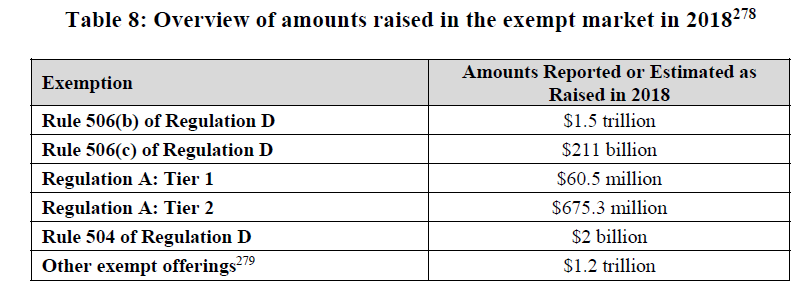

While the above discussed bump in the pool of individual investors is significant, the potential effect of the proposed modifications to the entity categories is GAME CHANGING! Putting it into context, as noted in the proposal, there was roughly $3 Trillion in investment funds raised via private securities transactions in 2018:

Looking at only the new “family office” category above, as noted by the SEC in the proposed amendments it is estimated that there are 2,500 to 3,000 single family offices managing more than $1.2 trillion in assets. Now many of these existing “family offices” (and the investment entities utilized by them) may already be able to qualify under the existing standards. However, “family offices” typically involve the investment of money on behalf of multiple generations of the subject family, some of which might be non-accredited persons. This may cause a given “family offices” (or the investment entities utilized by them) to be unable to satisfy the current standards; leaving them generally unable to engage in private funding transactions. The new proposed “family office” category will alleviate the foregoing issue altogether and even if it opens the door to only a minor percentage of new “family office” investors you’re talking about billions of dollars in previously untapped investor funds coming into the private securities market which is huge.

The real game changer, however, are the two new general categories offering qualification for entities holding more than $5 Million in assets/investments. Under the current standards only certain entity types can qualify as “accredited investors” regardless of the amount of assets/investments. This has completely shut out many sophisticated, and deep pocketed, investment entities from participating in the private securities market and has been a big topic of heavy debate over the last decade (for a  more detailed discussion please see “Out of Alignment: The Dysfunctional Definition of an Accredited Investor & The Often Overlooked “Entity” Issue”). Such excluded entities include among others, native american tribes, labor unions, sovereign wealth funds, 529 Educational Savings Plans, and governmental/quasi-governmental bodies. This means that the Trillions, maybe tens of Trillions, of investable dollars held by these entities are currently excluded from flowing into the private market which is insane. Take for example prosperous native american tribes who, collectively, generated $32.4 billion in revenues from the gaming industry in 2017 alone. Consider also Labor Unions who hold a significant percentage of the estimated $9.8 trillion in assets held by U.S. pension/benefit plans as of 2018. These new amendments open up the private securities markets to these two entity classes (among others) and new investments from these classes alone have the potential to double, if not triple, the total amount of investment funds raised via private securities transactions today. Not to mention the fact that these are only two of the numerous, previously excluded, entity classes which may now qualify under the amended standards. As such, the potential effect of these proposed new general categories, in terms of both new investor participation and the available pool of private investment capital, is truly monumental.

more detailed discussion please see “Out of Alignment: The Dysfunctional Definition of an Accredited Investor & The Often Overlooked “Entity” Issue”). Such excluded entities include among others, native american tribes, labor unions, sovereign wealth funds, 529 Educational Savings Plans, and governmental/quasi-governmental bodies. This means that the Trillions, maybe tens of Trillions, of investable dollars held by these entities are currently excluded from flowing into the private market which is insane. Take for example prosperous native american tribes who, collectively, generated $32.4 billion in revenues from the gaming industry in 2017 alone. Consider also Labor Unions who hold a significant percentage of the estimated $9.8 trillion in assets held by U.S. pension/benefit plans as of 2018. These new amendments open up the private securities markets to these two entity classes (among others) and new investments from these classes alone have the potential to double, if not triple, the total amount of investment funds raised via private securities transactions today. Not to mention the fact that these are only two of the numerous, previously excluded, entity classes which may now qualify under the amended standards. As such, the potential effect of these proposed new general categories, in terms of both new investor participation and the available pool of private investment capital, is truly monumental.

Conclusion:

These proposed amendments have been a long time coming and represent the culmination of years of heated debate. While there have been various bills and other legislation put forth over the years to accomplish one or more of the proposed amendments, none have made this far. We are on the precipice of witnessing a  mass opening of the private securities market which will materially change the industry, in all respects, going forward.

mass opening of the private securities market which will materially change the industry, in all respects, going forward.

It should be noted that the proposed amendments are still in the 60 day comment period (which expires mid-March of this year) and are thus subject to additional modification prior to the release of the final rule. That being said, the overwhelming majority of the current comments appear to be on the individual investor side and not the entity investor side. As such it’s expected that the final rules related to the entity investor side, which has by far the greatest potential to effect the current private securities industry, will be substantively similar to the proposed rules.