This is part two of my two-part article exploring the use of real estate crowdfunding (i.e. “RECfunds” or “RECfunding“) as a vehicle for investing in real estate (for part 1, click HERE). This part will focus primarily on the associated benefits of RECfunding over more traditional approaches to real estate investment for today’s investors.

This is part two of my two-part article exploring the use of real estate crowdfunding (i.e. “RECfunds” or “RECfunding“) as a vehicle for investing in real estate (for part 1, click HERE). This part will focus primarily on the associated benefits of RECfunding over more traditional approaches to real estate investment for today’s investors.

When You Invest In RECfunds What Do You Actually Own?

Equity-Based RECfunds:

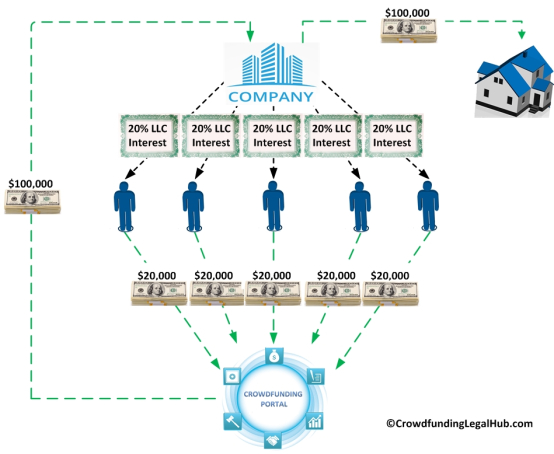

Short and sweet, you will be a part owner of the property that is purchased (indirectly of course). Most equity-based RECfunds are set up to acquire and hold the investment property in the name of a separate “single purpose” (i.e. the only purpose is to own and operate the property) entity (e.g. a Limited Liability Company (LLC), Limited Liability Partnership (LLP) or Limited Partnership (LP)). The use of such a separate entity to acquire and hold the property both helps to insulate individual investors from other liabilities of the developer and to centralize reporting and distributions to investors. Since it will be the entity that will actually purchase the property, as an investor in an equity-based RECfund you would actually be buying (and your “ownership” interest in the investment property would be evidenced by) an interest in the purchasing entity.

property in the name of a separate “single purpose” (i.e. the only purpose is to own and operate the property) entity (e.g. a Limited Liability Company (LLC), Limited Liability Partnership (LLP) or Limited Partnership (LP)). The use of such a separate entity to acquire and hold the property both helps to insulate individual investors from other liabilities of the developer and to centralize reporting and distributions to investors. Since it will be the entity that will actually purchase the property, as an investor in an equity-based RECfund you would actually be buying (and your “ownership” interest in the investment property would be evidenced by) an interest in the purchasing entity.

By way of example, let’s say a real estate developer wants to set up an equity-based RECfund to raise $100,000 in order to fully acquire and develop a particular piece of property (the “Project”). The developer sets up a separate LLC to acquire the property (the “Investment LLC”) and creates a RECfund looking for people to invest in the Project. You think the Project is a good investment and you choose to invest $20,000 in the developer’s RECfund. In return for your $20,000 you would receive a 20% ownership interest in the Investment LLC. While not an owner of an interest in the property directly, by owning a 20% interest in Investment LLC you would be entitled to 20% of everything that the LLC owns (i.e. the subject Project property).

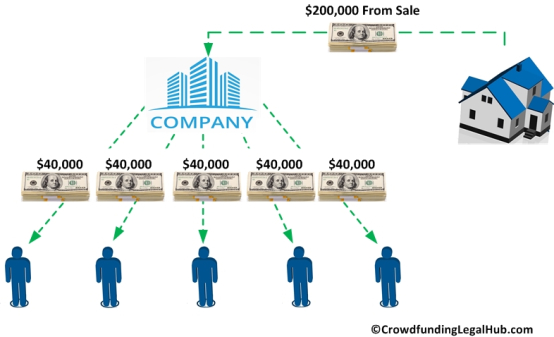

In terms of what type of return an investor actually receives in an equity-based RECfund, that would depend on what the developer intends to do with the property (e.g. will the developer be building a house on the property and selling it, renovating a property and renting it, etc.) and how the “investment” entity is set up.

For sake of continuing the above example, let’s assume that: (1) the above developer intends to build a home on the property and turn around and sell it; (2) the developer pays $50,000 to acquire the property and another $50,000 to build the home (i.e. the total $100,000 in raised funds); (3) the Investment LLC is set up to make equal distribution to all the owners; and (4) upon completion, the developer sells the house for $200,000 (after all expenses). Now the Investment LLC has $200,000 in cash and it distributes all of the income to its owners. As an owner of a 20% interest in the Investment LLC you would receive a distribution of $40,000 (i.e. 20% of $200,000) and would have doubled your original investment.

Please note, this is a VERY simplified example meant only to illustrate the basics of what equity-based RECfund investors receive in return for their investment dollars. For example, rarely will a developer be looking to finance 100% of an entire project as in the example above (and you wouldn’t want to invest in such project because the investors are taking ALL of the risk). Moreover, certain “investment” entities are set up to distribute profits in an unequal (i.e. not pro-rata) manner and/or with profits being paid to one or more owners before others (e.g. preferential distributions, “waterfall” distributions, etc). These are just a couple of variables which would change the ownership/pay-out examples illustrated above.

Each equity-based RECfund will have its own variables (e.g. project strategy, company distribution procedures, preferred distributions, etc.), an in-depth discussion of such variables being beyond the scope of this article. As a result, before investing in any equity-based RECfund, the investor needs to evaluate and understand the terms of the deal from investment to exit. Further, if you are unfamiliar with these types of investments I highly recommend consulting a knowledgeable professional who can help you evaluate the potential benefits and risks of a particular equity-based RECfund.

variables being beyond the scope of this article. As a result, before investing in any equity-based RECfund, the investor needs to evaluate and understand the terms of the deal from investment to exit. Further, if you are unfamiliar with these types of investments I highly recommend consulting a knowledgeable professional who can help you evaluate the potential benefits and risks of a particular equity-based RECfund.

Debt-Based RECfunds:

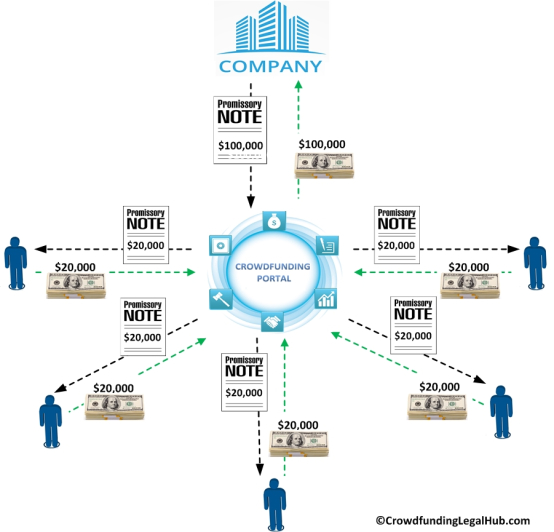

In a debt-based RECfund, the investors are essentially lending money to a real estate developer to acquire/develop a particular property. In return for the money, the investor will receive a promise (i.e. a promissory note) to pay the amount of the loan back along with a set amount of interest (currently averaging anywhere from 6% - 14%). You homeowner’s might be thinking, “oh I get it, it’s just like when I took out a loan from my bank to buy my house except this time I get to be the bank, right?”… the answer is… sort of.

of interest (currently averaging anywhere from 6% - 14%). You homeowner’s might be thinking, “oh I get it, it’s just like when I took out a loan from my bank to buy my house except this time I get to be the bank, right?”… the answer is… sort of.

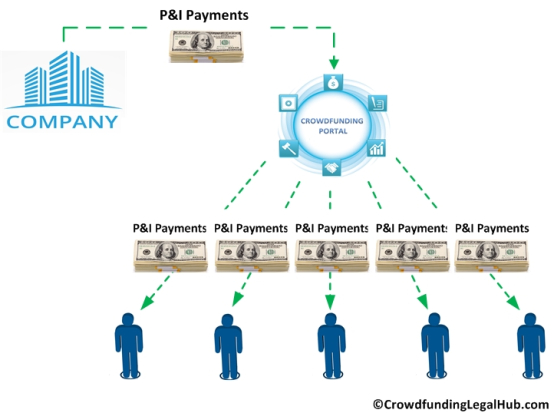

What is actually happening in most, if not all, debt-based RECfunds is that the investors will lend money to a separate entity which will typically be the crowdfunding portal (the “Lending Entity”) rather than lending the money directly to the developer. The Lending Entity technically acts as the “bank” by taking all of the investor money and making a loan to the developer. Each investor will receive a “promissory note” from the Lending Entity (the “Investor Note”) promising to pay the respective investor’s loan back plus interest. Similarly, the Lending Entity will receive a “promissory note” from the developer (the “Lending Entity Note”) promising to pay the Lending Entity’s loan back plus interest.

The Investor Note will often provide for regular monthly/quarterly payments of principal and/or interest from the Lending Entity to the investor (similar to the monthly payment you might have to make to your bank on a loan). The ability to receive these regular payments makes the investment somewhat less risky than an equity-based RECFund in that you are getting your money back (and interest) a little at a time instead of waiting for some future event to get money back (i.e. if/when the property is sold/rented as illustrated above). That being said it needs to be noted that the terms of the Investor Note will say that the Lending Entity will only be required to pay back investors under the Investor Note if, and to the extent, that it gets paid back by developer under the Lending Entity Note. Put simply, if the developer stops paying the Lending Entity the Lending Entity will stop paying you.

Gone cross-eyed yet??? I feel your pain, and just think, this again is a VERY simplified version. I haven’t even addressed the issue of what, if anything, secures these loans (which I will have to reserve for another article given the complexity of this issue). Unfortunately, due to certain current regulations, administrative and other reasons, an indirect structure is required in the U.S. For purposes of this article, the two main take-aways are: (1) in a debt-based RECfund the overall intent is that the investors will be lending money (indirectly) to the developer and the developer will be paying the money back (indirectly) to the investors; and (2) a debt-based RECfund is generally considered less risky than an equity based RECfund because the investor receives a stated promise of repayment (as opposed to the chance at a speculative profit if/when the property is sold/rented) as well as, typically, regular payments over the life of the loan (as opposed to waiting until the property is sold/rented).

As above, please note that this is NOT intended to be an in-depth discussion of investments in debt-based RECfunds and is only intended to illustrate the basics of the concept. Like equity-based RECfunds, debt-based RECfunds carry their own complexities and variables which need to be researched and understood thoroughly by any potential investor. In particular, a potential investor needs to understand what payments (if any) will be made under the Investor Note and what (if anything) will be securing that payment. Again, if you are unfamiliar with these types of investments you should consider consulting with a knowledgeable professional before investing in a debt-based RECfund.

Benefits Of RECfunds Over Traditional Real Estate Investments

-

Control – Unlike REITs and certain network-based deals, an investor in a RECfund will know exactly what property is being acquired prior to investing funds. By being able to choose between RECfunds (and by virtue, between specific real properties), an investor has significantly more control over how, and in what, their money is being invested.

Control – Unlike REITs and certain network-based deals, an investor in a RECfund will know exactly what property is being acquired prior to investing funds. By being able to choose between RECfunds (and by virtue, between specific real properties), an investor has significantly more control over how, and in what, their money is being invested.  Low Cost of Investment – Each of the traditional approaches requires a substantial amount of capital and time. In today’s society, many investors may not have access to significant amounts of investable capital, let alone spare time to spend actively managing their real estate investments. RECfunds, on the other hand, require a minimal amount of upfront capital and time when compared to these traditional approaches making them a much more viable option for the ordinary investor.

Low Cost of Investment – Each of the traditional approaches requires a substantial amount of capital and time. In today’s society, many investors may not have access to significant amounts of investable capital, let alone spare time to spend actively managing their real estate investments. RECfunds, on the other hand, require a minimal amount of upfront capital and time when compared to these traditional approaches making them a much more viable option for the ordinary investor. Diversification of Risk (both by project and by geographic area) – This goes hand in hand with the control and the low minimum investment benefits discussed above. As investors are able to invest small amounts of money in multiple RECfunds, they can more easily diversify the risk of their investments. This includes diversifying among the types of properties acquired (e.g. residential vs. commercial property), as well as, where the investment properties are located (e.g. U.S. or abroad).

Diversification of Risk (both by project and by geographic area) – This goes hand in hand with the control and the low minimum investment benefits discussed above. As investors are able to invest small amounts of money in multiple RECfunds, they can more easily diversify the risk of their investments. This includes diversifying among the types of properties acquired (e.g. residential vs. commercial property), as well as, where the investment properties are located (e.g. U.S. or abroad). Access to Projects – As discussed, traditionally access to profitable real estate investments has been limited to those in-the-know or those with access to such people. With RECfunding however, access to profitable real estate projects is being granted to a MUCH larger audience. Moreover, with the steady recent growth of the RECfunding industry, the sheer number of investable real estate projects grows by the day.

Access to Projects – As discussed, traditionally access to profitable real estate investments has been limited to those in-the-know or those with access to such people. With RECfunding however, access to profitable real estate projects is being granted to a MUCH larger audience. Moreover, with the steady recent growth of the RECfunding industry, the sheer number of investable real estate projects grows by the day. Passive vs. Active Investment – RECfunds, like REITs and most network based deals, are “passive” investments. Being “passive” means that while the investor is acquiring an ownership (or debt based) interest in the purchased real estate, the investor will not have to worry about the day-to-day operations and management of the asset (or being responsible for the associated costs). For example, to the ordinary investor the fact that an equity-based RECfund is a passive investment represents a significant benefit over the direct approach, which is an “active” investment where the investor is directly responsible for the continued operation and management of the property (not to mention the associated costs).

Passive vs. Active Investment – RECfunds, like REITs and most network based deals, are “passive” investments. Being “passive” means that while the investor is acquiring an ownership (or debt based) interest in the purchased real estate, the investor will not have to worry about the day-to-day operations and management of the asset (or being responsible for the associated costs). For example, to the ordinary investor the fact that an equity-based RECfund is a passive investment represents a significant benefit over the direct approach, which is an “active” investment where the investor is directly responsible for the continued operation and management of the property (not to mention the associated costs). Access to professionals – Generally speaking, RECfunds will be created by experienced real estate investors/developers. As a result, investors can leverage the knowledge and experience of a particular professional (who they should always research) by investing in their particular RECfund. Being able to leverage the expertise of such professionals has been traditionally limited to those with enough capital to invest in a REIT and those with access to network opportunities. RECfunding, however, opens up this benefit to the masses.

Access to professionals – Generally speaking, RECfunds will be created by experienced real estate investors/developers. As a result, investors can leverage the knowledge and experience of a particular professional (who they should always research) by investing in their particular RECfund. Being able to leverage the expertise of such professionals has been traditionally limited to those with enough capital to invest in a REIT and those with access to network opportunities. RECfunding, however, opens up this benefit to the masses. Limitation of Liability – The liability of an investor in a RECfund will be limited to a loss of their investment. This is the same as under most REITs and network based opportunities, but there are some types of REITs and network opportunities that are set up to require the investor to contribute additional funds (though these are the exceptions and not the norm). Further, under a direct approach, there is no cap as to the liability of the investor who will be directly responsible for any and all costs and liabilities associated with the property.

Limitation of Liability – The liability of an investor in a RECfund will be limited to a loss of their investment. This is the same as under most REITs and network based opportunities, but there are some types of REITs and network opportunities that are set up to require the investor to contribute additional funds (though these are the exceptions and not the norm). Further, under a direct approach, there is no cap as to the liability of the investor who will be directly responsible for any and all costs and liabilities associated with the property. Direct Investment/Higher Expected Rates of Return – As Fundrise co-founder Daniel Miller said in a recent interview, with RECfunds “you’re cutting out a lot of the middlemen. People are investing directly in a property so a lot of private equity firms and traditional finance groups that are in the middle are gone.” The elimination of these middlemen leaves a greater portion of the profit pie to be split by the investors. This often translates into significantly higher rates of return than with comparable traditional passive real estate investments.

Direct Investment/Higher Expected Rates of Return – As Fundrise co-founder Daniel Miller said in a recent interview, with RECfunds “you’re cutting out a lot of the middlemen. People are investing directly in a property so a lot of private equity firms and traditional finance groups that are in the middle are gone.” The elimination of these middlemen leaves a greater portion of the profit pie to be split by the investors. This often translates into significantly higher rates of return than with comparable traditional passive real estate investments.

Risks Of RECFunds

RECfunding is not without risks. According to some critics, RECfunding is being used only by property developers and managers who cannot gain access to traditional forms of funding because the ventures are too risky, they are too inexperienced, etc. Others believe the industry is growing too fast and is prone to the same fate as the dot-com bubble. Then there is always the general concerns surrounding fraud and the chance of people investing in a project that doesn’t exist or never comes to fruition.

As with any investment, there are bound to be risks and disruptive investment methods like RECfunding typically elicit critics and concerns about fraud. Don’t get me wrong, people looking to invest in RECfunds NEED to do their homework. Investors should thoroughly research the property, the surrounding area, and the parties involved before investing their hard-earned money. Moreover, investors should take advantage of the “social networking” capabilities and educational material offered by RECfund platforms, as well as, the internet itself to help them understand what they are investing in, who they are investing with, and what they should expect to receive in return. RECfunds can offer amazing returns for those willing to take the time to carefully research and select projects but they can also result in significant losses for casual, shoot-from-the-hip types of investors.

As with any investment, there are bound to be risks and disruptive investment methods like RECfunding typically elicit critics and concerns about fraud. Don’t get me wrong, people looking to invest in RECfunds NEED to do their homework. Investors should thoroughly research the property, the surrounding area, and the parties involved before investing their hard-earned money. Moreover, investors should take advantage of the “social networking” capabilities and educational material offered by RECfund platforms, as well as, the internet itself to help them understand what they are investing in, who they are investing with, and what they should expect to receive in return. RECfunds can offer amazing returns for those willing to take the time to carefully research and select projects but they can also result in significant losses for casual, shoot-from-the-hip types of investors.

“No matter which platform an investor chooses, they should ensure that the management team has the requisite experience to properly evaluate and curate the deals that show up on the platform. We think real estate is a great asset class more investors should have exposure to, but as with all investments, the risk profile of each deal should be carefully evaluated; chasing the highest yields possible isn’t necessarily the best strategy.” — Joe Elias of Loquidity.

The Future Of Real Estate Investing

Real estate has always been a favorite investment of the wealthy due to its overall stability (present downturn excluded) and potential for high returns. In a recent interview with Fox Business, Jilliene Helman, C.E.O. of Seattle-based RECfunding platform RealtyMogul.com, was quoted saying “the best vehicle I know of to generate cash flow and income is real estate.” Many of today’s wanna-be real estate investors share this sentiment but the traditional methods of real estate investment are just not viable.

As Daniel Miller said, “there are always real estate projects going on … but to date [investors] have had very little opportunity to impact and invest.” RECfunding platforms such as Realty Mogul and Fundrise are looking to change this reality by “taking asset classes that are traditionally reserved for high net worth institutional investors and allowing everyone to participate” said Miller. Realty Mogul and Fundrise are clearly not  the only ones who see potential in the RECfunding industry. Several other RECfunding sites have emerged, each with their own unique focus, including Loquidity.com, CrowdStreet.com, GroundBreaker.co, PatchofLand.com, RealtyShares.com and RealCrowd.com.

the only ones who see potential in the RECfunding industry. Several other RECfunding sites have emerged, each with their own unique focus, including Loquidity.com, CrowdStreet.com, GroundBreaker.co, PatchofLand.com, RealtyShares.com and RealCrowd.com.

Currently, the majority of RECfund platforms (other than Fundrise and certain “intrastate” only platforms) are only accessible to individuals that meet the requisite income and/or net worth requirements to be considered an “accredited investor.” Accordingly, even RECfunding is currently limited to investment by those making more than the average joe. That being said, RECfunds are breaking down the doors to the country club and giving today’s investors access to a multitude of real estate investment opportunities which were previously off-limits. Where else but through RECfunds could the everyday investor have the ability to own a piece of a shopping mall or the next Hard Rock Café?

As traditional real estate investment practices continue to be replaced with debt and/or equity RECFunds, the real estate investment landscape that we have always known is set for a major change. There will likely always be a place for traditional real estate investment approaches but I believe that in the next few years RECfunding will establish itself as the primary vehicle for the majority of passive investors looking to invest in commercial and residential real estate.

Pingback: RECFUNDS VS TRADITIONAL REAL ESTATE INVESTMENT, AN OVERVIEW (Part 1) | CROWDFUNDINGLEGALHUB.com

Pingback: RECFUNDS VS TRADITIONAL REAL ESTATE INVESTMENT, AN OVERVIEW (Part 2) | CROWDFUNDINGLEGALHUB.com

This is a great follow to Part 1 in the series. Real Estate crowdfunding has exploded and is poised for more exponential growth when Title III and IV are passed. You have the ability to breakdown complex information into bite sized chunks for digestion.

Pingback: INVESTOR PROTECTION ISSUE - WHY YOU MAY WANT TO RECONSIDER HOW “SECURE” YOU FEEL ABOUT YOUR REAL ESTATE CROWDFUNDING INVESTMENT | CROWDFUNDINGLEGALHUB.com

Pingback: New Markets | Times Realty News

Pingback: How Crowdfunding is Transforming the Traditional Real Estate Market | Amrank Real Estate