There has been a lot of chatter and debate lately on how, or even if, the current definition of “accredited investor” should be substantively changed. To date however, there has only been one affirmative action taken to actually change the definition which I am aware of. That is the ‘‘Fair Investment Opportunities for Professional Experts Act” bill (H.R. 2187) originally proposed by Representative David Schweikert back in April of last year. Although Schweikert’s bill attempts to make some positive changes to the definition, I believe recent substantive changes to the bill have significantly limited, if not eliminated, the intended effects.

There has been a lot of chatter and debate lately on how, or even if, the current definition of “accredited investor” should be substantively changed. To date however, there has only been one affirmative action taken to actually change the definition which I am aware of. That is the ‘‘Fair Investment Opportunities for Professional Experts Act” bill (H.R. 2187) originally proposed by Representative David Schweikert back in April of last year. Although Schweikert’s bill attempts to make some positive changes to the definition, I believe recent substantive changes to the bill have significantly limited, if not eliminated, the intended effects.

For those that don’t know, H.R. 2187 recently passed the U.S. House of Representatives earlier this month by a whopping 347 voted to 8 (with 78 members not voting). As currently the only real step forward on this issue I had been following it pretty closely. As such, this article was originally intended to focus on, and celebrate, the movement of the bill through the House and on to the Senate. I even reached out to some heavy hitters in the crowdfunding industry for quotes who were elated at the victory and ready to praise the movement. However, after reviewing the actual form of the bill which made it through the House, I noticed that certain amendments had been made from the original bill which, in my opinion, make the House win somewhat of a hollow victory. Before I get all legal eagle on you, let’s discuss what the bill was trying to do….

The Good:

As the name of the bill implies, it was originally intended broaden the scope of the current accredited investor to include various classes of “professionals.” Specifically it proposes including any natural person:

- who is a licensed or registered as a broker investment adviser with the Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), or a state level equivalent division;

- who is licensed attorney in good standing under the laws of the jurisdictions in which he or she is admitted to practice law;

- who is a registered CPA in good standing under the laws of the place of his or her residence or principal office;

- who has retained and used the services of any person referred to in numbers 1-3 above to make an investment decision relative to the subject investment being offered; or

- who has passed an examination administered by FINRA to qualify as accredited investor.

If you have seen my other posts on this subject you know that I vehemently agree with each of the above proposals (See Changes To “Accredited Investor” Definition Recommended By SEC Staff; The Good, The Bad And The Ugly), except maybe number 4 which may be a bit to tenuous and hard to moderate. Still, the above proposals represent a truly noble effort to re-codify and expand an outdated definition. However, spoiler alert, categories 2-5 above did NOT make it into the final form of the bill which was recently approved by the House.

The Bad:

As noted above, many of the originally included categories of professionals didn’t make it into the current iteration of the bill. Including number 5 which most professionals agree is going to be the easiest way to qualify new people. Moreover, the revised bill attempts to codify the current accredited investor income and net worth thresholds by keeping them at the current levels but requiring an upward adjustment for inflation (oddly in the net worth standard only) every five years. Not sure how this attempted codification relates to the whole “Professional Experts” focus of the bill but I have bigger problems with the revised bill.

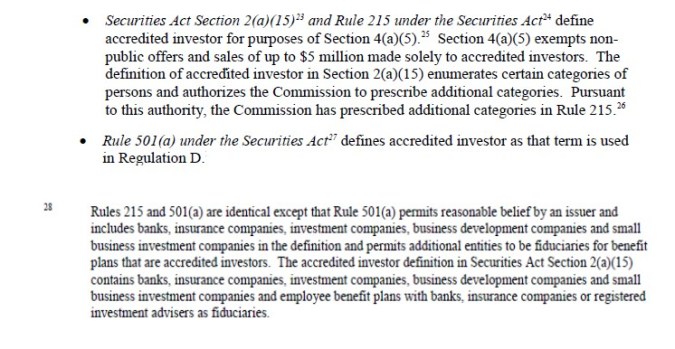

Now here is where my inner lawyer is about to kick in so if you don’t feel like listening to an analysis of code sections you may want to scroll down to the punchline section. For those of you still reading, the amendments from the original bill create an even more problematic issue than simply losing a few categories of individuals. The original proposed bill was intended to change the definition of accredited investor under Rule 501 (17 C.F.R. 230.501). This is the definition we all know and the one that runs through Regulation D (including Rule 506(c), the basis of all online offerings). Now looking at the current bill, the concept of changing Rule 501 has been completely abandoned. Instead the amended bill proposes to change the definition of accredited investor under Section 2(a)(15) of the Securities Act of 1933 (15 U.S.C. 77b(a)(15)). This definition, while it has always been the same as Rule 501 (see Rule 215 - 17 CFR 230.215) is ONLY used for offerings made under Section 4(a)(5) of the 33 Act. In the SEC’s recent review of the accredited investor definition this relationship between the sections was even discussed (in pertinent part) as follows:

The problem is first that a Section 4(a)(5) offering is limited to $5 million dollars. More importantly though, a Section 4(a)(5) offering (unlike a Rule 506(c) offering) CANNOT use general solicitation. Verbatim, Section 4(a)(5) provides as follows (emphasis added):

“transactions involving offers or sales by an issuer solely to one or more accredited investors, if the aggregate offering price of an issue of securities offered in reliance on this paragraph does not exceed the amount allowed under section 3(b)(1) of this title, if there is no advertising or public solicitation in connection with the transaction by the issuer or anyone acting on the issuer’s behalf, and if the issuer files such notice with the Commission as the Commission shall prescribe.”

Sooooo, when you put all this legal mumbo jumbo together, what do you have? You have an amended bill that creates a new pool of “accredited investors” who can invest in offerings that are under $5 Million and that are NOT advertised over the net. Yeah, that’s probably not going to move the needle much.

The Punchline:

Without naming names, I have talked to certain individuals involved with the bill about the amendments that were made from the original form of the bill. I can tell you that the removal of categories 2-5 mentioned above was intentional. I never got a clear answer as to why except some hints that certain political parties felt these categories were too broad, and that category number 5 would lead to an industry of test providers which was not a good idea (Huh??). I can also tell you that the legal effectiveness issue discussed above was NOT intended. The reasoning for this change is even cloudier.

Without naming names, I have talked to certain individuals involved with the bill about the amendments that were made from the original form of the bill. I can tell you that the removal of categories 2-5 mentioned above was intentional. I never got a clear answer as to why except some hints that certain political parties felt these categories were too broad, and that category number 5 would lead to an industry of test providers which was not a good idea (Huh??). I can also tell you that the legal effectiveness issue discussed above was NOT intended. The reasoning for this change is even cloudier.

Apparently certain constitutional (i.e. non-practicing) attorneys felt that approving a change to Section 2(a)(15) would force the SEC to change the definition under Rule 501. I am not sure I follow the logic here (and I am not alone), but even IF they are correct when might we expect such a change and who is going to enforce it? Hey constitutional attorneys, remember when Congress SPECIFICALLY REQUIRED the SEC to Issues final Title III rules within 270 days of the passing of the JOBS Act? That only took 3 years and they had a specific Congressional deadline. Lord knows how long a forced change like the one proposed by the constitutional attorneys might take. Moreover, in the interim, the bill will create a weird bi-furcated definition of “accredited investor” and I just cannot see any practicing securities attorney recommending an issuer to rely on a definition that is not codified under Rule 501. Whatever categories of covered persons the final bill ended up including, the changes simply should have been made to Rule 501 as originally proposed.

With the passing of the amended bill through the House there are limited modifications, if any, that can be made to rectify the above issues before it is presented to the Senate. I know that those working on the bill intend to make it clear in the history and discussions of the bill that the intent is, and always has been, to force the SEC to amend Rule 501 but I don’t think that is going to do much. Like I said, the SEC has its own timetable even when they are specifically required to act let alone when they are left to interpret Congressional intent.

All-in-all I unfortunately have to say that the passing of this bill by the House is more of a hollow victory than anything else. The bill, as amended, appears to have lost much of its heart in terms of those “professionals” it now covers and it does not specifically force the SEC’s hand by requiring a change to Rule 501. Whether the changes were recommended by other politicians or committee attorneys, the damage is done. Even if this bill makes it all the way through the Senate I am not sure what, if anything, it will actually do. Put another way, as I see it we are back at square 1 waiting for the SEC to act to change the definition.

All-in-all I unfortunately have to say that the passing of this bill by the House is more of a hollow victory than anything else. The bill, as amended, appears to have lost much of its heart in terms of those “professionals” it now covers and it does not specifically force the SEC’s hand by requiring a change to Rule 501. Whether the changes were recommended by other politicians or committee attorneys, the damage is done. Even if this bill makes it all the way through the Senate I am not sure what, if anything, it will actually do. Put another way, as I see it we are back at square 1 waiting for the SEC to act to change the definition.