The Securities and Exchange Commission (SEC) recently issued a series of proposed rule amendments which, in their words, are intended to “provide a more rational framework, eliminate complexity and increase access to capital while preserving and enhancing important investor protections to simplify.” Among the most significant amendments are the significant increases to the maximum offering amounts under both Reg. A (Tier 2) and Reg. CF (“Regulation Crowdfunding) rules. These amendments will significantly improve the usefulness of these respective offering types, in particular the usefulness of Reg. CF offerings as a serious capital raising option.

The Securities and Exchange Commission (SEC) recently issued a series of proposed rule amendments which, in their words, are intended to “provide a more rational framework, eliminate complexity and increase access to capital while preserving and enhancing important investor protections to simplify.” Among the most significant amendments are the significant increases to the maximum offering amounts under both Reg. A (Tier 2) and Reg. CF (“Regulation Crowdfunding) rules. These amendments will significantly improve the usefulness of these respective offering types, in particular the usefulness of Reg. CF offerings as a serious capital raising option.

In the SEC Release concerning the proposed amendments, Chairman Jay Clayton was quoted as saying:

The complexity of the current framework is confusing for many involved in the process, particularly for those smaller companies whose limited resources spent on navigating our overly complex rules are diverted from direct investments in the companies’ growth. These proposals are intended to create a more rational framework that better allows entrepreneurs to access capital while preserving and enhancing important investor protections.

The proposed rules are focused on reducing certain complexities and ambiguities in the current offering framework to help market participants better navigate, and stay on the  right side of, applicable regulations.For those that are interested, the proposed rules are set forth in the 341 page, SEC Release No. 33-10763. The majority of the release is actually background information on the current securities offering framework, existing offering exemptions, etc. For those that have time the release has a great discussion on the various types of currently available offering exemption (including a handy chart starting on page 11) as well as the regulatory gaps and complexities that have arisen in the private offering framework over time.

right side of, applicable regulations.For those that are interested, the proposed rules are set forth in the 341 page, SEC Release No. 33-10763. The majority of the release is actually background information on the current securities offering framework, existing offering exemptions, etc. For those that have time the release has a great discussion on the various types of currently available offering exemption (including a handy chart starting on page 11) as well as the regulatory gaps and complexities that have arisen in the private offering framework over time.

For those that don’t quite have the time or patience to review the lengthy release, here is a summary of the primary modifications.

Amendments to Offering and Investment Limits:

The proposed amendments to the offering and investment limits under Reg. A (Tier 2) and Reg. CF are arguably among the most significant of the proposed amendments. As proposed:

- the maximum offering amount under Reg. A (Tier 2) would be raised from $50 Million to $75 Million; and

- the maximum offering amount under Reg. CF would be raised from $1.07

Million to $5 Million.

Million to $5 Million.

Additionally, the provisions concerning individual investment limits under Reg. CF would be amended by:

- removing the existing investment limitations (e. there would be no investment limitations) with respect to investing persons/entities who qualify as “accredited investors; and

- revising the calculation method for investment limits for non-accredited investors, to allow such inventors to rely on the greater of their net worth or annual income in calculating their respective investment limit.

Amendments to Reg. CF and Reg. A Eligibility:

The SEC’s exempt offering framework includes various specific eligibility restrictions which can exclude certain types of entities or activities by issuers and these restrictions  can vary significantly by offering type. The SEC is proposing to amend the current Reg. CF restrictions to allow for the use of certain special purpose vehicles (“SPVs”) to facilitate and aggregate investments (the use of which is currently prohibited). This has been a big sticking point to the use of Reg. CF and will go along way toward improving its attractiveness as a capital raising option.

can vary significantly by offering type. The SEC is proposing to amend the current Reg. CF restrictions to allow for the use of certain special purpose vehicles (“SPVs”) to facilitate and aggregate investments (the use of which is currently prohibited). This has been a big sticking point to the use of Reg. CF and will go along way toward improving its attractiveness as a capital raising option.

In addition to the above the SEC is proposing to:

- amend the types of securities which may be offered under Reg. CF to match those under Reg. A (e. equity and debt securities, securities convertible or exchangeable for equity interest, and guarantees of any of those securities); and

- amend Reg. A to exclude issuers that are delinquent in their Exchange Act reporting obligations in the prior two years.

One important point to note on the above changes is that they would eliminate the use of “Simple Agreements for Future Equity” (or “SAFESs”) in Reg. CF offerings. This is due to the SECs concern that SAFE offerings are highly risky and offer little protection for investors.

Amendments to General Solicitation Rules:

Under the existing exempt offering framework issuers are generally prohibited (except in connection with Reg. A and Rule 506(c) offerings) from doing any kind of “general  solicitation” (see Rule 502(c)). That being said, what exactly falls into the category of “general solicitation” is often unclear; particularly in today’s society.

solicitation” (see Rule 502(c)). That being said, what exactly falls into the category of “general solicitation” is often unclear; particularly in today’s society.

The proposed amendments would specifically exclude “demo day” communications from being a form of “general solicitation.” Demo days refer to a meeting/event hosted by a college, angel investor group, incubator or accelerator, or other such group where one or more companies are able to present their businesses to potential investors. Under the proposed amendments communications in connection with these “demo day” events would not be considered “general solicitation” provided that:

- information in the notice of the event would be limited to (respectively, per presenting issuer): (a) notification that the subject presenting issuer is in the process of offering or planning to offer securities; (b) the type and amount of securities being offered; and (c) the intended use of the proceeds of the offering; and

- the organizer would not be permitted to conduct certain activities, including: (a) charging fees to attendees (other than administrative fees); (b) receiving fees for introductions; (c) making investment recommendations or providing investment advice to attendees; and (d) engaging in any investment negotiations between the issuer and investors attending the event.

The SEC is also proposing to delete the examples of general solicitation in Rule 502(c) and to add a new rule outside of Reg. D that would be updated and expanded to include “general solicitation” examples more in line with present-day communication methods (e.g. emails and text messages, and information sharing about issuers by angel investors).

While the proposed amendments do not change the general prohibition against “general solicitation” under Reg. CF it does amend the rules slightly to allow issuers to make oral communications so long as such communications comply with Rule 204.

Amendments to allow for “Test-the-Waters” Solicitations:

Under the existing rules, in connection with a proposed Reg. A offering the issuer may currently “test-the-waters” for offerings (i.e. gauge interest) from potential investors before or after filing an offering statement with the SEC. The SEC is proposing a new rule that would permit any issuer (i.e. not just those conducting a Reg. A offering) to solicit indications of interest in an exempt offering, orally or in writing, prior to determining which exemption it would rely on to conduct the offering. Without limitation, this concept would include generic solicitations of interest prior to  determining under which exemption to conduct the offering (e.g. Reg. D, Reg. A, Reg. CF., etc.).

determining under which exemption to conduct the offering (e.g. Reg. D, Reg. A, Reg. CF., etc.).

It should be noted that the SEC cautions in the proposed rules that if soliciting generic indications of interest is done in a manner that would constitute “general solicitation,” and the issuer ultimately decides to conduct an exempt offering pursuant to an exemption that does not permit “general solicitation,” (e.g. Rule 506(b) or Reg. CF) the issuer would need to analyze whether the generally solicited offer and the subsequent private offering could be integrated. Without limiting the foregoing, under the proposed rules: (a) if a Reg. A or Reg. CF offering is commenced within 30 days of a generic “test-the-waters” solicitation, then any materials used for the “test-the-waters” solicitation would be required to be included as an exhibit to the Reg. A/Reg. CF filings with the SEC; and (b) in the case of a Rule 506(b) offering where securities are sold to a non-accredited investor within 30 days of a generic “test-the-waters” solicitation, any materials used for the “test-the-waters” solicitation materials would be required to be delivered to that purchaser within a reasonable time prior to the sale.

Amendments to Offering Integration Rules:

Integration rules determine whether one offering of an issuer should be considered part of, or otherwise integrated with, one or more other offerings of such issuer. This is important because each type of exempt offering has its own distinct rules and regulations that must be expressly complied with. Accordingly, the consequence of finding that two (or more) offerings should be integrated is that each of the integrated offerings must satisfy, in full, the conditions of a single exemption. Failing to do so can lead to, among other things, rescission of one/all of the offering, a five-year capital-raising injunction under the “bad actor” rules and/or prosecution for violating Section 5  of the Securities Act by making an unregistered public offering.

of the Securities Act by making an unregistered public offering.

Under the existing rules analyzing whether any two or more offerings are considered to be integrated involves undertaking a complex, and often subjective, analysis which centers around five main factors; whether: (a) the different offerings are part of a single plan of financing; (b) the offerings involve the issuance of the same class of security; (c) the offerings are made at or about the same time; (d) the same type of consideration is to be received; and (e) the offerings are made for the same general purpose. Recognizing the limitations inherent in, and the often subjective nature of, the foregoing five-factor test, the SEC has adopted various safe harbor rules and other guidance throughout the years. Most notably, Rule 502 provides a “safe harbor” for Reg. D offerings and provides that any such Reg. D securities offerings which are made within six months after or before another securities offering will not be considered integrated.

Under the proposed amendments the foregoing five-factor test would be replaced with the following four nonexclusive safe harbors and overriding general principal:

- 30-Day Safe Harbor: Any offering made more than 30 calendar days before the commencement or more than 30 calendar days after the termination or completion of any other offering would not be integrated. Plus, for offerings not using “general solicitation,” purchasers either were not solicited through the use of general solicitation or there was a prior substantive relationship.

- Rule 701/Reg. S (Reg. S): Rule 701 offerings (pursuant to employee benefit plans) and Reg. S offerings (offerings outside the United States) would not be integrated with other offerings.

- Registered Offerings: A registered offering would not be integrated if made subsequent to: (a) a terminated or completed offering for which “general solicitation” is not permitted; (b) a terminated or completed offering for which “general solicitation” is permitted and made only to qualified institutional buyers (QIBs) and institutional accredited investors (IAIs), or (iii) an offering for which “general solicitation” was used and that terminated or completed more than 30 calendar days prior to the commencement of the registered offering.

- General Solicitation Offerings: Offerings for which “general solicitation” is permitted would not be integrated if made subsequent to any prior terminated or completed offering.

- General Principal: For offerings which are not covered by any of the above four safe harbors, the offering would nonetheless not be integrated if it can be established that each offering complied with applicable registration requirements or an exemption from such registration requirements. The proposed rules further clarify the application of the foregoing general principal depending on whether the subject offering permits or prohibits “general solicitation” as follows:

- Exempt Offerings Where General Solicitation IS NOT Permitted: The issuer must have a reasonable belief, based on the facts and circumstances, that the purchasers in the exempt offering: (a) were not solicited through the use of general solicitation; or (b) established a substantive relationship with the issuer prior to the commencement of the offering. This actually codifies a current SEC position that an issuer may conduct an offering that prohibits general solicitation concurrently or subsequently, without integration concerns, with an offering that permits general solicitation (g a Rule 506(c), Reg. A or Reg. CF offering) as long as the investors in the subject exempt offering were not solicited via general solicitation or they had a prior substantive relationship prior to the exempt offering.

- Exempt Offerings Where General Solicitation IS Permitted: If an exempt offering permitting general solicitation includes information about the material terms of a concurrent exempt offering that permits general solicitation, the offering materials must include the necessary legends for, and otherwise comply with, the requirements of each exemption.

While the above may seem a bit convoluted they are actually much more streamlined with respect to application then the current five-factor test and will go a long way toward analyzing integration concerns in connection with multiple offerings.

Additional Amendments:

The proposed amendments also provide for the following:

- Amendments to Rule 506(c) Verification Requirements: Rule 506(c) of Reg. D, which permits general solicitation, provides a non-exclusive list of verification methods that issuers may use in seeking to satisfy the verification requirement that natural person investors are “accredited investors.” The proposed amendments would add an additional category of permitted verification whereby an issuer could verify that a particular investor, for which the issuer previously took reasonable steps to verify as an “accredited investor,” remains an “accredited investor” as of the time of a subsequent sale if the investor provides a written representation to that effect and the issuer is not aware of information to the contrary.

- Harmonization of Disclosure Requirements. The SEC has proposed that financial statement information for Reg. D offerings that include non-accredited investors be the same as for Reg. A offerings. Specifically, any such Reg. D offering which is $20 million or less would require the same financial information as a Reg. A - Tier 1 offering and would not require audited financials, whereas any such Reg. D offering of more than would require the same financial information as a Reg. A - Tier 2 offering and would require audited financials. Traditional registered offerings and Reg. A offerings would also be harmonized so that Reg. A issuers could do the following: (a) file certain redacted exhibits using the simplified process previously adopted for registered offerings; (b) make draft offering statements and related correspondence available to the public via EDGAR rather than requiring them to be filed as exhibits; (c) incorporate financial statement information by reference to other documents filed on EDGAR; and (d) have post-qualification amendments declared abandoned.

- Increase to Rule 504 Offering Limit. The proposed amendments increase the maximum offering limit under Rule 504 from $5 Million to $10 Million.

Conclusion:

You really have to commend the SEC in listening to market comments and actively trying to streamline the exempt offering process. The proposed amendments actually go a long way toward accomplishing the SEC’s stated goal of addressing “gaps and complexities in the exempt offering framework that may impede access to capital for issuers and access to investment opportunities for investors.” In my opinion these amendments significantly improve the usefulness and viability of both Reg. A and Reg. CF offerings as serious capital raising options as well as improving the framework of exempt offerings  across the board.

across the board.

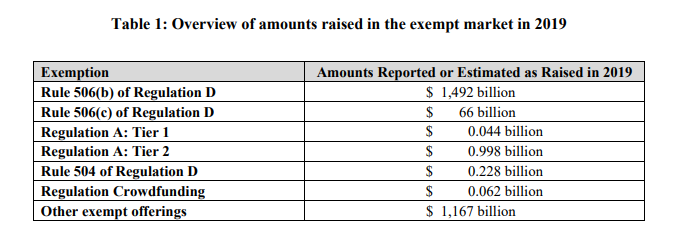

One interesting take away from those discussions is the fact that the traditional Reg. D (i.e Rule 506(b)) offering exemption remained the most popular during 2019 as illustrated by the following table in the proposed amendments despite the introduction of multiple “semi-public” offering exemptions over the last couple years (e.g. Reg. A, Reg. CF, etc.):

With the introduction of these new amendments however who knows what 2020 and beyond will look like.

It should also be noted that the proposed amendments are still in the 60 day comment period (which expires mid-May of this year) and are thus subject to additional modification prior to the release of the final rules. We can only hope that these amendments are substantively passed as drafted as they will fix many of the existing potholes which have slowed the use of some of the newer classes of exempt offerings.