In an open meeting Wednesday, the Securities and Exchange Commission (SEC) elected to approve and release the long-awaited final rules for Title IV of the JOBS Act (commonly referred to as Regulation A+). Per the final rules, under Regulation A+ companies will be permitted to offer and sell up to $50 million of securities to the general public subject to certain eligibility, disclosure and reporting requirements.

In an open meeting Wednesday, the Securities and Exchange Commission (SEC) elected to approve and release the long-awaited final rules for Title IV of the JOBS Act (commonly referred to as Regulation A+). Per the final rules, under Regulation A+ companies will be permitted to offer and sell up to $50 million of securities to the general public subject to certain eligibility, disclosure and reporting requirements.

Please note that this post is only intended to be a brief update regarding the new rules and I intend to post a more detailed analysis in the near future. Unfortunately the final rules which were just posted last night, are over 450 pages long and even I don’t read that fast. That being said, given the importance of the announcement, I thought it would be beneficial to my readers to post some of the highlights.

For those that don’t know, the original Regulation A was a federal securities exemption that allowed companies to raise up to $5 million in a public offering (i.e. a “mini-IPO”). It was rarely used however, because the costs of complying with the federal and individual state disclosure/filing requirements where exorbitant given the maximum amount that could be raised. Especially in light of the fact that significantly less cumbersome exemptions such as Rule 505 and 506 exists which could be used to raise the same amount, or more (although via a non-public offering). Title IV of the JOBS Act was intended to revitalize the rarely used Regulation A exemption by, among other things, significantly increasing the maximum offering amount making it a much more attractive tool for capital formation. While it has taken almost three years for the SEC to release the final Title IV rules, they represent a huge opportunity for small and mid-sized businesses looking to raise capital as well as investors. As SEC Chair Mary Jo White noted:

“These new rules provide an effective, workable path to raising capital that also provides strong investor protections … It is important for the Commission to continue to look for ways that our rules can facilitate capital-raising by smaller companies.”

“These new rules provide an effective, workable path to raising capital that also provides strong investor protections … It is important for the Commission to continue to look for ways that our rules can facilitate capital-raising by smaller companies.”

In December of 2013, the SEC first released its proposed rules under Regulation A+. These proposed rules were generally excepted favorably except for one very contentions point; the included pre-emption of State “blue sky” securities regulation. As mentioned above, one of the biggest issues with the original Regulation A exemption was that it required compliance with the respective “blue sky” securities regulations of each state in which an issuer wanted to sell securities. As you can imagine this was not just time-consuming but costly and wrought with the potential for oversight. Under the proposed rules however, compliance with the individual state regulations would not be required (i.e. pre-empted) when using the exemption.

Since the release of the proposed rules the issue of state pre-emption has been the source of much heated debate. In fact, many were worried that the SEC would succumb to the pressure of state securities regulators and remove the pre-emption feature from its final rules altogether (which would have significantly reduced the attractiveness of the Regulation A+ exemption). Luckily for everyone, the SEC stayed strong and retained the pre-emptive nature of the Regulation A+ exemption, at least with respect to “Tier II” offerings as discussed below.

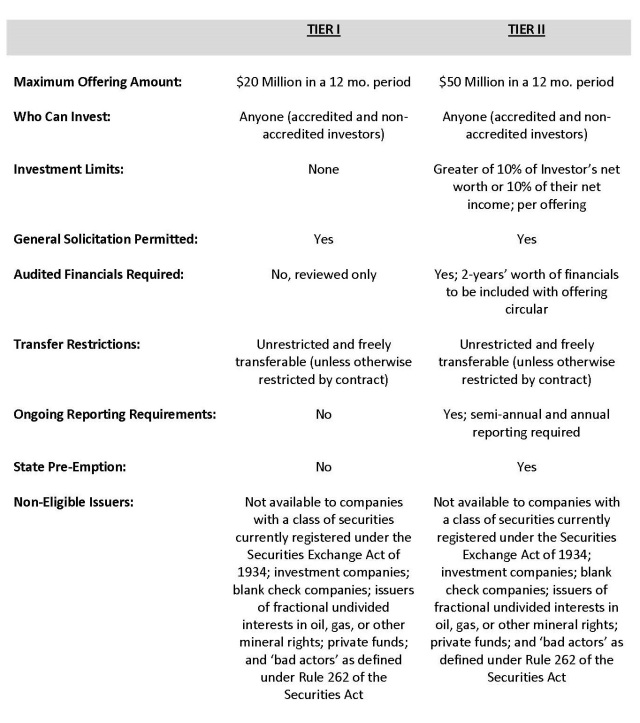

Without going into too much detail, here are some of the highlights of the final rules:

Now before you go running to take advantage of the new rules please keep in mind two things. First, the rules are not yet effective. The final rules released Wednesday will now be published in the Federal Register and will become effective sixty (60) days after publication. Second, while this exemption will be monumental for some companies it will not fit for use with many very small businesses (and can’t be used by start-ups that qualify as “blank check” companies at all). While Regulation A+ is a very scaled down version of the disclosure and compliance requirements associated with a traditional IPO, compliance with these new rules won’t be easy or cheap. That being said, the finalized new Regulation A+ is going to be a certified game changer for many small and midsized companies and is going to substantially change both the IPO market as we know it and the way people invest.

very scaled down version of the disclosure and compliance requirements associated with a traditional IPO, compliance with these new rules won’t be easy or cheap. That being said, the finalized new Regulation A+ is going to be a certified game changer for many small and midsized companies and is going to substantially change both the IPO market as we know it and the way people invest.

Hi Anthony,

I am the President of a film production company in Florida. Ever since the recent SEC ruling on Title IV of the JOBS act the entire film industry has been abuzz. As such, there is a lot of misinformation out there. It it true that crowdfunding sites such as kickstarter will allow us to offer people equity into our movies once the final rules take effect, thereby making them investors? Also, once the final rules take effect, will a private placement memorandum and subscription agreement still be require by law to be drawn up for the investors. Lastly, is there an amount of time it normally takes for these type of rulings to published in the Federal Register? Thank you for your time and consideration.

James,

Thank you for your comment. I am happy to discuss your questions with you, just give me a call or shoot me an email directly.

Pingback: LOOKING FOR THE EXIT - Commissioner Aguilar Presses On The Need For Greater Secondary Market Liquidity | CROWDFUNDINGLEGALHUB.com

Pingback: The “Mini-IPO “ Is Here!!! New Regulation A+ Rules Become Effective Today | CROWDFUNDINGLEGALHUB.com

Pingback: THE “MINI-IPO“ IS HERE!!! NEW REGULATION A+ RULES BECOME EFFECTIVE TODAY | Mini-IPO Exchange

Pingback: Crowdfunding: A look at 2015 and Beyond! | CROWDFUNDINGLEGALHUB.com