- With it just turning 2016 and all, what better time to reflect on all the advancements made this year and to look ahead to all those still to come in 2016. If you follow this industry at all you know that 2015 was an absolute landmark year for crowdfunding. In many ways however, we have only seen the tip of the crowdfunding iceberg.

A review of 2015:

Where to begin … With so many advancements in the industry this year, it would take me until mid 2016 to discuss them all in detail so here are the highlights:

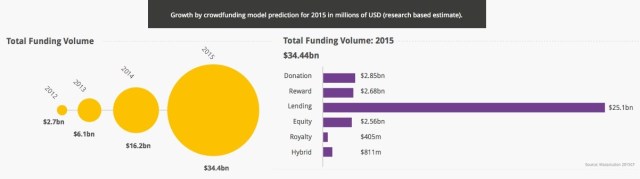

Massive Industry Growth.

The total funding volume of the crowdfunding industry has more than doubled year over year since 2012 and 2015 is expected to come out the same. According to Massolution’s 2015CF report issued earlier this year, the global crowdfunding industry is expected to grow to approximately $34.4 Billion (yes, with a “B”) by the end of 2015. Looking at these by market segment, it is clear that “P2P Lending,” or “Marketplace Lending” as it is becoming more commonly known as, continues to be the largest segment of this industry with an expected $25.1 Billion in funding for 2015 (more than doubling the approx. $11B in 2014 and representing almost 75% of expected total industry funding). Reward and donation based crowdfunding represent the second largest segment of the industry with about $5.5 Billion (about 16% of expected total industry funding) in funding with equity based crowdfunding coming third at an expected $2.5 Billion (about 7% of expected total industry funding). In terms of where this money went, the percentage breakdown by category remained markedly consistent between 2013 and 2014, and is expected to remain consistent once the smoke clears for 2015.

Breaking the industry growth down by region, the United States continues to represent the largest segment of the industry with just under 50% of expected total industry funding. The United States also continues to have an extremely high annual industry growth rate (at 82%). That being said, the Europe and Africa markets are each expected to show growth of almost 100% over their 2014 numbers and the Asia markets is expected to show a phenomenal 210% growth rate (representing the 2nd largest region by volume at approx. $10.5 Billion).

Release of final Title IV (“Regulation A+”) rules.

2015 brought with it the SEC’s passing of the long awaited final Title IV (“Regulation A+”) rules. Since its introduction, crowdfunding has been touted as THE method for democratizing private investment. However, until mid-2015 when the final Reg A+ rules went into effect, investment based crowdfunding (i.e. debt and equity based crowdfunding) was limited almost exclusively to high-net worth “accredited  investors” under Title II (i.e. Rule 506(c)) offerings. With the passing into law of the new Reg A+ rules, participation by unaccredited investors finally became a reality.

investors” under Title II (i.e. Rule 506(c)) offerings. With the passing into law of the new Reg A+ rules, participation by unaccredited investors finally became a reality.

In comparison to Title II (Rule 506(c)) offerings, there is no doubt that Reg A+ offerings are more complex and costly, in terms of both time and money. Nevertheless, the unique ability to solicit unaccredited investors, and to “test the waters” without significant upfront expenses, have made Reg A+ offerings attractive to certain issuers. More importantly, the process has proven to be workable, even with the increased costs, as we have seen a handful of companies be approved by, or at least file an application with, the SEC in 2015 to complete a Regulation A+ offering including:

- A $25 Million Dollar offering by Elio Motors, an Arizona based alternative vehicle manufacturer (offering formally qualified by the SEC in November of this year);

- A $15 Million Dollar offering by Med-X, Inc. , a California based cannabis cultivator (offering formally qualified by the SEC in November of this year);

- A $10 Million Dollar offering by XTI Aircraft Company, a Denver based alternative aircraft manufacturer; and

- A $50 Million Dollar offering by Fundrise Real Estate Investment Trust, LLC (an affiliate of Fundrise, LLC), a Delaware fund entity formed as the world’s first “eREIT”

Release of final Title III (“Regulation CF” or “retail crowdfunding”) rules.

If there was one thing that was more anticipated in this industry in 2015 than the final Reg A+ rules, it was the release of the final Title III rules. Well Title III proponents finally got their wish and, after over three LONG years of waiting, the SEC approved (by a vote of 3 to 1, with Commissioner Piwowar voting against) and released the final Title III crowdfunding rules in late October. However, what’s that old adage, “be careful what you wish for?” … Some Title III proponents are feeling that way after  reviewing the 685-pages of final Title III rules.

reviewing the 685-pages of final Title III rules.

Conceptually Title III was supposed to be the TRUE democratizer of early-stage company funding. In contrast to Reg A+, Title III was intended to be an easier and less costly method (i.e. a private offering and not a registered public offering like Reg A+) for small and emerging companies to raise capital while at the same time allowing everyone, not just high net worth investors and venture capital funds, to invest and potentially be part of the next big “thing.” However many people feel the finals rules, while workable and a significant improvement in many respects from the original proposed rules, significantly over-regulate what was intended to be an easy capital raising tool making it an unattractive option for most small and emerging companies (particularly in light of other available options such as Title II and Title IV offerings).

Some of the more contested provisions of the final rules include:

- A maximum offering limit of $1 million dollar;

- A maximum investor cap of $100,000, regardless of whether such investor is accredited or non-accredited (as SEC Commissioner Piwowar stated, “even if you are Warren Buffet or Bill Gates, you are limited [on how much you can invest]”); and

- The requirement that crowdfunding portals will have to not only be SEC registered entities but FINRA regulated members as well (though, under both, being subject to less regulatory burdens than for registered broker-dealers).

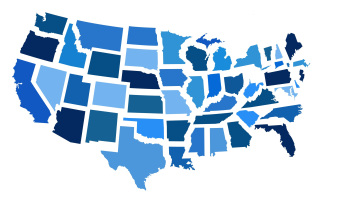

Multiple new states enact intrastate crowdfunding rules.

While notably less “sexy” than the release of the above federal rules, in 2015 fifteen (15) new states enacted intrastate crowdfunding regulations. These states include AZ, FL, IA, MA, MN, MS, MT, NE, NJ, NM, OR, SC, TN and VA. This brings the total number of states with enacted crowdfunding regulations to a hoping majority of thirty (30) states (from only sixteen (16) at the end of 2014) with seven (7) states (AK, HI, MO, NV, NH, NC and WV) having proposed regulations in various stages of approval.

(from only sixteen (16) at the end of 2014) with seven (7) states (AK, HI, MO, NV, NH, NC and WV) having proposed regulations in various stages of approval.

I would be remiss to note that 2015 brought a personal victory for me as the Illinois crowdfunding exemption (which I wrote) was finally signed into law. The new law, which will be effective as of January 1, 2016, provides for a maximum offering cap of $4 Million (recognized as one of, if not the, highest cap of all states; at least until formally Georgia ups their cap to $5 Million as currently proposed).

Proposed new amendments (amendments to Rule 147, Rule 504 and “Accredited Investor” definition).

Although nothing has been formally approved, the SEC released a proposal late this year (at the same time as the Title III rules were approved) to significantly amend existing Rule 147 to help facilitate intrastate crowdfunding. The proposal, if accepted (with minor tweaks) would go a LONG way toward making intrastate crowdfunding a  more workable and trusted method of raising capital. Under the SEC’s proposal, the existing Rule 504 would also be amended to increase the offering cap to $5 million (or more) to make the exiting rule more useful and to help facilitate “regional” based crowdfunding.

more workable and trusted method of raising capital. Under the SEC’s proposal, the existing Rule 504 would also be amended to increase the offering cap to $5 million (or more) to make the exiting rule more useful and to help facilitate “regional” based crowdfunding.

While the above amendments are each significant in their own right, who qualifies as an “accredited investor” is one of the most important topics in all of securities law. As such, any change to the current “accredited investor” definition standard can have substantial, and far reaching, effects. Pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act, the SEC is required to re-examine the definition of “accredited investor” every four (4) years to determine whether it should be modified. So, for the last year and a half or so, the SEC has been actively examining this issue and its Staff recently released a detailed and comprehensive report analyzing the current definition and making certain recommendations for modifying it. As you can imagine, how the SEC ultimately determines to modify (or not modify) this definition is going to be pivotal for the crowdfunding industry, and the securities industry as a whole.

My Predictions For 2016:

Now for the fun part, my predictions for the upcoming year and beyond:

Continuing Massive Growth.

I believe not only will the juggernaut like growth of the industry continue in 2016, it will get significantly stronger. While those of us in the industry live and breathe crowdfunding everyday, we have to remember that majority of people still have no idea what investment based crowdfunding really is (uhhh it’s that thing where those guys funded a cooler thing on Kickstarter right?). As an industry we have only scraped the surface in terms of educating the 90% of the investing public represented by “non-accredited” investors, let alone the majority of “accredited investors,” as to the power and benefits of crowdfunding. However, media coverage of investment based crowdfunding deals is really starting to hit its stride as it moves out of the dark corners of obscure industry publications and into mainstream media. I mean we even  have a new CNBC crowdfunding index for goodness sake! Soon there will be fewer questions about what investment based crowdfunding is and more questions around how people/businesses can get in.

have a new CNBC crowdfunding index for goodness sake! Soon there will be fewer questions about what investment based crowdfunding is and more questions around how people/businesses can get in.

In 2016 I predict industry exposure will significantly expand (i.e. blow up). As larger Title II based platforms such as SeedInvest, Patch of Land, RealtyMogul, Fundrise, etc. continue to successfully offer bigger and better deals, the investing public has, and will continue, to take notice. Moreover, with the release of Final Reg A+ rules, Title III rules, and various Intrastate rules (particularly Illinois’) which will allow everyday investors to participate, I predict you will see lot more deals making mainstream headlines in 2016 bringing more attention and focus to the industry. As exposure and eduction increases so will the size of the market. It’s inevitable. Hence my prediction is that we will see a significant uptick in the growth rate, and overall volume, of the industry in 2016.

In terms of exactly where the growth in the industry might be, here are my predictions:

- By Geographic Location – I predict that the U.S. will continue to represent the largest segment of the crowdfunding industry by volume and will still have a high rate of growth (though probably lower than 2015). That being said, I think that it will be overshadowed in some respects by the meteoric growth in the Asia, Europe and Africa markets which I expect to continue and get stronger.

- By Market Share – “P2P Lending,” or “Marketplace Lending,” will continue to lead the pack in terms of market share (no doubt about that). However I believe you will see a noticeable uptick in the market share for equity investments as a result of the new regulations.

- By Category – I predict that the current industry breakdown by category will continue to remain consistent for, the most part, as it has over the past couple years. However, I believe you will see the “Real Estate” category move up several notches on this ladder as this segment explodes in 2016.

More Regulation A+ offerings.

This is a virtual certainty rather than a prediction. With the expected success of Elio’s $25 Million Reg A+ offering there is little doubt that others will follow in their footsteps. In fact, given XTI’s and Fundrise’s upcoming Reg A+ offerings, as well as the multiple other Reg A+ offerings already in various stages of SEC review and approval, 2016 is shaping up to be the year of the Reg A+ offering.

This is a virtual certainty rather than a prediction. With the expected success of Elio’s $25 Million Reg A+ offering there is little doubt that others will follow in their footsteps. In fact, given XTI’s and Fundrise’s upcoming Reg A+ offerings, as well as the multiple other Reg A+ offerings already in various stages of SEC review and approval, 2016 is shaping up to be the year of the Reg A+ offering.

Few Title III Offerings/More Intrastate Offerings.

For me, the final Title III rules just do not live up to the expectations. Someone had to say it. While I do not envy the SEC’s job in trying to draft these rules, I just don’t see Title III Regulation crowdfunding being very useful in its current form; in particular with the $1 Million offering cap. Although workable in theory, I believe that, from an administrative and cost standpoint, complying with the 685-pages of detailed final rules is just not worth it to raise $1 million dollars. As a result, while I think you will see a few companies attempt to do a Title III offering in 2016, I doubt you will see more than a handful of these offerings make it to market (with even less of them, if any, will be successful). Unless, and until, the rules are changed to at least up the offing cap of course. Even Doug Ellenoff, arguably the biggest Title III proponent,  agrees as he was quoted as saying “[f]or Title III to really become useful, it will have to be increased to permit $5 million dollar financings.”

agrees as he was quoted as saying “[f]or Title III to really become useful, it will have to be increased to permit $5 million dollar financings.”

The desire to truly democratize private investments remains strong even in light of the less than optimal final Title III rules. That is why I predict that you will see a marked increase in the number of intrastate offerings, in particular successful offerings, conducted in 2016. The majority of current intrastate crowdfunding regulations have offering caps of over $1 Million (with Illinois and other states having caps of over $2 million). Not to mention that compliance with these regulations is significantly less costly and time consuming then what is expected for a Title III offering.

It’s true that we have only seen about a hundred intrastate offerings completed over the last three or so years. However, I believe that was more the result of a lack of investor/issuer education and certain unworkable state regulatory rules (e.g. escrow requirements) than anything else, much of which has been remedied. As a result, I am going to go out on a limb and say that 2016 is going to be a HUGE year for intrastate offerings. Just remember, you heard it here first!

Adoption of new regulations.

As noted above, certain proposals for significant amendments to existing securities rules and regulations are already in process. I predict that the proposal to amend Rule 147 and 504 will be passed (with the necessary revisions) in 2016 (which only strengthens my belief that 2016 will be big for intrastate offerings). I also predict that the SEC will approve final changes to the “accredited investor” definition in 2016. Though I can only hope that their changes will expand, and not contract, the current pool of “accredited investors.” Finally, I believe that you will see the current, and inevitable future, proposals to modify the final Title III rules gain significant steam in 2016, though I highly doubt anything formal will be done to approve any changes in the next year.

Shake-up of market participants.

While I do believe we are only knocking at the door of what is expected to be a $300 Billion dollar industry in the next 10 years, I do believe the industry is a little “portal” saturated. Some platforms saw tremendous success over the last year. However, several smaller crowdfunding portals, and even related service providers  (e.g. “Crowdentials” and “CrowdBouncer”), who had hoped to gain a foothold in this industry, were forced to shut their doors. This is an inevitable part of a growing industry and I expect the trend to continue (and even grow) in 2016 as the stronger players continue to break away from the general pack. I also think you will see more mergers of companies, either with one another or outside strategic partners, in 2016 as companies strive to gain market share and a competitive advantage.

(e.g. “Crowdentials” and “CrowdBouncer”), who had hoped to gain a foothold in this industry, were forced to shut their doors. This is an inevitable part of a growing industry and I expect the trend to continue (and even grow) in 2016 as the stronger players continue to break away from the general pack. I also think you will see more mergers of companies, either with one another or outside strategic partners, in 2016 as companies strive to gain market share and a competitive advantage.

Pingback: D&O Questionnaires: Whether to Address the Clayton Act? : TheCorporateCounsel.net Blog