Normally when I write about updates on intrastate crowdfunding legislation it’s simply to let readers know that one, two maybe even as many as three states, have either enacted or proposed new legislation. Not this time however, as the first quarter of 2015 has brought an explosion of intrastate legislation.

The Big Picture:

Maybe with the new legislative season, state politicians are looking for an arguably bi-partisan bill they think will be popular with their constituents. I mean who can say no to legislation designed to open up sources of capital to small and growing businesses? On the other hand, maybe state politicians/regulators are simply seeing other states enacting similar rules and they don’t want their state to be left behind. Whatever the reason, 2015 is shaping up to be the year of intrastate crowdfunding.

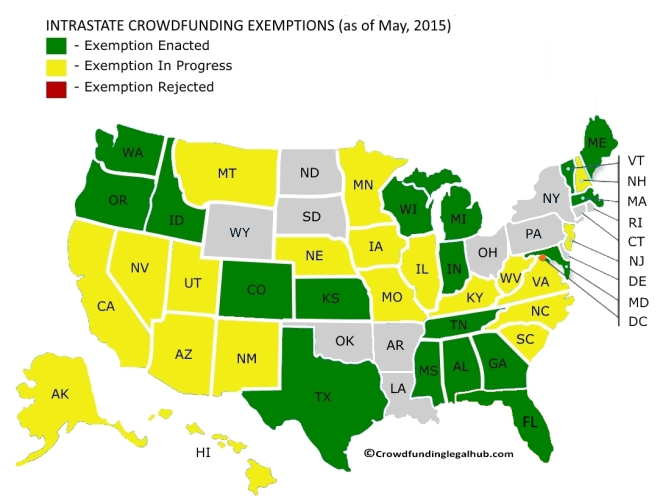

Since my last update in mid-February of this year, the following eight (8) new states have filed proposed intrastate crowdfunding bills: Hawaii, Iowa, Kentucky, Nebraska, Nevada, New Hampshire, North Carolina and West Virginia. During the same period of time, intrastate crowdfunding regulations were enacted/became effective in the District of Columbia and the states of Florida, Mississippi and Vermont. This brings the count as of today (to the best of my knowledge) to twenty-one states (21) states who have filed proposed intrastate crowdfunding regulations and nineteen (19) states with currently enacted/effective intrastate crowdfunding regulations. They break down as follows:

To put this in perspective, the number of proposed bills as the end of 2014/beginning of 2015 was somewhere around thirteen (13) and the number of then states with enacted/effective intrastate crowdfunding regulations was somewhere around fifteen (15). That is a VERY significant jump if you ask me.

For a full list of (and links to) each of the currently enacted/proposed rules, see my recently updated post “STATE OF THE STATES – List of Current Active And Proposed Intrastate Crowdfunding Exemptions (Updated).” Also, for a side-by-side comparative summary of each of the currently enacted/proposed rules, see my other recently updated post “STATE OF THE STATES – Comparative Summaries of Current Active And Proposed Intrastate Crowdfunding Exemptions (Updated).”

The Good and the Bad:

Having reviewed each of the enacted and proposed legislation (yes, I have no life), I can say that many of the recent bills do have a lot of positives when compared to their earlier counterparts but many of them suffer from, what I believe, to be a very material roadblock.

Speaking generally and without going into too much detail (for more detail, see the comparative summaries noted above), the current proposed rules are, in terms of material provisions, substantially similar to each other and to many of the enacted exemptions. That being said, the following two trends should be noted:

Cap Rates; Automatic CPI Adjustment: The majority of the proposed bills continue the precedent of setting the overall offering cap at $2,000,000 (provided they deliver independently audited financials, otherwise $1,000,000). However, a few of the states (e. Illinois and Minnesota) propose to allow for significantly higher offering caps, and certain of the states (i.e. New Mexico and North Carolina (HB 63 only), and South Carolina) have not included a cap at all. Moreover, many of the newly proposed bills specifically require the offering caps to be reviewed and increased every five (5) years to reflect changes in the Consumer Price Index (CPI).

Cap Rates; Automatic CPI Adjustment: The majority of the proposed bills continue the precedent of setting the overall offering cap at $2,000,000 (provided they deliver independently audited financials, otherwise $1,000,000). However, a few of the states (e. Illinois and Minnesota) propose to allow for significantly higher offering caps, and certain of the states (i.e. New Mexico and North Carolina (HB 63 only), and South Carolina) have not included a cap at all. Moreover, many of the newly proposed bills specifically require the offering caps to be reviewed and increased every five (5) years to reflect changes in the Consumer Price Index (CPI).

- “Authorized” v “Chartered”: One of the issues that have plagued some of the previous legislation is that

escrow agents and/or offering portals were specifically required to be chartered/formed within the respective state. Administratively, this turned out to be much easier said than done. Many of the currently proposed bills alleviate this roadblock by providing that such entities only need to be “authorized to transact business” within the state.

escrow agents and/or offering portals were specifically required to be chartered/formed within the respective state. Administratively, this turned out to be much easier said than done. Many of the currently proposed bills alleviate this roadblock by providing that such entities only need to be “authorized to transact business” within the state.

While I believe the pros outweigh the cons in the majority of the currently proposed bills, there is one recurring provisions that I think will be a material issue in terms of actual application. The majority of the proposed rules exclude (generally) any “investment company” (as defined by the Investment Company Act of 1940, 15 U.S.C. sec. 80a-3) from using the proposed exemption. A detailed analysis as to why this exclusion is an issue is beyond the scope of this article. That being said, it is important to note that a lot of real estate holding/development entities are set up in a manner that would fall under the noted definition of “investment company.” Given that real estate investment has been one of the most popular forms of investment crowdfunding to date, states currently proposing legislation may want to consider tailoring this exemption much more narrowly (see my proposed language in the Illinois proposed bill, HB 3429).

Conclusion:

I said it before and I will say it again. The people want investment based crowdfunding for the masses and, in the absence of federal regulation, they will find a way to make it happen. This would explain the rising popularity of intrastate exemptions. However, passing the legislation is only the first step. Even in states that currently have effective  exemptions, the use of such exemptions has been very slow. I truly believe that this is more a reflection of a general lack of public knowledge as to what these exemptions do and how to use it rather than an expression of the effectiveness of any exemption itself. States that currently have (or are proposing) intrastate crowdfunding exemptions NEED to also actively work to get the word out to the target users of these exemptions.

exemptions, the use of such exemptions has been very slow. I truly believe that this is more a reflection of a general lack of public knowledge as to what these exemptions do and how to use it rather than an expression of the effectiveness of any exemption itself. States that currently have (or are proposing) intrastate crowdfunding exemptions NEED to also actively work to get the word out to the target users of these exemptions.

Only time will tell whether intrastate exemptions will be materially beneficial to small and emerging businesses. That being said, if the recent flurry of legislation is any indicator, the awareness and popularity of these exemptions is currently growing rapidly. As awareness continues to grow in 2015 and beyond, I firmly believe that it will bring with it a significant increase in the use and effectiveness of these exemptions.